Exhibit 10.11

LEASE

11525 SOUTH STREET

CERRITOS, CALIFORNIA

CERRITOS WEST COVENANT GROUP LLC,

a Nevada limited liability company

as Landlord

and

YOSHIHARU CERRITOS,

a California Corporation,

dba “Yoshiharu Japanese Ramen”

as Tenant

LEASE

TABLE OF CONTENTS

| PAGE | |

| ARTICLE 1. - BASIC LEASE PROVISIONS | 1 |

| ARTICLE 2. - PREMISES | 4 |

| ARTICLE 3. - TERM | 5 |

| ARTICLE 4. - POSSESSION AND CONSTRUCTION | 5 |

| ARTICLE 5. - RENTAL | 6 |

| ARTICLE 6. - TENANT FINANCIAL DATA | 8 |

| ARTICLE 7. - TAXES | 8 |

| ARTICLE 8. - UTILITIES | 9 |

| ARTICLE 9. - TENANT’S CONDUCT OF BUSINESS | 10 |

| ARTICLE 10. - MAINTENANCE, REPAIRS AND ALTERATIONS | 12 |

| ARTICLE 11. - COMMON AREA | 13 |

| ARTICLE 12. - PROMOTIONAL CHARGE; ADVERTISING | 16 |

| ARTICLE 13. - INSURANCE | 16 |

| ARTICLE 14. - DAMAGE | 18 |

| ARTICLE 15. - EMINENT DOMAIN | 20 |

| ARTICLE 16. - ASSIGNMENT AND SUBLETTING | 20 |

| ARTICLE 17. - DEFAULTS BY TENANT | 22 |

| ARTICLE 18. - SUBORDINATION, ATTORNMENT AND TENANT’S CERTIFICATE | 24 |

| ARTICLE 19. - MATTERS OF RECORD | 25 |

| ARTICLE 20. - MISCELLANEOUS | 25 |

| EXHIBIT A | - GENERAL SITE PLAN |

| EXHIBIT A-1 | - LEGAL DESCRIPTION OF PROJECT |

| EXHIBIT B | - PREMISES FLOOR PLAN |

| EXHIBIT C | - CONSTRUCTION PROVISIONS |

| EXHIBIT D | - SIGN CRITERIA |

| EXHIBIT E | - FORM OF GUARANTY OF LEASE |

| EXHIBIT F | - RULES AND REGULATIONS |

| EXHIBIT G | - EXCLUSIVE AND PROHIBITED USES |

| EXHIBIT H | - FORM OF LANDLORD’S SUBORDINATION OF LIEN |

| i |

LEASE

This Lease (“Lease”) is entered into as of the “Effective Date” (as defined in Section 1.1 below) by and between “Landlord” and “Tenant” (each as defined in Sections 1.2 and 1.3 below).

ARTICLE 1. - BASIC LEASE PROVISIONS

| 1.1 | Effective Date: March 2nd, 2021. | |

| 1.2 | Landlord: CERRITOS WEST COVENANT GROUP LLC, a Nevada limited liability company, CERRITOS WEST EXCHANGE I LLC, a Nevada limited liability company and CERRITOS WEST EXCHANGE II LLC, a Nevada limited liability company, as tenants in common. | |

| 1.3 | Tenant: YOSHIHARU CERRITOS, a California Corporation, dba “Yoshiharu Japanese Ramen”. | |

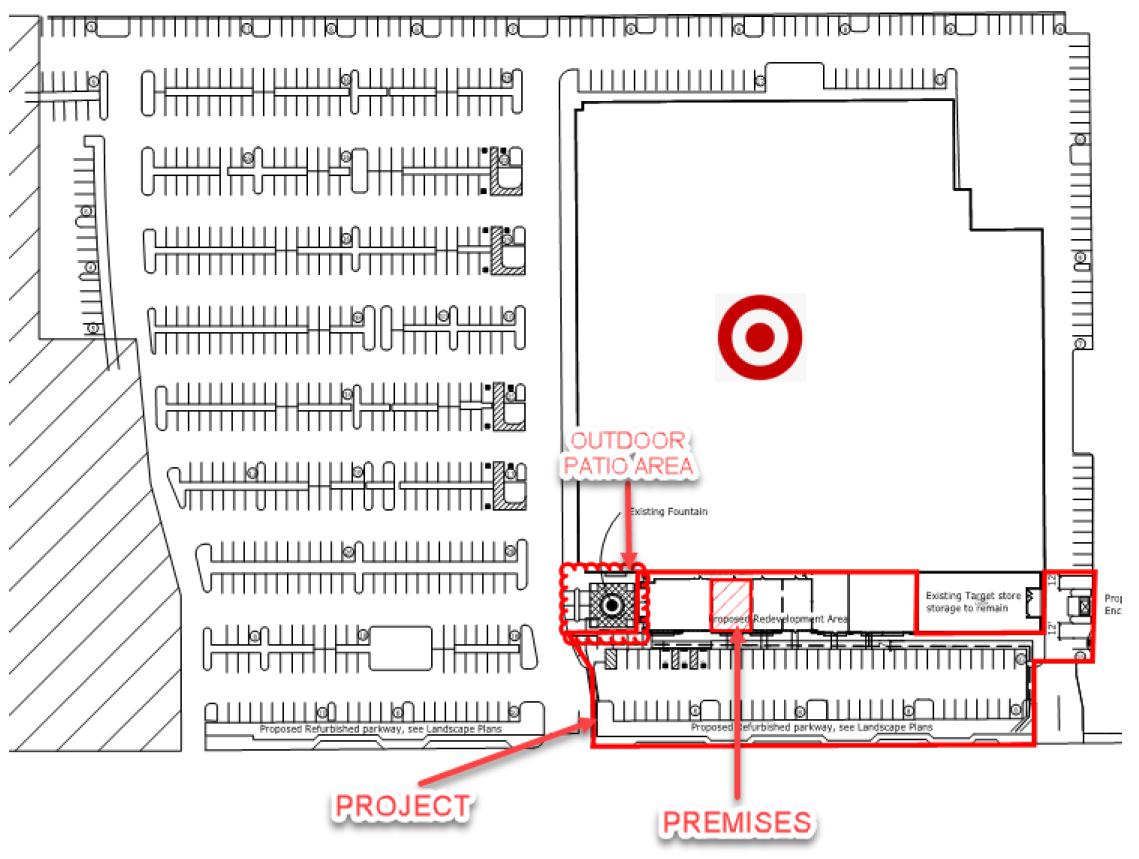

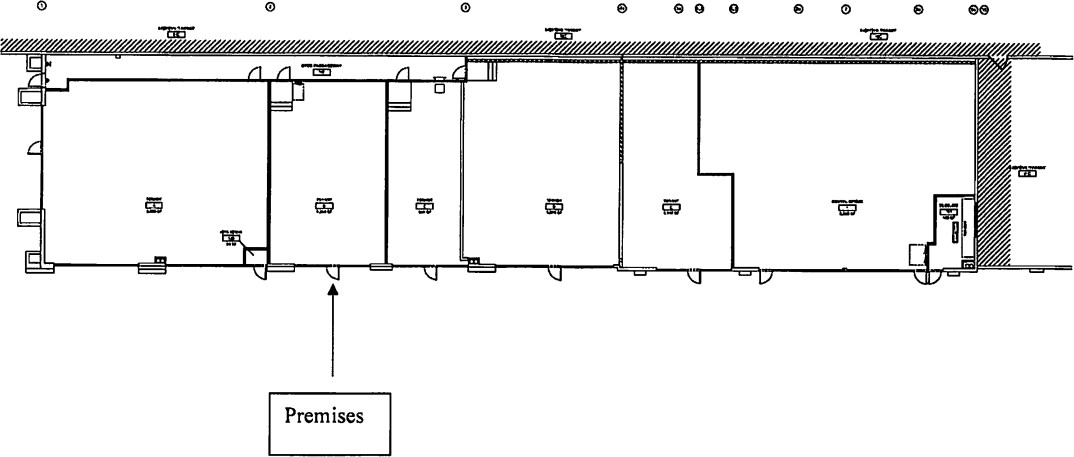

| 1.4 | Premises: That certain premises located at 11533 South Street, Cerritos, California 90703, within that certain multi-tenant building located at 11529 – 11549 South Street, Cerritos, California 90703 (the “Building”) within the Project, as depicted on the site plan attached hereto as Exhibit A and the floor plan attached hereto as Exhibit B. | |

| 1.5 | Floor Area of Premises: One thousand two hundred sixty-four (1,264) square feet. (Article 2) | |

| 1.6 | Project: A portion of “Cerritos Promenade” located at 11401 Gridley Road, in Cerritos, California 90703, as generally depicted on the site plan attached hereto as Exhibit A and legally described on Exhibit A-1 attached hereto. | |

| 1.7 | Time to Complete Tenant’s Work: One hundred twenty (120) days following the Possession Date (as defined in Section 4.1). (Article 3) | |

| 1.8 | Initial Term: Ten (10) Lease Years. (Article 3) | |

| 1.9 | Options to Extend: Two (2) Option Terms of five (5) Lease Years each. (Article 3) | |

| 1.10 | Minimum Annual Rent: (Article 5) |

| Lease Years | Monthly MAR | Annual MAR | Annual MAR/SF | |||||||||

| 1 | $ | 5,688.00 | $ | 68,256.00 | $ | 54.00 | ||||||

| 2 | $ | 5,858.64 | $ | 70,303.68 | $ | 55.62 | ||||||

| 3 | $ | 6,034.55 | $ | 72,414.56 | $ | 57.29 | ||||||

| 4 | $ | 6,215.72 | $ | 74,588.64 | $ | 59.01 | ||||||

| 5 | $ | 6,402.16 | $ | 76,825.92 | $ | 60.78 | ||||||

| 6 | $ | 6,593.87 | $ | 79,126.40 | $ | 62.60 | ||||||

| 7 | $ | 6,791.89 | $ | 81,502.72 | $ | 64.48 | ||||||

| 8 | $ | 6,995.19 | $ | 83,942.24 | $ | 66.41 | ||||||

| 9 | $ | 7,204.80 | $ | 86,457.60 | $ | 68.40 | ||||||

| 10 | $ | 7,420.73 | $ | 89,048.80 | $ | 70.45 | ||||||

| Option Terms | ||||||||||||

| 11 - 15 | *FMV | *FMV | *FMV | |||||||||

| 16 - 20 | *FMV | *FMV | *FMV | |||||||||

*As determined for the first (1st) Lease Year in accordance with Section 5.2 with three percent (3%) annual increases thereafter.

One month’s Minimum Annual Rent and Tenant’s estimated share of one (1) month’s Common Area Costs, Taxes and Insurance are due upon Lease execution.

| 1.11 | Percentage Rent: None. (Article 5) | |

| 1.12 | Use of Premises: The Premises shall be used solely for the operation of a first-class, quick-serve or fast-casual restaurant operating under Tenant’s Trade Name specializing in the preparation and retail sale of Japanese ramen noodle entrees and other related Japanese menu items as reflected on the website www.yoshiharuramen.com (the “Permitted Use”), and for no other purpose, use or trade name whatsoever. Additionally, in connection with Tenant’s operation of the permitted restaurant from the Premises, provided all necessary approvals pursuant to the Agreements are obtained, Tenant may sell beer and wine for on-Premises consumption only, subject to the following terms and conditions: (i) Tenant shall obtain, continuously maintain and comply with, at Tenant’s sole cost and expense, (A) any and all necessary permits, licenses and/or governmental or quasi-governmental approvals required for the sale of beer and wine (copies of which permits, licenses and/or approvals shall be provided to Landlord and shall be conspicuously posted in the Premises at all times), and (B) the liquor law liability insurance required pursuant to Section 13.1(a) of this Lease, and (ii) Tenant’s right to sell beer and wine shall be limited to incidental sales made in connection with the operation of the permitted restaurant from the Premises (i.e., in no event shall the Premises be used primarily as a bar, tavern or cocktail lounge or otherwise primarily for the sale of alcoholic beverages). Notwithstanding anything in the foregoing to the contrary, in no event shall Tenant use or permit the use of the Premises for any purposes which would breach any covenant of or affecting Landlord concerning radius, location, use or exclusivity in any other lease, financing agreement, or other agreement relating to the Project including, without limitation, the OEA and other Agreements (as defined in Article 19) and the exclusive and prohibited uses set forth on Exhibit G. (Article 9) | |

| 1.13 | Tenant’s Trade Name: “Yoshiharu Japanese Ramen”. (Article 9) | |

| 1.14 | Initial Promotional Assessment: None. (Article 12) | |

| 1.15 | Promotional Charge: None. | |

| 1.16 | Security Deposit: Six Thousand Seven Hundred Thirty-Seven and 12/100 Dollars ($6,737.12). (Article 20) | |

| 1.17 | Guarantor: JAMES CHAE and JENNIE Y. CHAE, husband and wife, jointly and severally, on behalf of each of their marital, community and sole and separate property estates. (Exhibit E) |

| 2 |

| 1.18 | Notices: |

To Landlord:

Cerritos West Covenant Group LLC

2460 Paseo Verde Parkway, Suite 145

Henderson, Nevada 89074

Attention: Real Estate Department

To Tenant:

Yoshiharu Cerritos

6940 Beach Blvd., Unit D-705

Buena Park, CA 90621

Attention: James Chae

E-Mail: jchae@apiis.com

(Article 20)

| 1.19 | Commencement Date: The earlier to occur of: (a) the date Tenant initially opens for business to the public in the Premises, or (b) the date immediately following the expiration of the period set forth in Section 1.7. (Article 3) | |

| 1.20 | Rent Commencement Date: Rent shall commence on the Commencement Date. | |

| 1.21 | Opening and Operating Covenants: Tenant shall open and operate as a fully fixturized, stocked and staffed “Yoshiharu Japanese Ramen” restaurant no later than the Required Opening Date (as defined in Section 9.2) and shall thereafter continuously operate from the Premises in accordance with Section 1.12 above and Section 9.2 below. | |

| 1.22 | Radius Restriction: Three (3) miles. (Article 9) | |

| 1.23 | Signage: Subject to conformance with Landlord’s Sign Criteria attached hereto as Exhibit D, the OEA, the Agreements (as defined in Section 19) and applicable governmental standards, and subject to Landlord’s approval, not to be unreasonably withheld, Tenant shall provide its standard signage on the Building elevations designated by Landlord. (Article 9) | |

| 1.24 | Landlord’s Work: As described in, and in accordance with, Exhibit C. | |

| 1.25 | Tenant Improvement Allowance: Landlord shall provide Tenant with a Tenant Improvement Allowance in an amount not to exceed Forty-Four Thousand Two Hundred Forty and 00/100 Dollars ($44,240.00) (based upon $35.00 per square foot of Floor Area). Said Tenant Improvement Allowance shall be paid within thirty (30) days from Tenant’s opening for business and provision of its contractors’ lien releases, and satisfaction of the remaining conditions set forth in this Lease. (Article 20) | |

| 1.26 | Broker(s): Jones Lang LaSalle represents the Landlord (“Landlord’s Broker”) and Andrew Yun represents the Tenant (“Tenant’s Broker”). Landlord shall pay Landlord’s Broker a real estate brokerage commission (the “Commission”) per a separate agreement by and between Landlord and Landlord’s Broker; Landlord’s Broker shall pay Tenant’s Broker a Commission per a separate agreement by and between Landlord’s Broker and Tenant’s Broker. (Article 20) |

| 3 |

ARTICLE 2. - PREMISES

2.1 Premises. Landlord leases to Tenant and Tenant leases from Landlord, for the “Term” (as defined in Article 3) and upon the covenants and conditions set forth in this Lease, the premises described in Section 1.4 (“Premises”). The Premises shall specifically include the roof, floor slab and foundations, and structural and exterior walls which are a part of or immediately adjacent to the Premises.

2.2 Reservation. Landlord reserves the right to use the exterior walls, floor, roof and plenum in, above and below the Premises for the repair, maintenance, use and replacement of pipes, ducts, utility lines and systems, structural elements serving the Project and for such other purposes as Landlord deems necessary. In exercising its rights reserved herein, Landlord shall not unreasonably interfere with the operation of Tenant’s business on the Premises.

2.3 Floor Area. “Floor Area”, as used in this Lease, means all areas designated by Landlord for the exclusive use of a tenant measured from the exterior surface of exterior walls (and extensions, in the case of openings) and from the center of interior demising walls, and shall include, but not be limited to, restrooms, mezzanines to the extent utilized for retail sales, warehouse or storage areas, clerical or office areas and employee areas. The Premises contain approximately the number of square feet of Floor Area specified in Section 1.5. Landlord shall have the right, at Landlord’s sole option, during the first ninety (90) days following the Commencement Date to cause the Floor Area of the Premises to be remeasured by a licensed architect. Upon determination of the actual Floor Area of the Premises in the manner set forth above, the Minimum Annual Rent and all other charges payable by Tenant under this Lease which are determined with reference to the Floor Area of the Premises shall be adjusted accordingly.

2.4 Outdoor Patio Area. Subject to the OEA and Agreements and reasonable, written, non- discriminatory rules and regulations promulgated by Landlord and subject to compliance with applicable governmental requirements (including, without limitation, Tenant’s obtaining all necessary governmental approvals, licenses and permits [and without imposing additional parking requirements for such use], at Tenant’s sole cost), Tenant shall have the right to utilize the common outdoor patio area as generally shown on Exhibit A attached hereto (the “Outdoor Patio Area”) on a non-exclusive basis for on-site consumption of items sold from the Premises, as an incident to Tenant’s primary Permitted Use, in accordance with the first-class standards of customary operation of Tenant’s business, subject to the provisions of this Section. In no event shall Tenant have the right to terminate this Lease based upon the City’s, or other applicable governmental entity’s, refusal to grant Tenant the right to use the Outdoor Patio Area without imposing additional parking requirements. Landlord shall, as part of Outdoor Patio Maintenance Costs, acquire for such Outdoor Patio Area and arrange therein, certain furniture, which may include outdoor tables, chairs (if permitted by the OEA and the City), umbrellas and waste receptacles, the number, design, color and location of which (including any changes thereto) shall be determined by Landlord. Tenant’s use of the Outdoor Patio Area use shall not unreasonably interfere with pedestrian or vehicular traffic within the Project. Landlord shall maintain the Outdoor Patio Area in a neat, clean and orderly condition (collectively, the “Outdoor Patio Area Maintenance”). Tenant shall pay its prorata share of the costs incurred by Landlord in performing such Outdoor Patio Area Maintenance (the “Outdoor Patio Area Maintenance Costs”). Tenant’s prorata share of the Outdoor Patio Area Maintenance Costs shall equal a fraction, the numerator of which is the Floor Area of the Premises, and the denominator of which is the aggregate Floor Area of the premises (including the Premises) of all restaurant or food or beverage tenants whose customers have the express right to use the Outdoor Patio Area. Tenant shall reimburse Landlord for Tenant’s prorata share of the Outdoor Patio Area Maintenance Costs incurred by Landlord pursuant to this Section, plus an administration fee of fifteen percent (15%) of such costs incurred by Landlord, upon written demand by Landlord. Landlord’s approval under this Section will not be unreasonably withheld, conditioned or delayed.

| 4 |

ARTICLE 3. - TERM

3.1 Term. This Lease shall be effective from and after the Effective Date. The term of this Lease (“Term”) shall commence on the Commencement Date. The Term shall continue, unless sooner terminated in accordance with the provisions of this Lease, for the number of Lease Years specified in Section 1.8 from the first day of the month following the Commencement Date. The term “Lease Year” shall mean each consecutive twelve (12) month period commencing after the Commencement Date, except if the Commencement Date is other than the first day of a calendar month, the first Lease Year shall commence on the Commencement Date and end on the last day of the twelfth full calendar month following the Commencement Date.

3.2 Extension Options. Provided that Tenant is not in default under this Lease beyond any applicable cure period at the time of exercise of an option to extend provided herein or at any time thereafter prior to the commencement of an Option Term (as hereinafter defined), Tenant shall have the option to extend the Term for two (2) additional periods of five (5) Lease Years each (each such period being referred to herein as an “Option Term”) only by giving Landlord written notice at least one hundred eighty (180) days before the expiration of the then Initial Term or the first Option Term, as the case may be. All of the terms, covenants, conditions, provisions and agreements applicable to the Initial Term shall be applicable to the Option Terms, except that the Minimum Annual Rent payable during each Option Term shall be increased in accordance with Section 1.10 above and Section 5.2 below. Time is of the essence with respect to Tenant’s exercise of the options to extend the Term provided herein. Tenant’s failure to exactly comply with the time requirements set forth herein shall cause the options provided herein to automatically cease and terminate and, in such event, this Lease shall terminate upon the expiration of the Initial Term or the first Option Term, as the case may be. All references in this Lease to the “Term” shall be deemed to mean the Initial Term as extended by the Option Terms, if and as applicable. The options to extend this Lease as described in this Section are personal to the original Tenant and to its successor following a Permitted Transfer (as defined in Section 16.4). If Tenant subleases any portion of the Premises or assigns or otherwise transfers any interest under this Lease to any person or entity other than in connection with a Permitted Transfer prior to the exercise of any option, such options and any succeeding option shall lapse.

ARTICLE 4. - POSSESSION AND CONSTRUCTION

4.1 As-Is. Except for Landlord’s Work (as such term is defined in Exhibit C), Tenant acknowledges that: (a) it has been advised by Landlord to satisfy itself with respect to the condition of the Premises (including but not limited to the electrical, fire sprinkler systems, security, environmental aspects, and compliance with applicable law), and their suitability for Tenant’s intended use, (b) Tenant has made such investigation as it deems necessary with reference to such matters and assumes all responsibility therefor as the same relate to its occupancy of the Premises, and (c) neither Landlord, Landlord’s agents, nor any broker has made any oral or written representations or warranties with respect to said matters other than as set forth in this Lease. Consequently, except for Landlord’s Work and the Building Systems Warranty (as such term is defined in Exhibit C), Tenant shall accept possession of the Premises in its “AS IS” condition, without representation or warranty by Landlord, except as may be otherwise expressly provided herein.

4.2 Delivery of Possession. Tenant shall accept possession of the Premises upon the Possession Date. As used herein, the term “Possession Date” means the later to occur of (i) the date Landlord tenders notice of delivery of the Premises to Tenant with Landlord’s Work substantially complete (“Delivery Notice”), or (ii) the earlier to occur of (a) Tenant’s receipt of its Building Permits (as defined in Section 20.11), and (b) the expiration of the Building Permit Period (as defined in Section 20.11). The Delivery Notice shall be conclusive and binding upon the parties hereto. Notwithstanding the foregoing to the contrary, if Landlord inadvertently fails to give Tenant the Delivery Notice prior to Tenant taking possession of the Premises, such notice shall be deemed given as of the date Tenant takes possession of the Premises. Landlord shall not be obligated to deliver possession of the Premises to Tenant until Landlord has received from Tenant all of the following: (a) the Security Deposit and first monthly installment of Minimum Annual Rent and Tenant’s estimated share of Common Area Costs, Taxes and Insurance for the first (1st) month of the Initial Term; (b) Final Plans (as defined in Exhibit C), if required by Landlord; (c) a copy of Tenant’s Building Permit, if applicable and if issued by such date; and (d) executed copies of policies of insurance or certificates thereof (as required under Article 13). If Landlord chooses not to deliver possession of the Premises to Tenant because one or more of the above items are not received by Landlord, the Possession Date shall not be affected thereby and the Possession Date shall be deemed to have occurred on the date Landlord would have tendered possession of the Premises if it were not for the failure to receive such item(s).

| 5 |

4.3 Tenant’s Construction. Tenant shall commence construction of Tenant’s Work immediately following the Possession Date, and shall diligently prosecute same to completion. Tenant shall deliver to Landlord a copy of the certificate of occupancy for the Premises issued by the appropriate governmental agency upon completion of Tenant’s Work.

ARTICLE 5. - RENTAL

5.1 Minimum Annual Rent. Tenant shall pay the sum specified in Section 1.10 (“Minimum Annual Rent”) in monthly installments (as specified in such Section), in advance, on or before the first (1st) day of each month, without prior demand and without offset, abatement or deduction (except as expressly and specifically provided in this Lease), commencing on the Commencement Date. Should the Commencement Date be a day other than the first (1st) day of a calendar month, then the monthly installment of Minimum Annual Rent for the first partial month shall be equal to one-thirtieth (1/30th) of the monthly installment of Minimum Annual Rent for each day from the Commencement Date to the end of the partial month.

5.2 Adjustment to Minimum Annual Rent.

(a) The Minimum Annual Rent payable under Section 1.10 and this Article 5 during the Initial Term and the Option Terms, if applicable, shall be adjusted on each of the dates and to the amounts specified in Section 1.10.

(b) In addition to the foregoing, in the event Tenant exercises its right to extend the Term of this Lease for either Option Term, effective on the first day of each Option Term, Minimum Annual Rent for the first (1st) Lease Year of the subject Option Term shall be increased to the amount equal to the fair market rent of the Premises (meaning the fair market rent for the highest and best retail use of the Premises) as of the commencement of the subject Option Term, as determined by Landlord, the amount of which Landlord shall notify Tenant of prior to the commencement of the subject Option Term; provided, however, in no event shall Minimum Annual Rent for the first (1st) Lease Year of either Option Term be less than three percent (3%) greater than the Minimum Annual Rent in effect immediately prior to the subject Option Term.

(c) If Tenant objects to Landlord’s determination of the fair market rent of the Premises for the first (1st) Lease Year of either Option Term, Tenant shall, within fifteen (15) days after receipt of Landlord’s notice, notify Landlord in writing that Tenant disagrees with Landlord’s determination of fair market rent, whereupon Landlord and Tenant shall meet and attempt to resolve such disagreement. In the event that Landlord and Tenant are unable to agree upon the fair market rent of the Premises for the first (1st) Lease Year of the relevant Option Term within twenty (20) days following Tenant’s notice, then the fair market rent for the first (1st) Lease Year of the relevant Option Term shall be determined by appraisal in the manner provided below. Until such appraisal procedures are completed, Tenant shall pay to Landlord the amount of Minimum Annual Rent due immediately preceding the commencement of the relevant Option Term increased by an amount equal to three percent (3%). After such appraisal procedure is completed and the fair market rent for the for the first (1st) Lease Year of the relevant Option Term is established, Tenant shall promptly make payment to Landlord for any underpayment of Minimum Annual Rent owing for prior months.

| 6 |

(d) The process for determining the fair market rent of the Premises by appraisal shall be as follows: The Premises shall be appraised by a Qualified Appraiser (as defined below) chosen by Landlord (“First Appraisal”) and the resulting appraisal report forwarded to Tenant. If the First Appraisal is deemed unacceptable by Tenant, then Tenant shall so advise Landlord in writing within ten (10) working days after receipt of the First Appraisal and Tenant shall have the right to engage a Qualified Appraiser to appraise the Premises (“Second Appraisal”) and the resulting appraisal report shall be forwarded to Landlord. In the event Landlord shall deem the Second Appraisal to be unacceptable, then Landlord shall advise Tenant within ten (10) working days after receipt of the Second Appraisal, and the first Qualified Appraiser and second Qualified Appraiser shall together choose a third Qualified Appraiser (the “Third Qualified Appraiser”) who shall appraise the Premises (“Third Appraisal”) and forward the resulting appraisal report to Landlord and Tenant. The Third Qualified Appraiser shall, within ten (10) days of its appointment, review the First Appraisal and the Second Appraisal and such other information as it shall deem necessary and shall determine which of the two appraisals is closer to the actual fair market rent for the first (1st) Lease Year of the relevant Option Term. The Third Qualified Appraiser shall be instructed, in deciding whether the Landlord’s determination of the fair market rent (as set forth in the First Appraisal) or the Tenant’s determination of the fair market rent (as set forth in the Second Appraisal) is closer to the actual fair market rent, to use the criteria as to the determination fair market rent set forth above. The Third Qualified Appraiser shall not establish its own fair market rent, and must select either the First Appraisal or the Second Appraisal and shall immediately and concurrently notify the parties of its selection. The fair market rent determined by the First Appraiser or the Second Appraiser and selected as the one closer to the actual fair market rent by the Third Qualified Appraiser shall be the Minimum Annual Rent payable by Tenant for the first (1st) Lease Year of the relevant Option Term; provided, however, in no event shall Minimum Annual Rent for the first (1st) Lease Year of either Option Term be less than three percent (3%) greater than the Minimum Annual Rent in effect immediately prior to the relevant Option Term. The cost of the First Appraisal shall be borne by Landlord. The cost of the Second Appraisal shall be borne by Tenant. The cost of the Third Appraisal shall be borne by the party whose appraisal was not selected by the Third Appraiser. As used in this Section, the term “Qualified Appraiser” means an MAI appraiser or licensed commercial real estate broker with no less than ten (10) years of experience appraising retail property in Los Angeles County, California.

(e) Commencing on the first (1st) day of the second (2nd) Lease Year of the relevant Option Term, and annually thereafter during the remainder of such Option Term, the Minimum Annual Rent then-in-effect shall be increased by an amount equal to three percent (3%).

5.3 Gross Sales Reporting.

(a) Intentionally Omitted.

(b) Upon Landlord’s request made not more frequently than once per year, Tenant shall furnish or cause to be furnished to Landlord a statement of the annual Gross Sales of Tenant within ten (10) days after Landlord’s request. Such statements shall be in a form mutually acceptable to Landlord and Tenant. Such statements shall be certified as an accurate accounting of Tenant’s Gross Sales by an authorized representative of Tenant. Landlord hereby agrees to keep such gross sales statements confidential and shall not disclose same to anyone other than its lenders and prospective lenders, buyers and prospective buyers, employees, attorneys, accountants and other consultants or as required by applicable law or court of competent jurisdiction. Landlord shall use its commercially reasonable efforts to require any of those recipients to keep such reports confidential.

(c) “Gross Sales”, as used in this Lease, shall mean the gross selling price of all merchandise or services sold or rented in or from the Premises by Tenant, its subtenants, licensees and concessionaires, whether for cash or on credit and whether made by store personnel or by machines or whether made by catalogue or internet sale (from on or off the Premises), excluding therefrom the following: (i) sales taxes, excise taxes or gross receipts taxes imposed by governmental entities upon the sale of merchandise or services, but only if collected from customers separately from the selling price and paid directly to the respective governmental entities; (ii) proceeds from the sale of fixtures, equipment or property which are not stock in trade; (iii) the selling price of all merchandise returned by customers and accepted for full credit; (iv) interest or other charges paid by customers for extension of credit; and (v) receipts from vending machines used solely by Tenant’s employees (the “Exclusions from Gross Sales”). Tenant shall use its reasonable good faith efforts to maximize Gross Sales from the Premises.

| 7 |

5.4 Additional Rent. Tenant shall pay, as “Additional Rent”, without offset, abatement or deduction (except as expressly set forth herein), all sums required to be paid by Tenant to Landlord pursuant to this Lease in addition to Minimum Annual Rent. Landlord shall have the same rights and remedies for the nonpayment of Additional Rent as it has with respect to the nonpayment of Minimum Annual Rent.

5.5 Late Payments. If Tenant fails to pay when the same is due any Minimum Annual Rent or Additional Rent, the unpaid amounts shall bear interest at the Interest Rate, as defined in Section 20.10(d), from the date the unpaid amount was initially due, to and including the date of payment. In addition, if any installment of Minimum Annual Rent or Additional Rent is not received by Landlord when due, Tenant shall immediately pay to Landlord a late charge equal to ten percent (10%) of the delinquent amount. Landlord and Tenant agree that this late charge represents a reasonable estimate of the costs and expenses Landlord will incur and is fair compensation to Landlord for its loss suffered by reason of late payment by Tenant. If Tenant shall issue a check to Landlord which is dishonored by Tenant’s depository bank and returned unpaid for any reason, including without limitation, due to insufficient funds in Tenant’s checking account, Tenant shall pay to Landlord in addition to any other rights or remedies available to Landlord pursuant to this Lease, the sum of One Hundred and 00/100 Dollars ($100.00) for Landlord’s administrative expense in connection therewith.

5.6 Place of Payment. Tenant shall pay Minimum Annual Rent and Additional Rent to Landlord at the address specified in Section 1.18, or to such other address and/or person as Landlord may from time to time designate in writing to Tenant.

ARTICLE 6. - TENANT FINANCIAL DATA

6.1 Intentionally Omitted.

6.2 Intentionally Omitted.

6.3 Intentionally Omitted.

6.4 Financial Statements. Within fifteen (15) business days after Landlord’s written request, Tenant shall furnish, and cause Guarantor to furnish, Landlord with financial statements or other reasonable financial information reflecting Tenant’s and Guarantor’s current financial condition, certified by Tenant or its financial officer and Guarantor, respectively. If Tenant is a publicly-traded corporation, delivery of Tenant’s last published financial information shall be satisfactory for purposes of this Section. Landlord hereby agrees to keep such financial statements confidential and shall not disclose same to anyone other than its lenders and prospective lenders, buyers and prospective buyers, employees, attorneys, accountants and other consultants or as required by applicable law or court of competent jurisdiction.

ARTICLE 7. - TAXES

7.1 Real Property Taxes.

(a) As used in this Lease, the term “Taxes” shall include any form of tax or assessment, license fee, license tax, possessory interest tax, tax or excise on rental, or any other levy, charge, expense or imposition imposed by any Federal, state, county or city authority having jurisdiction, or any political subdivision thereof, or any school, agricultural, lighting, drainage or other improvement or special assessment district on any interest of Landlord or Tenant in the Project. The term “Taxes” shall not include Landlord’s general income taxes, inheritance, estate or gift taxes.

| 8 |

(b) From and after the Commencement Date, Tenant shall pay to Landlord, as Additional Rent, a share of the Taxes pursuant to subparagraph (c) below. Taxes for any partial year shall be prorated. Landlord, at its option, may collect Tenant’s payment of its share of Taxes after the actual amount of Taxes are ascertained or in advance, monthly or quarterly, based upon estimated Taxes. If Landlord elects to collect Tenant’s share of Taxes based upon estimates, Tenant shall pay to Landlord from and after the Commencement Date, and thereafter on the first (1st) day of each month during the Term, an amount estimated by Landlord to be the monthly Taxes payable by Tenant. Landlord may periodically adjust the estimated amount. If Landlord collects Taxes based upon estimated amounts, then following the end of each calendar year or, at Landlord’s option, its fiscal year, Landlord shall furnish Tenant with a statement covering the year just expired showing the total Taxes for the Project for such year, the total Taxes payable by Tenant for such year, and the payments previously made by Tenant with respect to such year, as set forth above. If the actual Taxes payable for such year exceed Tenant’s prior payments, Tenant shall pay to Landlord the deficiency within ten (10) days after its receipt of the statement. If Tenant’s payments exceed the actual Taxes payable for that year, Tenant shall be entitled to offset the excess against the next payment(s) of Taxes and/or other Additional Rent that become due to Landlord; provided that Landlord shall refund to Tenant the amount of any overpayment for the last year of the Term.

(c) Tenant’s share of the Taxes shall be determined by multiplying all of the Taxes on the Project by a fraction, the numerator of which shall be the Floor Area of the Premises and the denominator of which is the total Floor Area in the Project. Notwithstanding the foregoing, if any owner or tenant of a portion of the Project separately pays taxes on the parcels which include its own premises and Common Area, the Floor Area on such owner’s or tenants’ parcels shall not be included in the denominator for purposes of calculation of Tenant’s share of Taxes. Notwithstanding the foregoing provisions, if the Taxes are not levied and assessed against the entire Project by means of a single tax bill (i.e., if the Project is separated into two (2) or more separate tax parcels for purposes of levying and assessing the Taxes), then, at Landlord’s option, Tenant shall pay Tenant’s pro rata share of all Taxes which may be levied or assessed by any lawful authority against the land and improvements of the separate tax parcel on which the Building containing the Premises is located. Tenant’s pro rata share under such circumstances shall be apportioned according to the Floor Area of the Premises as it relates to the total leasable Floor Area of the Building or buildings situated in the separate tax parcel in which the Premises is located.

7.2 Other Property Taxes. Tenant shall pay, prior to delinquency, all taxes, assessments, license fees and public charges levied, assessed or imposed upon its business operation, trade fixtures, merchandise and other personal property in, on or upon the Premises. If any such items of property are assessed with property of Landlord, then the assessment shall be equitably divided between Landlord and Tenant.

7.3 Contesting Taxes. If Landlord reasonably contests any Taxes levied or assessed during the Term, Tenant shall be required to pay its proportionate share of the out-of-pocket costs or expenses reasonably incurred by Landlord in connection with such contest; however, if Landlord is successful in such contest, Tenant shall be entitled to its proportionate share of any refund received pursuant to the formula set forth in Section 7.1(c) for the allocation of Taxes.

ARTICLE 8. - UTILITIES

Tenant agrees to pay directly to the appropriate utility company all charges for utility services supplied to Tenant for which there is a separate meter. Tenant agrees to pay to Landlord its share of utility services supplied to the Premises for which there is a submeter based on its actual consumption pursuant to the submeter reading upon billing by Landlord. Tenant agrees to pay to Landlord its share of all charges for utility services supplied to the Premises for which there is no separate meter or submeter upon billing by Landlord of Tenant’s share, as reasonably determined by Landlord based upon estimated actual usage, or based on a pro rata share basis. Landlord and Tenant shall reconcile the foregoing utility expenses at the same time and manner as Common Area Costs pursuant to Section 11.5 below. Regardless of the entity which supplies any of the utility services, Landlord shall not be liable in damages for any failure or interruption of any utility or service. No failure or interruption of any utility or service shall entitle Tenant to terminate this Lease or discontinue making payments of Minimum Annual Rent or Additional Rent. Tenant shall be responsible for the payment of all utility connection and/or hook-up fees for utility services supplied to the Premises and any other charges imposed in connection with the commencement of said utilities. Tenant agrees to reasonably cooperate with Landlord to the extent required by Landlord to comply with California Public Resources Code Section 25402.10 including, without limitation, providing or consenting to any utility company providing Tenant’s energy consumption information for the Premises to Landlord.

| 9 |

ARTICLE 9. - TENANT’S CONDUCT OF BUSINESS

9.1 Permitted Trade Name and Use. Tenant shall use the Premises solely under the Trade Name specified in Section 1.13 and shall not use the Premises under a different trade name without Landlord’s prior written consent, which consent shall not be unreasonably withheld, conditioned, or delayed; provided, however, Tenant may, without seeking Landlord’s prior written consent (but with prior written notice to Landlord), change the trade name under which its business in the Premises is operated to any trade name under which Tenant operates all or substantially all of its other locations in California previously operating under the original Trade Name are changed to. Tenant shall use the Premises solely for the use specified in Section 1.12 and for no other use or purpose.

9.2 Covenant to Open and Operate. Tenant covenants to open for business to the public with the Premises fully fixturized and stocked with merchandise and inventory on or before the Rent Commencement Date (the “Required Opening Date”) and to operate continuously and uninterruptedly in the entirety of the Premises throughout the Term the business described in Section 1.12, subject only to those temporary closures for casualty, condemnation, remodel, or force majeure (as defined in Section 20.5) which may prevent Tenant from conducting its normal business operations in the Premises.

9.3 Tenant’s Signs. Tenant shall not affix upon the exterior (or interior windows or doors) of the Premises any sign, advertising placard, name, insignia, trademark, descriptive material or other like item (collectively, the “Exterior Signs”), unless the Exterior Signs (i) comply with all governmental requirements, (ii) comply with the sign criteria (the “Sign Criteria”) for the Project attached hereto as Exhibit D, (iii) comply with the OEA and the Agreements, and (iv) are approved by Landlord, which approval shall not be unreasonably withheld, conditioned, or delayed. All of the Exterior Signs shall be erected by Tenant at its sole cost and expense, and Tenant shall maintain all of its Exterior Signs in good condition and repair during the Term. Tenant shall be permitted to use the standard and customary “Yoshiharu Japanese Ramen” corporate trademarked logos, lettering and fonts in its exterior signs and awnings on the facade of the Premises, subject to all governmental requirements, the Sign Criteria, the OEA, the Agreements and Landlord’s prior written approval, which approval shall not be unreasonably withheld, conditioned, or delayed; provided, however, such signage shall be professionally prepared and maintained in a neat manner and shall not, at any time, occupy more than twenty-five percent (25%) of the storefront windows or doors. Notwithstanding anything to the contrary herein this Section 9.3 above or elsewhere in this Lease, Tenant shall have the right and option, but not the obligation, to install its standard individual internally illuminated channel letter signage upon the front exterior sign band of the Premises, provided such signage is in compliance with applicable law and the Sign Criteria.

9.4 Hours of Business. From and after the Commencement Date, Tenant shall keep the entire Premises continuously open for business during those days and hours as are customary and usual for the type of business operated by Tenant including, but not limited to, all holidays except Christmas and New Year’s Day; provided, however, in no event shall Tenant be open for business less than 11:30 a.m. to 8:00 p.m. Monday through Sunday. Tenant shall have its exterior signs adequately illuminated continuously during those hours and days that the Premises are required to be open for business to the public.

| 10 |

9.5 Hours for Deliveries. All deliveries (exclusive of United Parcel Service and U.S. Postal Service), loading, unloading and services to the Premises shall be completed prior to 10:00 a.m. each day. All deliveries, loading, unloading and services to the Premises shall be accomplished within the service areas of the Project.

9.6 Radius Restriction. During the Term, neither Tenant nor any entity affiliated with Tenant shall own, operate or have any financial interest in any business similar to the business of Tenant, as set forth in Section 1.12, if such other business is opened after the Effective Date and its front door or storefront opening is located within the radius set forth in Section 1.22 (the “Radius Restriction Area”) of any portion of the Premises. Without limiting Landlord’s remedies if Tenant violates this covenant, Landlord, for so long as Tenant is operating the other business, may increase the Minimum Annual Rent hereunder to equal one hundred fifty percent (150%) of the Minimum Annual Rent then in effect.

9.7 Exclusive Use. From and after the Effective Date of this Lease, Landlord shall not execute any lease for premises located within the Project to any other “Japanese Ramen Restaurant,” as defined below (the “Exclusive Use”), subject to all of the following terms and the satisfaction of each and all of the following conditions:

(a) The Exclusive Use is not applicable to (i) Target or any tenant or occupant of the Cerritos Promenade Center located outside of the Project; or (ii) any leases for space in the Project entered into on or before the date of this Lease or to any tenants or occupants, including their successors and assigns, who have executed a lease for space in the Project on or before the date of this Lease (“Existing Tenants”), or to any new leases or extensions of existing leases entered into with such Existing Tenants; provided, however, Landlord agrees to withhold its consent to any proposed change of use under any existing lease with an Existing Tenant that would directly violate the terms of Tenant’s Exclusive Use or any extensions of any existing lease with any Existing Tenant or any new lease with any Existing Tenant that would otherwise directly violate the terms of Tenant’s Exclusive Use only if (A) Landlord has the right to do so under the terms of such lease (it being understood that Landlord shall not be obligated to exercise any right of recapture it may have under any such lease), and (B) by doing so Landlord shall not be in breach or default under the terms of such lease;

(b) The Exclusive Use restrictions shall automatically terminate in the event Tenant fails to open for business to the general public within thirty (30) days following the Rent Commencement Date or thereafter fails to continuously operate for business, excepting temporary closures due to remodeling, repairs due to casualty or condemnation or other force majeure events;

(c) The Exclusive Use restrictions shall automatically terminate and be of no further force or effect effective as of the date which is the earliest of (i) a change in the original Permitted Use of the Premises set forth in Section 1.12 such that the Premises is no longer used primarily as a Japanese Ramen Restaurant; or (ii) the expiration or earlier termination of the Lease; and

(d) The term “Japanese Ramen Restaurant” shall mean a restaurant whose primary business is the preparation and sale of Japanese Ramen entrees and related products (including sushi). As used herein, the term “primary business” means that the gross sales of Japanese Ramen entrees constitute more than fifteen percent (15%) of such tenant’s total annual gross sales from its premises.

Notwithstanding anything contained herein to the contrary, Landlord shall not be obligated to maintain or enforce the terms of this Section 9.7 or any similar provisions of the Lease to the extent same would be in violation of any anti-trust law. If such anti-trust violation is the basis of a claim or counterclaim against Landlord in connection with Landlord’s attempted enforcement of this Exclusive Use, then Landlord shall promptly consult with Tenant regarding Tenant’s desire to further pursue enforcement of this exclusive. In addition, Tenant shall defend, indemnify and save Landlord and its employees, agents and assigns harmless from and against any and all losses, damages, actions, causes of action, claims, liabilities, demands, costs and expenses including, without limitation, attorneys’ fees, arising out of the Exclusive Use restrictions set forth herein or arising out of the enforcement of such restrictions. Landlord shall have the right to provide a copy of this Section 9.7 to any tenant or prospective tenant of the Project.

| 11 |

ARTICLE 10. - MAINTENANCE, REPAIRS AND ALTERATIONS

10.1 Landlord’s Maintenance Obligations. Landlord shall maintain in good condition and repair the structural components and foundations, roofs and exterior surfaces of the exterior walls of all buildings (exclusive of doors, door frames, door checks, windows, window frames and, unless Landlord elects to include cleaning of the storefronts and storefront awnings of tenants of the Project as part of Common Area maintenance pursuant to Section 11.2 below, storefronts and storefront awnings). Notwithstanding the foregoing, Tenant shall pay for the cost of any repairs or replacements resulting from (i) Tenant’s negligence or willful acts, or those of anyone claiming under Tenant, or (ii) Tenant’s failure to observe or perform any condition or agreement contained in this Lease, or (iii) any alterations, additions or improvements made by Tenant or anyone claiming under Tenant. It is acknowledged by Tenant that the cost of all or some of Landlord’s maintenance obligations referenced in the preceding sentence shall be prorated and paid as Common Area Costs. Without limiting the foregoing, Tenant waives the right to make repairs at Landlord’s expense and/or any related termination right under any law, statute or ordinance now or hereafter in effect (including the provisions of California Civil Code Sections 1932(1), 1941 and 1942 and any successor sections or statutes of similar nature).

10.2 Landlord’s Right of Entry. Landlord, its agents, contractors, servants and employees may enter the Premises following reasonable prior notice to Tenant and Landlord’s good faith efforts to coordinate such entry with Tenant’s on-site management so as to minimize interference with Tenant’s business operations (except in a case of emergency): (a) to examine the Premises; (b) to perform any obligation or exercise any right or remedy of Landlord under this Lease or make repairs, alterations, improvements or additions to the Premises or to other portions of the Project; (c) to perform work necessary to comply with laws, ordinances, rules or regulations of any public authority or of any insurance underwriter; and (d) to perform work that Landlord deems necessary to prevent waste or deterioration in connection with the Premises should Tenant fail to commence such work within ten (10) days after written notice from Landlord of the need for such work (or if more than ten (10) days shall be required because of the nature of the work, if Tenant shall fail to diligently proceed to commence to perform such work after written notice). If Landlord makes any repairs which Tenant is obligated to make pursuant to the terms of this Lease, Tenant shall pay the cost of such repairs to Landlord, as Additional Rent, promptly upon receipt of a bill from Landlord for same.

10.3 Tenant’s Maintenance Obligations. Except for the portions and components of the Premises to be maintained by Landlord as set forth in Section 10.1, Tenant, at its expense, shall keep the Premises and all utility facilities and systems exclusively serving the Premises (“Tenant Utility Facilities”) in first-class order, condition and repair and shall make replacements necessary to keep the Premises and Tenant Utility Facilities in such condition; provided, however, Tenant shall have no right to spray paint the exterior or interior of the windows or doors without Landlord’s prior written consent, which consent shall not be unreasonably withheld, conditioned, or delayed. All replacements shall be of a quality equal to or exceeding that of the original. At the option of Landlord, (a) Tenant shall contract with a service company approved by Landlord for the regular (but not less frequently than quarterly) maintenance, repair and/or replacement (when necessary) of the heating, ventilating and air conditioning equipment serving the Premises (the “HVAC System”) and shall provide Landlord with a copy of any service contract within ten (10) days following its execution, or (b) Landlord may contract with a service company of its own choosing (or provide such service itself) for the maintenance, repair and/or replacement of the HVAC System and bill Tenant periodically for the cost of same or based upon estimates in a manner similar to the way in which Common Area Costs are estimated and billed. Until further written notice from Landlord, Landlord hereby elects option (b) set forth above. If required by applicable laws and/or applicable governmental authority, Tenant shall, at Tenant’s sole cost and expense, operate, maintain, repair, replace and clean any remote grease trap interceptor (together with all necessary lines and ancillary equipment and connections to the Premises) (collectively, the “Grease Interceptor Equipment”) required for Tenant’s Permitted Use in size and capacity as determined by the applicable governmental authorities and maintain same in compliance with all applicable laws, governmental requirements and the Agreements in first class order, condition and repair and shall make all replacements necessary to keep such Grease Interceptor Equipment in such condition. Additionally, at the option of Landlord, (a) Tenant shall contract with a service company reasonably approved by Landlord for the regular (but not less frequently than quarterly) cleaning, maintenance, repair and/or replacement (when necessary) of the Grease Interceptor Equipment serving the Premises and shall provide Landlord with a copy of any service contract within fifteen (15) days following request therefor, or (b) Landlord may contract with a service company of its own choosing (or provide such service itself) for the cleaning, maintenance, repair and/or replacement of the Grease Interceptor Equipment and bill Tenant periodically for the cost of same or based upon estimates in a manner similar to the way in which Taxes are estimated and billed. Until further written notice from Landlord, Landlord hereby elects option (a) set forth above.

| 12 |

10.4 Alterations. After initially opening the Premises for business, Tenant shall not make or cause to be made to the Premises or the Tenant Utility Facilities any addition, renovation, alteration, reconstruction or change (collectively, “Alterations”) (i) costing in excess of Ten Thousand Dollars ($10,000.00), (ii) affecting the exterior storefront, fire sprinkler systems, exterior walls, floor slab, or roof of the Premises, (iii) requiring or resulting in any penetration of the roof, demising walls or floor slab of the Premises, or (iv) involving structural changes or additions, without first obtaining the written consent of Landlord, which consent shall not be unreasonably withheld, conditioned, or delayed. Tenant shall provide Landlord with not less than ten (10) days prior written notice of the commencement of any Alterations in the Premises and Landlord shall have the right to enter upon the Premises to post customary notices of non- responsibility with respect thereto. Subject to Section 20.6, all improvements to the Premises by Tenant including, but not limited to, light fixtures, floor coverings and partitions and other items comprising Tenant’s Work pursuant to Exhibit C, but excluding trade fixtures and signs, shall be deemed to be the property of Landlord upon installation thereof. Within thirty (30) days after the completion of any Alterations, Tenant shall deliver to Landlord a set of “as built” plans depicting the Alterations as actually constructed or installed. If Tenant shall make any permitted Alterations, Tenant shall carry “Special Form Causes of Loss” or “Builder’s All Risk” insurance in an amount reasonably determined by Landlord covering the construction of such Alterations and such other insurance as Landlord may reasonably require. Any Alterations to the Premises or the Tenant Utility Systems which are required by reason of any present or future law, ordinance, rule, regulation or order of any governmental authority having jurisdiction over the Premises or the Project or of any insurance company insuring the Premises, and regardless of whether or not such Alteration pertains to the nature, construction or structure of the Premises or to the use made thereof by Tenant, shall be at the sole cost of Tenant regardless of whether the work is performed by Landlord or Tenant.

ARTICLE 11. - COMMON AREA

11.1 Definition of Common Area. The term “Common Area”, as used in this Lease, shall mean all areas within the exterior boundaries of the Project (or areas immediately adjacent to the Project such as, but not limited to, landscaped medians), now or later made available for the general use of Landlord and other persons entitled to occupy Floor Area in the Project.

11.2 Use of Common Area. The use and occupancy by Tenant of the Premises shall include the non-exclusive use of the Common Area (except those portions of the Common Area on which have been constructed or placed permanent or temporary kiosks, displays, carts and stands and except areas used in the maintenance or operation of the Project) in common with Landlord and the other tenants of the Project and their customers and invitees, subject to reasonable and nondiscriminatory enforced rules and regulations concerning the use of the Common Area established by Landlord from time to time.

11.3 Control of and Changes to Common Area. Landlord shall have the sole and exclusive control of the Common Area, and the right to make changes to the Common Area. Landlord’s rights shall include, but not be limited to, the right to (a) utilize from time to time any portion of the Common Area for promotional, entertainment and related matters; (b) place permanent or temporary kiosks, displays, carts and stands in the Common Area and to lease same to tenants; (c) restrain the use of the Common Area by unauthorized persons; (d) temporarily close any portion of the Common Area for repairs, improvements or Alterations, to discourage non-customer use, to prevent dedication or an easement by prescription or for any other reason deemed sufficient in Landlord’s reasonable judgment; and (e) renovate, upgrade or change the shape and size of the Common Area or add, eliminate or change the location of improvements to the Common Area including, without limitation, buildings, parking areas, roadways and curb cuts, and to construct buildings on the Common Area. Landlord, at any time, may change the shape, size, location, number and extent of the improvements shown on Exhibit A and eliminate, add or relocate any improvements to any portion of the Project, and may add land to and/or withdraw land from the Project. Notwithstanding the foregoing to the contrary, except as required by applicable laws, applicable governmental authority or to comply with Agreements, Landlord shall not exercise the rights set forth in this Section in a manner that will materially and adversely affect (i) access to and from the Premises, (ii) visibility of the Premises from South Street, or (iii) parking for the Premises.

| 13 |

11.4 Common Area Costs. The term “Common Area Costs”, as used in this Lease, shall mean all costs and expenses incurred by Landlord in (a) operating, managing, policing, repairing and maintaining the Common Area and the on-site management and/or security offices, nonprofit community buildings and child care centers as may be located in the Project from time to time (which offices, buildings and center shall hereinafter be referred to as the “Joint Use Facilities”), (b) maintaining, repairing and replacing the exterior surface of exterior walls (and storefronts and storefront awnings if Landlord has elected to include the cleaning of same as part of Common Area maintenance) and maintaining, repairing and replacing roofs of the buildings from time to time constituting the Project, and (c) operating, insuring, repairing, replacing and maintaining all utility facilities and systems including, without limitation, sanitary sewer lines and systems, fire protection lines and systems, security lines and systems and storm drainage lines and systems not exclusively serving the premises of any tenant or store (“Common Utility Facilities”), Common Area furniture and equipment, seasonal and holiday decorations, Common Area lighting fixtures, directional signage, and Common Area fountains. Common Area Costs shall include the actual costs incurred by Landlord for personnel (whether employees of Landlord or third parties) employed in the management and/or operation of the Project. Common Area Costs shall include, without limitation, the following: Expenses for maintenance, repaving, resurfacing, landscaping, repairs, replacements, lighting, cleaning, painting, trash removal, management offices, security, non-refundable contributions toward reserves for replacements, maintenance and/or repairs such as, but not limited to, major parking lot repairs and repainting of buildings, fire protection and similar items; depreciation or rental on equipment; charges, surcharges and other levies related to the requirements of any Federal, state or local governmental agency; Taxes on the improvements and land comprising the Common Area; comprehensive or commercial general liability insurance on the Common Area; standard “all risks” fire and extended coverage insurance with, at Landlord’s option, an earthquake and/or flood damage endorsement covering the Common Areas; the cost of any deductibles or self-insured retentions relating to the insurance maintained by Landlord pursuant hereto; costs, expenses and assessments allocable to the Project pursuant to the Agreements; expenses related to the Common Utility Facilities; and a sum (the “Supervision Fee”) payable to Landlord for administration and overhead in an amount equal to fifteen percent (15%) of the Common Area Costs, Tenant’s share of Taxes pursuant to Section 7.1 and Tenant’s share of insurance premiums pursuant to Section 13.4. Landlord may include Capital Expenditures (as defined hereafter) in the Common Area Costs provided that (i) such Capital Expenditures are limited to compliance with applicable laws or legal requirements, including, without limitation, ADA (but excluding remedying any violation existing as of the Effective Date) and/or the repair or replacement of then-existing Common Area improvements and facilities (as distinguished from new capital improvements that are not required by applicable laws or legal requirements referenced above) (collectively, “Permitted Capital Expenditures”) and (ii) are amortized (together with interest at generally accepted rates) in accordance with generally accepted shopping center management practices over the useful life of the item as reasonably determined by Landlord. “Capital Expenditures” means those expenditures costing in excess of Twenty-Five Thousand Dollars ($25,000.00), which, in accordance with generally accepted accounting principles, are not fully chargeable to current expenses in the year the expenditure is incurred. In addition to the Common Area Costs, Tenant shall pay Landlord a management fee equal to three percent (3%) of the Minimum Annual Rent then payable hereunder (the “Management Fee”), which Management Fee shall be payable in equal monthly installments at the same time as Common Area Costs. Notwithstanding anything to the contrary herein this Section 11.4 above or elsewhere in this Lease, Common Area Costs shall not include any of the following: (i) Any charge for Landlord’s net income taxes; (ii) All costs relating to activities for the marketing, solicitation, negotiation, and execution of leases of space in the Project, including without limitation, costs of tenant improvements; (iii) The cost of correcting defects in the original construction of the building or in the building equipment, or other improvements in the Project; (iv) To the extent Landlord is reimbursed by third parties other than tenants, the cost of repair made by Landlord because of the total or partial destruction of the building in which the Premises are located or the other improvement in the Project, or the condemnation of a portion of the building in which the Premises are located or the Project; (v) The cost of any items for which Landlord is reimbursed by insurance or otherwise compensated by parties other than tenants of the building in which the Premises are located or the Project leased to other tenants; (vi) Ground rent or similar payments to a ground lessor; (vii) Legal fees and related expenses incurred by Landlord (together with any damages awarded against Landlord) due to the gross negligence or willful misconduct of Landlord; (viii) Capital Expenditures, other than the annual amortized amount of Permitted Capital Expenditures expressly set forth above; (ix) Costs arising from the presence of any Hazardous Materials within, upon, or beneath the Premises or Project prior to the Rent Commencement Date by reason of Landlord’s act or any other third party; (x) The costs of special services rendered to tenants (including Tenant) for which a special charge is made to such tenants; (xi) Any costs borne directly by Tenant under this Lease; or (xii) Loan payments of any type; (xiii) Any cost incurred on matters occurring outside of and/or unrelated to the Project.

| 14 |

11.5 Proration of Common Area Costs. The Common Area Costs shall be prorated in the following manner:

(a) From and after the Commencement Date, Tenant shall pay to Landlord, on the first (1st) day of each calendar month, an amount estimated by Landlord to be the monthly amount of Tenant’s share of the Common Area Costs. The estimated monthly charge may be adjusted periodically by Landlord on the basis of Landlord’s reasonably anticipated costs.

(b) Within one hundred fifty (150) days following the end of each calendar year or, at Landlord’s option, its fiscal year, Landlord shall furnish to Tenant a statement covering the calendar or fiscal year (as the case may be) just expired, showing by cost category the actual Common Area Costs for that year, the total Floor Area of the Project, the amount of Tenant’s share of the Common Area Costs for that year, and the monthly payments made by Tenant during that year for the Common Area Costs. If Tenant’s share of the Common Area Costs exceeds Tenant’s prior payments, Tenant shall pay to Landlord the deficiency within ten (10) days after receipt of such annual statement. If Tenant’s payments for the calendar year exceed Tenant’s actual share of the Common Area Costs, and provided Tenant is not in arrears as to the payment of any Minimum Annual Rent or Additional Rent, Tenant may offset the excess against payments of Common Area Costs next due Landlord. An appropriate proration of Tenant’s share of the Common Area Costs as of the Commencement Date and the expiration date of the Term shall be made.

(c) Tenant’s share of the Common Area Costs shall be determined by multiplying the Common Area Costs by a fraction, the numerator of which is the number of square feet of Floor Area in the Premises and the denominator of which is the Floor Area in the Project. Notwithstanding the foregoing, if any owner or tenant of a portion of the Project separately maintains its own Common Area, Common Area Costs shall not include costs relating to the Common Area so maintained by such owner or tenant, and the Floor Area on such owner’s or tenant’s parcel shall not be included in the denominator for purposes of calculation of Tenant’s share of Common Area Costs.

(d) Notwithstanding anything contained in this Section 11.5 to the contrary, at Landlord’s option: (i) Landlord shall have the right to allocate certain Common Area Costs to less than all of the occupants in the Project, in which event Tenant’s share of such costs (the “Cost Pool”) shall be as follows: (A) in the event Tenant is one of the occupants participating in such Cost Pool, its share of such Common Area Costs shall be calculated in the manner set forth in Section 11.5(c), but the denominator used to determine such share shall exclude those occupants not participating in such Cost Pool; or (B) in the event Tenant is not one of the occupants participating in such Cost Pool, its share of such Common Area Costs shall be calculated in the manner set forth in Section 11.5(c), but the denominator used to determine such share shall exclude those occupants participating in such Cost Pool; or (ii) Landlord shall have the right to cause Tenant to directly pay for any extraordinary expenses resulting from Tenant’s operations from the Premises (e.g., a restaurant user with an outdoor patio may be directly responsible for the extraordinary costs incurred by Landlord in cleaning the Common Area directly adjacent to such outdoor patio area).

| 15 |

11.6 Parking. Tenant and its employees shall park their vehicles only in the parking areas from time to time designated for that purpose by Landlord. Tenant’s contractors shall park their vehicles and stage their construction activities only in the areas identified on Exhibit A, or if not identified thereon, as designated by Landlord from time to time. Without limiting the generality of the foregoing, Landlord shall have the right to designate parking areas for Tenant’s employees at locations within walking distance of the Project or accessible by shuttle bus service. If any offsite employee parking program is implemented by Landlord, Tenant shall pay to Landlord Tenant’s percentage share of the cost of such program based on the ratio of the Floor Area of the Premises to the total Floor Area of the premises of all tenants in the Project required to participate in the program. Tenant shall furnish Landlord with a list of its and its employees’ vehicle license numbers within fifteen (15) days after the Commencement Date and, thereafter, within ten (10) days following written notice from Landlord. If Tenant’s employees park in violation of these provisions or other parking rules and regulations implemented by Landlord with respect to the Project, Landlord may charge Tenant, as Additional Rent, Ten Dollars ($10.00) per day per violation for each day or partial day the violation continues. Tenant authorizes Landlord to attach violation stickers or notices to any vehicle belonging to Tenant or Tenant’s employees parking in violation of these provisions. Tenant authorizes Landlord to tow, at Tenant’s expense, any vehicle belonging to Tenant or Tenant’s employees parking in violation of applicable laws or the Agreements or which is not promptly moved following notice from Landlord. Tenant author these provisions and/or to attach violation stickers or notices to any such vehicle. If Landlord implements any program related to parking, parking facilities or transportation or other program to limit, control, enhance, regulate or assist parking by customers of the Project, Tenant agrees to participate in the program and to pay its prorata share of the costs of the program under rules and regulations from time to time established by Landlord.

ARTICLE 12. – INTENTIONALLY OMITTED

ARTICLE 13. - INSURANCE

13.1 Tenant’s Insurance. Tenant, at its sole cost and expense, commencing on the Possession Date and continuing during the Term, shall procure, pay for and keep in full force and effect the following types of insurance, in at least the amounts and in the forms specified below:

(a) Comprehensive or commercial general liability insurance with coverage limits of not less than One Million Dollars ($1,000,000.00) per occurrence and Two Million Dollars ($2,000,000.00) in the aggregate for combined single limit for bodily injury, personal injury, death and property damage liability per occurrence or the limit carried by Tenant, whichever is greater, insuring against any and all liability of the insureds with respect to the Premises or arising out of the maintenance, use or occupancy of the Premises or related to the exercise of any rights of Tenant pursuant to this Lease, subject to increases in amount as Landlord may reasonably require from time to time. All such liability insurance shall specifically insure the performance by Tenant of the indemnity agreement as to liability for injury to or death of persons and injury or damage to property set forth in Section 13.5. Further, all such liability insurance shall include, but not be limited to, personal injury, blanket contractual, cross-liability and severability of interest clauses, broad form property damage, independent contractors, owned, non-owned and hired vehicles and, if alcoholic beverages are served, sold, consumed or obtained in the Premises, liquor law liability.

(b) Worker’s compensation coverage in an amount adequate to comply with law, and employer’s liability coverage with a limit of not less than One Million Dollars ($1,000,000.00).

(c) Plate glass insurance covering all plate glass on the Premises at full replacement value. Tenant shall have the option either to insure this risk or to self-insure.

| 16 |

(d) Insurance covering all of Tenant’s Work, Tenant’s leasehold improvements and Alterations permitted under Article 10 and all furniture, fixtures, equipment and other personal property located in or at the Premises, in an amount not less than their full replacement value from time to time, including replacement cost endorsement, providing protection against any peril included within the classification Fire and Extended Coverage, sprinkler damage, vandalism, theft, burglary, malicious mischief, earthquake and such other additional perils as covered in a “special form causes of loss” or an “all risks” standard insurance policy or as Landlord may reasonably require. Any policy proceeds shall be used for the repair or replacement of the property damaged or destroyed unless this Lease shall cease and terminate under the provisions of Article 14.

13.2 Policy Form. All policies of insurance required of Tenant herein shall be issued by insurance companies with a general policy holder’s rating of not less than “A” and a financial rating of not less than Class “X”, as rated in the most current available “Best’s Key Rating Guide”, and which are qualified to do business in the State of California. All such policies, except for the Workers’ Compensation coverage, shall name and shall be for the mutual and joint benefit and protection of Landlord, Tenant and Landlord’s agents and mortgagee(s) or beneficiary(ies) as additional insureds. The policies described in subparagraphs (c) and (d) of Section 13.1 shall also name Landlord and Landlord’s mortgagee(s) or beneficiary(ies) as loss payees, and Landlord shall furnish to Tenant the names and addresses of such mortgagee(s) and beneficiary(ies). Executed copies of the policies of insurance or certificates thereof shall be delivered to Landlord prior to Tenant, its agents or employees entering the Premises for any purpose. Thereafter, executed copies of renewal policies or certificates thereof shall be delivered to Landlord within thirty (30) days prior to the expiration of the term of each policy. All policies of insurance delivered to Landlord must contain a provision that the company writing the policy will give to Landlord thirty (30) days’ prior written notice of any cancellation or lapse or the effective date of any reduction in the amounts of insurance. All policies required of Tenant herein shall be endorsed to read that such policies are primary policies and any insurance carried by Landlord or Landlord’s property manager shall be noncontributing with such policies. No policy required to be maintained by Tenant shall have a deductible greater than Twenty-Five Thousand Dollars ($25,000.00) unless approved in writing by Landlord.

13.3 Blanket Policies. Notwithstanding anything to the contrary contained in this Article 13, Tenant’s obligation to carry insurance may be satisfied by coverage under a so-called blanket policy or policies of insurance; provided, however, that the coverage afforded Landlord will not be reduced or diminished and the requirements set forth in this Lease are otherwise satisfied by such blanket policy or policies.

13.4 Reimbursement of Insurance Premiums by Tenant. Landlord, at all times from and after the Possession Date, shall maintain in effect during the Term (i) comprehensive or commercial general liability insurance with coverage limits determined by Landlord in its sole discretion, and (ii) a policy or policies of insurance covering the Building of which the Premises are a part (including boiler and machinery) in an amount not less than eighty percent (80%) of the full replacement cost (exclusive of the cost of excavations, foundations and footings) or the amount of insurance Landlord’s mortgagee(s) or beneficiary(ies) may require Landlord to maintain, whichever is the greater, providing protection against any peril generally included in the classification “Special Form Causes of Loss” or “Fire and Extended Coverage”, loss of rental income insurance and such other additional insurance as covered in a “special form causes of loss” or an “all risks” standard insurance policy, with earthquake coverage insurance, terrorism insurance and/or environmental insurance if deemed necessary by Landlord in Landlord’s sole judgment or if required by Landlord’s mortgagee(s) or beneficiary(ies) or by any Federal, state, county, city or local authority. Landlord’s obligation to carry this insurance may be brought within the coverage of any so-called blanket policy or policies of insurance carried and maintained by Landlord. From and after the Commencement Date, Tenant agrees to pay to Landlord, as Additional Rent, its share of the cost to Landlord of all insurance maintained by Landlord pursuant to this Lease (“Landlord’s Insurance”). The cost of such insurance for any partial year of the Term shall be prorated. Payment shall be made in the same manner set forth for payment of Taxes in Section 7.1(b). Tenant’s share of the premiums for this insurance shall be a fractional portion of the premiums, the numerator of which shall be the Floor Area of the Premises and the denominator of which is the Floor Area covered by this insurance. Tenant acknowledges that Landlord shall have the right to maintain commercially reasonable deductibles and/or self-insured retentions in connection with any insurance carried by Landlord pursuant to this Lease, as determined by Landlord in its reasonable business judgment. In the event of an insurance loss covered by the insurance carried by Landlord pursuant to this Lease, Tenant shall be required to pay its share of such deductibles or self-insured retentions, as determined pursuant to this Section 13.4 or Section 11.5, as applicable.

| 17 |

13.5 Indemnity. “Landlord” for the purposes of this Section shall mean and include Landlord and Landlord’s directors, officers, shareholders, agents and employees. To the fullest extent permitted by law, Tenant covenants with Landlord that Landlord shall not be liable for any damage or liability of any kind or for any injury to or death of persons or damage to property of Tenant or any other person occurring from and after the Possession Date (or such earlier date if Tenant is given earlier access to the Premises) from any cause whatsoever related to the use, occupancy or enjoyment of the Premises by Tenant or any person thereon or holding under Tenant. Tenant shall pay for, defend (with an attorney approved by Landlord), indemnify, and save Landlord harmless against and from any real or alleged damage or injury and from all claims, judgments, liabilities, costs and expenses, including attorney’s fees and costs, arising out of or connected with Tenant’s use of the Premises and its facilities, or any repairs, Alterations or improvements (including original improvements and fixtures specified as Tenant’s Work) which Tenant may make or cause to be made upon the Premises, any breach of this Lease by Tenant and any loss or interruption of business or loss of rental income resulting from any of the foregoing; provided, however (and though Tenant shall in all cases accept any tender of defense of any action or proceeding in which Landlord is named or made a party and shall, notwithstanding any allegations of negligence or misconduct on the part of Landlord, defend Landlord as provided herein), Tenant shall not be liable for such damage or injury to the extent and in the proportion that the same is ultimately determined to be attributable to the negligence or misconduct of Landlord, and Landlord shall pay for, defend, indemnify, and save Tenant harmless against and from any and all claims, judgments, liabilities, costs and expenses, including attorneys’ fees and costs, resulting from any such damage or injury. The obligations to indemnify set forth in this Section shall include all attorneys’ fees, litigation costs, investigation costs and court costs and all other costs, expenses and liabilities incurred by the indemnified party from the first notice that any claim or demand is to be made or may be made. All indemnity obligations under this Section shall survive the expiration or termination of this Lease.