Exhibit

10.7

THE

IRVINE COMPANY

RETAIL

LEASE

Yoshiharu

Japanese Ramen

Orchard

Hills Shopping Center

RETAIL

LEASE

THIS

RETAIL LEASE and all exhibits attached hereto (collectively, “Lease”) is entered into by Landlord and Tenant

and is effective as of December 30, 2020 (“Lease Date”).

ARTICLE

1

BASIC

LEASE PROVISIONS

| 1.1 |

Landlord:

IRVINE ORCHARD HILLS RETAIL LLC, a Delaware limited liability company (“Landlord”). |

|

|

| |

|

|

|

| 1.2 |

Tenant:

YOSHIHARU IRVINE, a California corporation (“Tenant”). |

|

|

| |

|

|

|

| 1.3 |

Trade

Name: Yoshiharu Japanese Ramen (“Trade Name”). |

|

(Art.

7) |

| |

|

|

|

| 1.4 |

Shopping

Center: Orchard Hills Shopping Center, located in the City of Irvine, State of California (“Shopping Center”). |

|

(Art.

2) |

| |

|

|

|

| 1.5 |

Premises

Address: 3935 Portola Parkway, Irvine, CA 92602 (“Premises”). |

|

(Art.

2) |

| |

|

|

|

| 1.6 |

Floor

Area: Approximately 1,420 square feet, determined in accordance with Section 21.15 (“Floor Area”). |

|

(Art.

21) |

| |

|

|

|

| 1.7 |

Lease

Term (“Term”): Beginning on the date (“Commencement Date”) that is the earlier

of (i) the date Tenant opens for business to the public in the Premises and (ii) the expiration of 150 days following the date of

Landlord’s Notice to Tenant that the Premises are vacant and Tenant is entitled to possession of the Premises upon satisfaction

of the Delivery Requirements set forth in Exhibit C (“Delivery Notice”) and ending on the last day

of the month 120 months thereafter unless sooner terminated as provided in this Lease (“Expiration Date”). |

|

(Art.

2) |

| |

|

|

|

| 1.8 |

Base

Rent (“Base Rent”): |

|

(Art.

3) |

| Months | |

Rent PSF | | |

Monthly Rent | | |

Annual Rent | |

| 1 to 12 | |

$ | 52.00 | | |

$ | 6,153.33 | | |

$ | 73,840.00 | |

| 13 to 24 | |

$ | 53.56 | | |

$ | 6,337.93 | | |

$ | 76,055.20 | |

| 25 to 36 | |

$ | 55.17 | | |

$ | 6,528.45 | | |

$ | 78,341.40 | |

| 37 to 48 | |

$ | 56.83 | | |

$ | 6,724.88 | | |

$ | 80,698.60 | |

| 49 to 60 | |

$ | 58.53 | | |

$ | 6,926.05 | | |

$ | 83,112.60 | |

| 61 to 72 | |

$ | 60.29 | | |

$ | 7,134.32 | | |

$ | 85,611.80 | |

| 73 to 84 | |

$ | 62.10 | | |

$ | 7,348.50 | | |

$ | 88,182.00 | |

| 85 to 96 | |

$ | 63.96 | | |

$ | 7,568.60 | | |

$ | 90,823.20 | |

| 97 to 108 | |

$ | 65.88 | | |

$ | 7,795.80 | | |

$ | 93,549.60 | |

| 109 to 120 | |

$ | 67.86 | | |

$ | 8,030.10 | | |

$ | 96,361.20 | |

| 1.9 |

Percentage

Rent (“Percentage Rent”): |

Percentage

Rent is payable for each calendar year that Tenant’s Gross Sales (see Exhibit D) for such year exceed the applicable Gross

Sales threshold described in Section 1.9(a) below (“Breakpoint”), and shall equal the amount of such Gross

Sales in excess of the Breakpoint multiplied by the Percentage Rate set forth in Section 1.9(b) below.

| Months | |

Breakpoint | |

| 1 to 12 | |

$ | 1,500,000.00 | |

| 13 to 24 | |

$ | 1,545,000.00 | |

| 25 to 36 | |

$ | 1,591,350.00 | |

| 37 to 48 | |

$ | 1,639,090.50 | |

| 49 to 60 | |

$ | 1,688,263.22 | |

| 61 to 72 | |

$ | 1,738,911.11 | |

| 73 to 84 | |

$ | 1,791,078.44 | |

| 85 to 96 | |

$ | 1,844,810.80 | |

| 97 to 108 | |

$ | 1,900,155.12 | |

| 109 to 120 | |

$ | 1,957,159.78 | |

| |

(b) |

Percentage

Rate: 7.00% (“Percentage Rate”). |

(Art.

3)

| 1.10 |

Use

of Premises: The Premises shall be used for the operation of a first-class Japanese restaurant specializing in ramen-based cuisine.

Tenant will be permitted to offer other dishes; all in accordance with the menu attached hereto as Exhibit J (the “Menu”).

Tenant shall also be permitted to sell alcoholic beverages for on-Premises consumption only, provided Tenant obtains, at Tenant’s

sole cost and expense, any and all necessary and required permits, licenses and/or governmental approvals (Tenant will provide Landlord

copies of all such permits, licenses and governmental approvals promptly upon receipt). Tenant may make minor changes to the Menu

from time to time, provided that (1) the items offered on such revised menu and the original theme and concept of the restaurant

remain substantially the same as that which is in existence as of the Commencement Date, and (2) such minor changes do not violate

any exclusive use in the Shopping Center (“Permitted Use”). |

|

(Art.

7) |

| 1.11 |

Radius

Restriction: 5.00 miles, measured from the closest point on the perimeter of the Shopping Center to the “Other Business”

(as defined in Section 7.4) (“Radius Restriction Area”). |

|

(Art.

7) |

| |

|

|

|

| 1.12 |

|

|

(Art.

11) |

| |

|

|

|

| |

(a)

Initial Promotional Assessment: A one-time charge equal to $2,500.00 (“Initial Promotional Assessment”). |

|

|

| |

|

|

|

| |

(b)

Promotional Charge: An annual charge equal to $1.50 per square foot of the Floor Area of the Premises (“Promotional Charge”). |

|

|

| |

|

|

|

| 1.13 |

Minimum

Insurance Limits: Two Million Dollars ($2,000,000.00). |

|

(Ex.

F) |

| |

|

|

|

| 1.14 |

Security

Deposit: $6,768.66 (“Security Deposit”). |

|

(Art.

18) |

| |

|

|

|

| 1.15 |

Guarantor(s):

James Chae and Jennie Y. Chae, husband and wife, jointly and severally (“Guarantor”). |

|

(Ex.

I) |

| |

|

|

|

| 1.16 |

Tenant’s

Share (“Tenant’s Share”): A fraction, the numerator of which is the Floor Area of the Premises, and

the denominator of which is the following, as applicable, in each case determined as of the commencement of the applicable fiscal

year: |

|

(Art.

9)

(Ex.

F) |

(a)

For Common Area Expenses (described in Section 9.3), the greater of (i) the Floor Area in the Shopping Center occupied by tenants, excluding

Floor Area occupied by “Other Stores” (as defined in Section 9.4), and (ii) the product obtained by multiplying eighty-five

percent (85%) by the Floor Area in the Shopping Center, and subtracting from the result the Floor Area occupied by Other Stores; and

(b)

For Taxes (described in Section 5.1(a)), the greater of (i) the Floor Area in the parcel(s) covered by the tax bill(s) in question (“Larger

Parcel”) occupied by tenants who do not pay Taxes directly to the taxing authority, and subtracting from the result the

Floor Area occupied by Other Stores, and (ii) the product obtained by multiplying eighty-five percent (85%) by the Floor Area in the

Larger Parcel, and subtracting from the result the Floor Area occupied by Other Stores and the Floor Area of tenants who pay Taxes directly

to the taxing authority.

The

Floor Area of any management and/or security offices, postal facilities, storage areas and/or parking structures located or to be located

in the Shopping Center (collectively, “Common Facilities”) shall be excluded when calculating the above denominators.

| 1.17 |

Broker(s): |

(a) |

Irvine

Management Company, representing Landlord exclusively; and |

(Art.

21) |

| |

|

(b) |

Roy

Chin/New Star Realty, representing Tenant exclusively. |

|

| |

|

|

|

|

| 1.18 |

Addresses

for “Notice” (defined in Article 20) and Payments: |

| LANDLORD |

|

TENANT |

| |

|

|

| Landlord’s

Address for Notice and Payment of Initial Charges: |

|

Tenant’s

Address for Notice: |

| |

|

|

| IRVINE

ORCHARD HILLS RETAIL LLC |

|

YOSHIHARU

IRVINE |

| c/o

The Irvine Company LLC 110 Innovation |

|

6940

Beach Blvd., #D-413 |

| Irvine,

California 92617 |

|

Buena

Park, CA 90621 |

| Attention:

General Counsel, Retail Properties |

|

|

| with

copy to: |

|

|

| The

Irvine Company LLC 101 Innovation |

|

|

| Irvine,

California 92617 |

|

|

| Attention:

Accounting Department |

|

|

| |

|

|

| Tenant

Payment Portal Registration: |

|

Tenant’s

Address for Statements /Billings: |

| |

|

|

| Email

tenantportal@irvinecompany.com to request an account for the Tenant Payment Portal |

|

YOSHIHARU

IRVINE

6940

Beach Blvd., #D-413

Buena

Park, CA 90621 |

| 1.19 |

Architectural

Review Fee: $500.00 which fee is intended to cover the cost of review of plans by Landlord for the initial construction of the Premises

and is due and payable upon Tenant’s execution of this Lease. |

|

(Ex.

C) |

| |

|

|

|

|

| 1.20 |

(a) |

Construction

Deposit: $5,000.00 |

|

(Ex.

C) |

| |

(b) |

Signage

Deposit: $2,500.00 |

|

|

| |

|

|

|

|

| 1.21 |

Delayed

Opening Rent: $250.00 per day. |

|

(Art.

3) |

| |

|

|

|

|

| 1.22 |

Tenant

Improvement Allowance: $60.00 per square foot of Premises Floor Area. |

|

|

In

the event of a conflict between this Article 1 and the rest of the Lease, the rest of the Lease shall control.

ARTICLE

2

LEASE

OF PREMISES; RESERVATIONS

2.1

LEASE OF PREMISES. Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, for the Term described herein, the

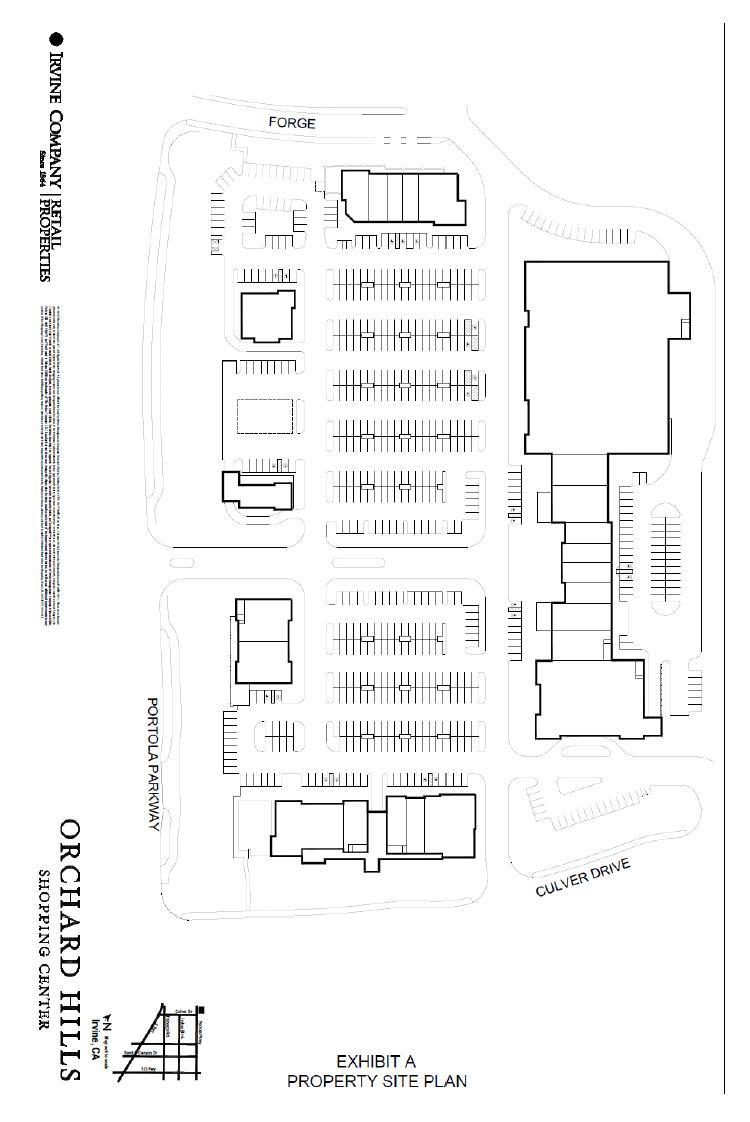

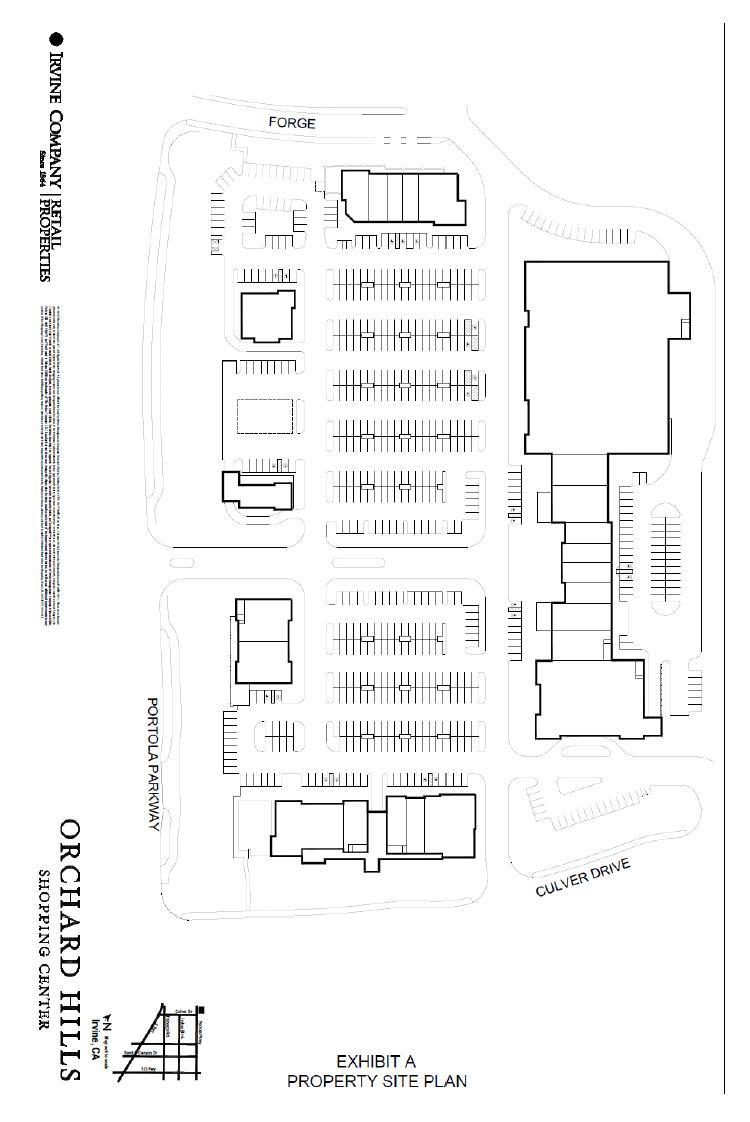

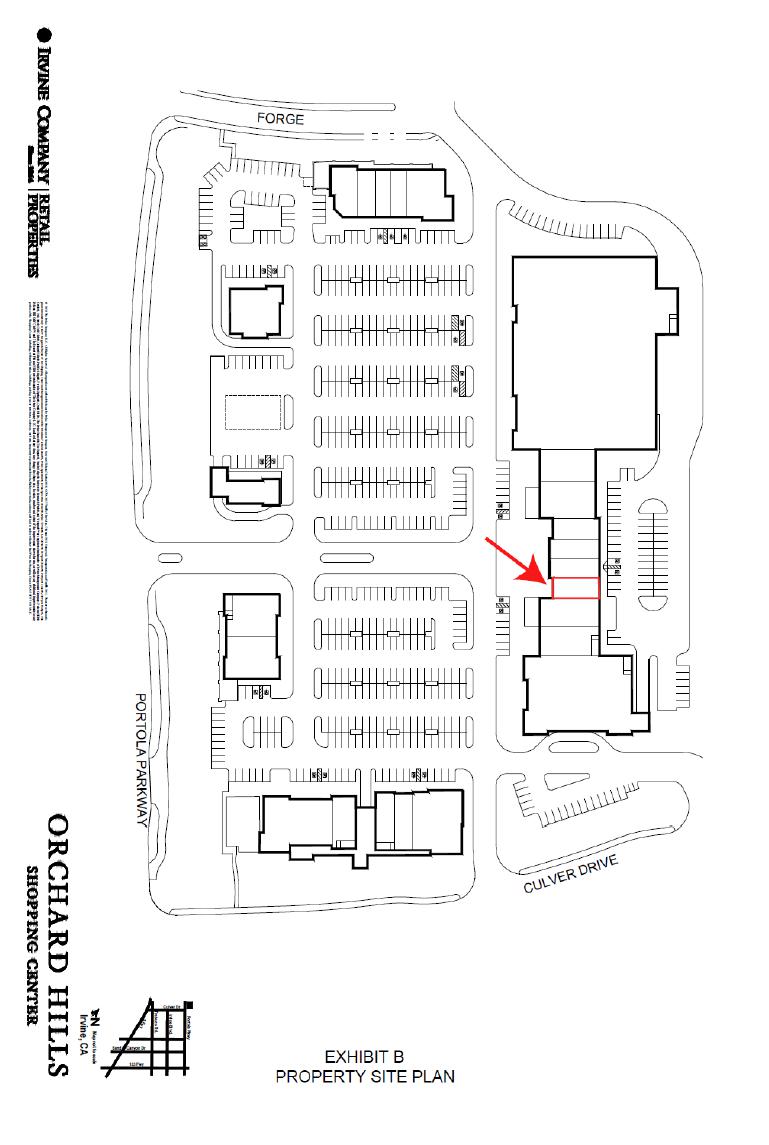

Premises identified in Section 1.5 and located in the Shopping Center depicted on the Shopping Center Site Plan attached as Exhibit

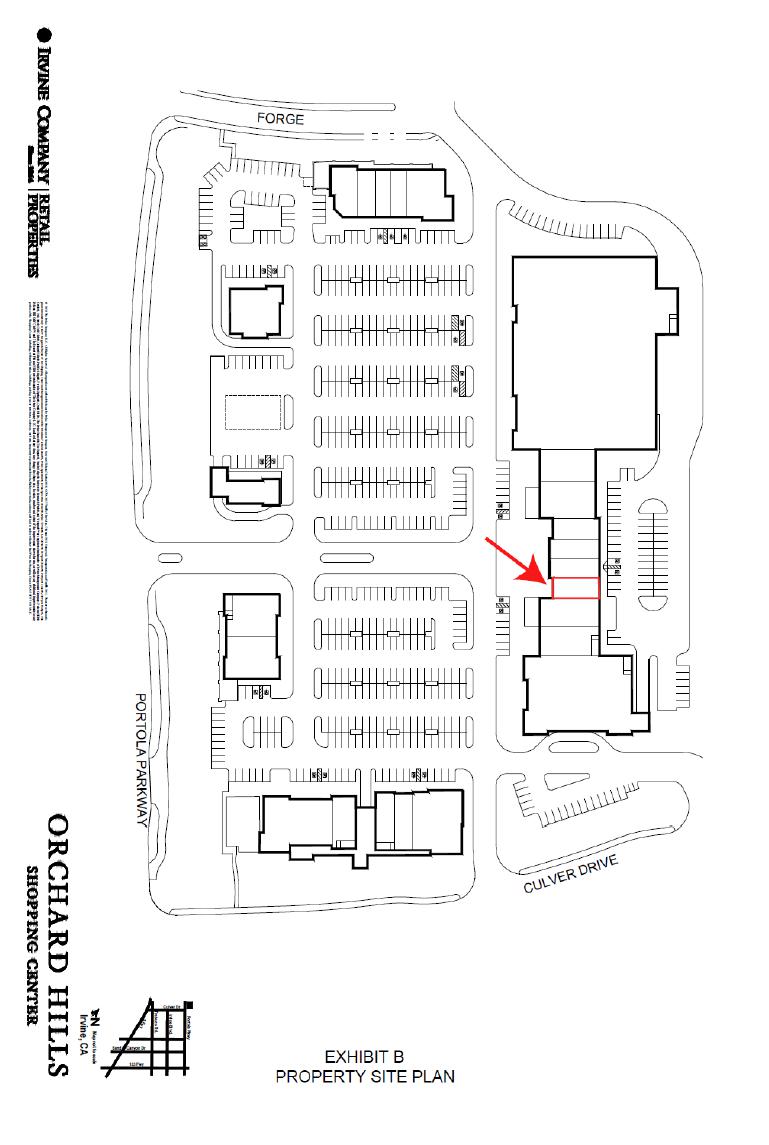

A. The Premises are deemed to contain the Floor Area set forth in Section 1.6, are generally depicted on the Premises Site Plan attached

as Exhibit B and are being delivered to Tenant in accordance with Exhibit C. All of Tenant’s Work and any other construction

by Tenant on the Premises must be performed in accordance with Exhibit C. Landlord has no obligation to deliver physical possession

of the Premises to Tenant until Tenant has satisfied the Delivery Requirements specified in Exhibit C. Tenant’s failure

to satisfy the Delivery Requirements shall not delay the determination of the Commencement Date.

2.2

RESERVATIONS. Exhibit A sets forth an approximate general layout of the Shopping Center and shall not be deemed a representation

by Landlord that the Shopping Center is or will be constructed as indicated thereon, nor as a representation or warranty as to the current

or future occupancy of any particular tenant in the Shopping Center, or that the Shopping Center will not be expanded, reduced or otherwise

modified. Landlord reserves the right at any time to (i) make alterations or additions to the building in which the Premises are contained

(“Building”); (ii) construct other buildings or improvements in the Shopping Center and to make alterations

or additions thereto; and (iii) access and use the exterior walls, floor, roof and plenum in, above and below the Premises for the purpose

of effecting certain items of repair and maintenance as provided in this Lease.

ARTICLE

3

RENT

Tenant

shall pay to Landlord as “Rent” hereunder, without Notice, demand, offset or deduction, all of the following:

3.1

BASE RENT. Beginning on the Commencement Date, Tenant shall pay the Base Rent specified in Section 1.8, monthly, in advance, on

or before the first day of each month. Upon execution of this Lease, Tenant shall pay the first monthly installment of Base Rent. Base

Rent for any partial month shall be prorated based on the number of days in the applicable calendar month.

3.2

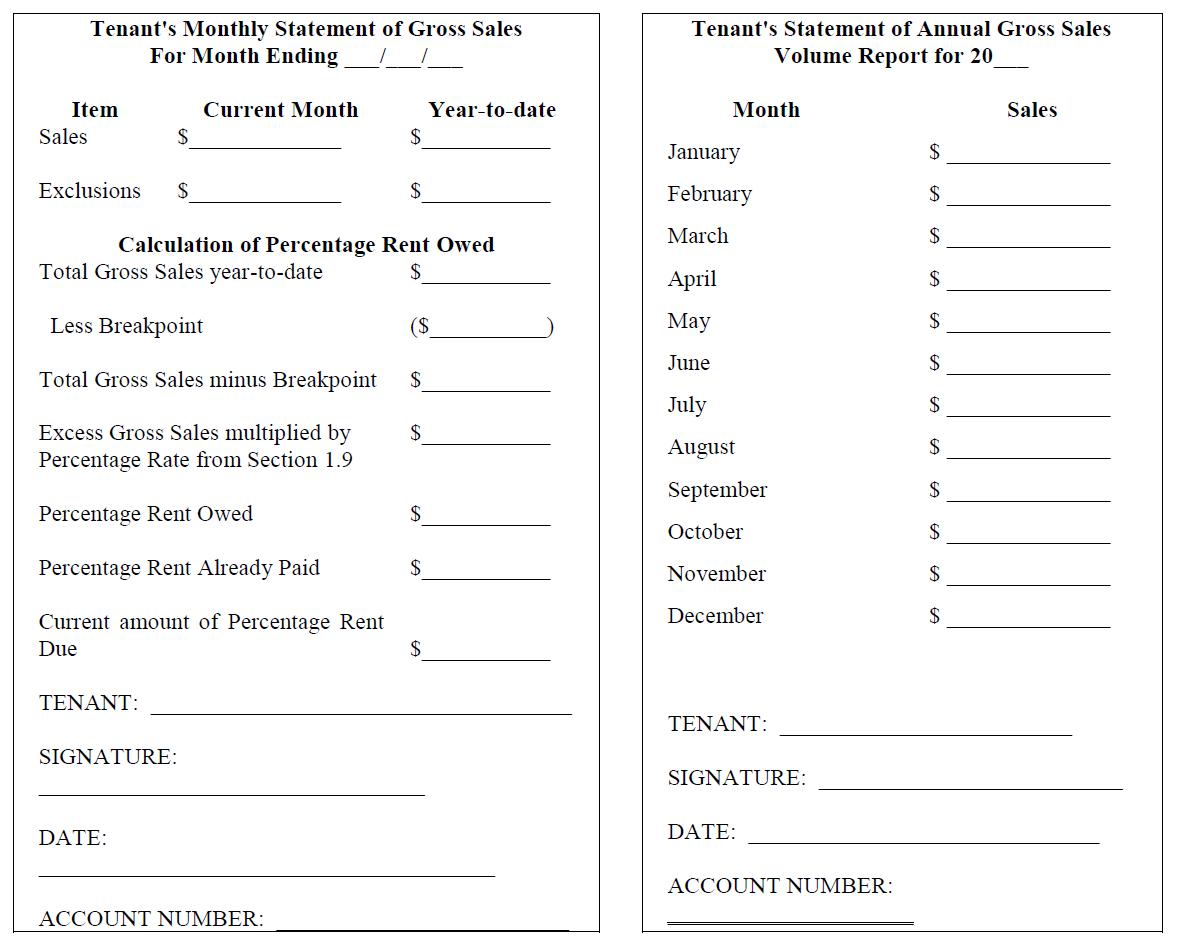

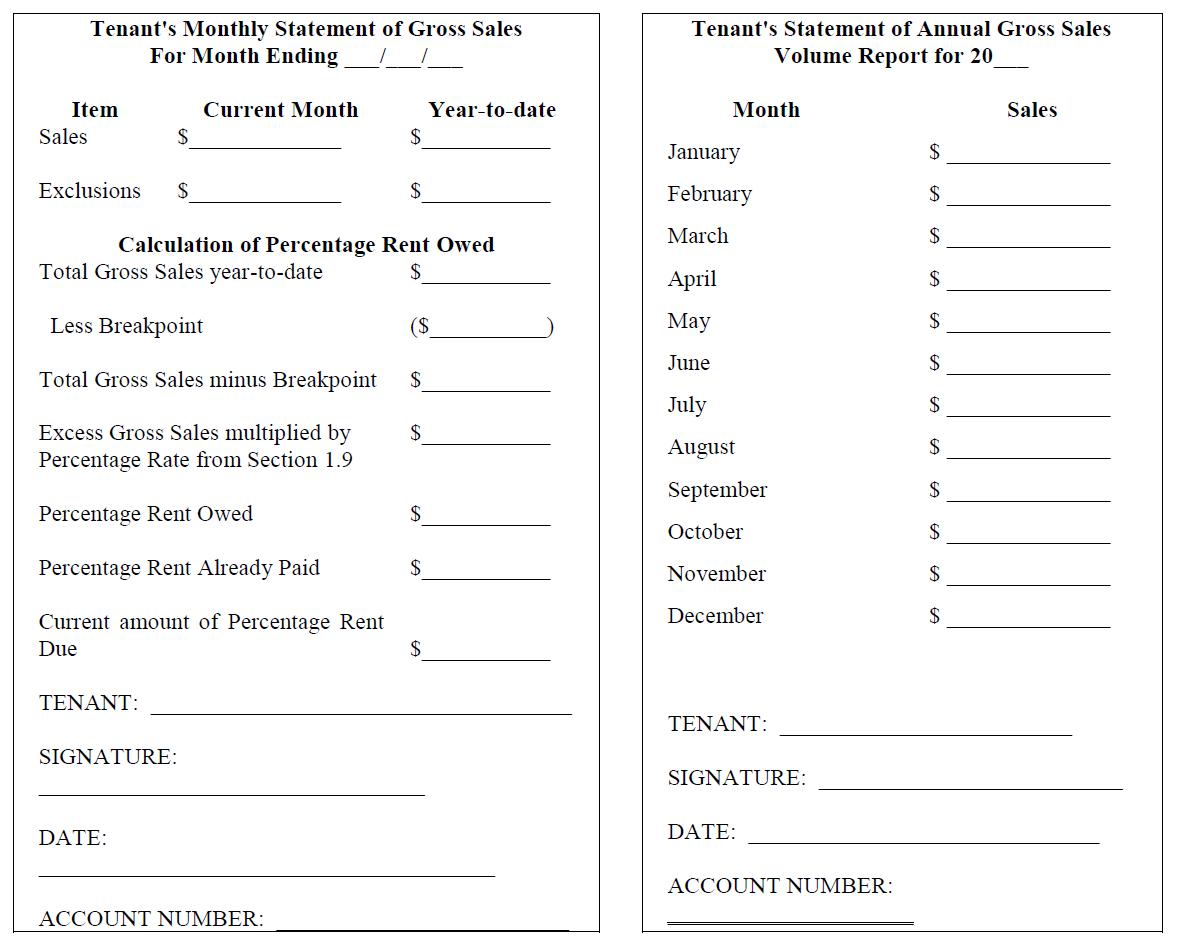

PERCENTAGE RENT. Beginning on the Commencement Date, Tenant shall pay Percentage Rent as determined pursuant to Section 1.9 on

a calendar year basis. For each calendar year during the Term, Percentage Rent is due beginning on the tenth (10th) day after the end

of the first month that Gross Sales have reached the Breakpoint (defined in Section 1.9(a)) and each month thereafter. Within ten (10)

days after the end of each calendar month, Tenant shall deliver to Landlord a certified statement of Gross Sales in the form of Exhibit

D. Within twenty (20) days after the end of each calendar year, Tenant shall deliver to Landlord a certified annual statement, including

a monthly breakdown of Gross Sales, in the form of Exhibit D (“Annual Statement”). Landlord shall review

Tenant’s Annual Statement and shall reconcile the amount of Gross Sales reported therein with the cumulative amount of monthly

Gross Sales previously reported to Landlord; any under or overpayment shall be promptly paid or credited, as applicable. “Gross

Sales” shall have the meaning set forth in Exhibit D. The Breakpoint for any partial year shall be prorated based upon a

three hundred sixty-five (365) day year. If Base Rent is abated or reduced for any reason during any calendar year, the Breakpoint for

such calendar year shall be reduced proportionately. If two Breakpoint amounts are in effect during different portions of a given calendar

year, the Breakpoint for such calendar year shall be the weighted average of both Breakpoint amounts, determined as follows: (a) each

Breakpoint amount shall be multiplied by the number of days during which it is in effect, and then divided by 365, and (b) the amounts

so computed shall be added to obtain the weighted average Breakpoint for such calendar year.

3.3

ADDITIONAL RENT. Any monetary amount required to be paid by Tenant to Landlord in addition to Base Rent and Percentage Rent, whether

or not such sums are designated as “Rent,” shall be included in Rent and referred to in this Lease as “Additional

Rent.”

3.4

DELAYED OPENING RENT. If Tenant fails to timely open for business in accordance with Section 7.2 below, Tenant shall pay to Landlord,

as liquidated damages and Additional Rent, and in addition to Base Rent, the amount set forth in Section 1.21 for each day Tenant is

not open for business in the Premises following the Commencement Date (“Delayed Opening Rent”). Delayed Opening

Rent accruing during any month of the Term shall be paid concurrently with Tenant’s installment of Base Rent next due.

ARTICLE

4

TENANT FINANCIAL DATA

4.1

RECORDATION OF SALES. At the time of a sale or other transaction, Tenant shall record the sale or other transaction either in

a cash register or computer with sealed continuous tape or by using another method of recording sequentially numbered purchases and keeping

a cumulative total, such as a point of sale cash register system or future digital technology devices, approved by Landlord. For a period

of three (3) years following the delivery of its certified Annual Statement for each year, Tenant shall keep full and accurate books

and records of all transactions from the Premises pertaining to Gross Sales and exclusions thereof in accordance with generally accepted

retail practices and generally accepted accounting principles consistently applied. Tenant’s obligation to maintain such books

and records, and Landlords right to audit the same pursuant to Section 4.2 below, shall survive the expiration or earlier termination

of this Lease.

4.2

AUDITS. Within three (3) years after receipt of an Annual Statement, upon at least fifteen (15) days’ prior “Notice”

(as defined in Article 20) to Tenant, Landlord or its authorized representatives may audit Tenant’s records and books in order

to verify Tenant’s Gross Sales and exclusions from Gross Sales (“Audit”). Tenant shall make all such

books and records available for the Audit at the Premises or at Tenant’s offices in the State of California. If the Audit discloses

an underpayment of Percentage Rent, Tenant shall immediately pay to Landlord the amount of the underpayment, with interest at the “Interest

Rate” (as defined in Section 21.5) from the date the payment should have been made. If (a) Landlord is not able to perform the

Audit in accordance with generally acceptable auditing standards because Tenant has not maintained its books and records as required

under Section 4.1 or (b) the Audit discloses an underreporting of Gross Sales in excess of two percent (2%) of the reported Gross Sales,

then Tenant shall also pay to Landlord the cost of the Audit and collection of any underpayment, including travel costs and reasonable

attorneys’ fees. If the Audit discloses an overpayment of Percentage Rent, Tenant may offset the excess against its next payment(s)

of Rent other than Base Rent.

4.3

FINANCIAL STATEMENTS. Upon fifteen (15) days’ prior Notice, Tenant will provide to Landlord a certified financial statement

reflecting Tenant’s current financial condition. If Tenant is a publicly-traded corporation, then delivery of Tenant’s last

published financial information will satisfy this obligation. Tenant hereby expressly acknowledges and agrees that Landlord has relied

on Tenant’s (and Guarantor’s, if applicable) financial documents delivered in connection with this Lease as evidence that

Tenant will have the ability to perform all financial and operational obligations under this Lease as of the Lease Date. The foregoing

requirements shall also apply to any Guarantor of Tenant under this Lease.

4.4

GUARANTOR. If a Guarantor is designated in Section 1.15, then Landlord’s obligations under this Lease shall be contingent

upon Tenant’s delivery to Landlord of a guarantee of Lease in the form of Exhibit I hereto (“Guarantee”).

ARTICLE

5

TAXES

5.1

REAL PROPERTY TAXES.

(a)

“Taxes” means and includes any form of tax or assessment (whether special or general, ordinary or extraordinary,

foreseen or unforeseen), license fee, license tax, tax or excise on Rent or any interest of Landlord or Tenant (including any legal or

equitable interest of Landlord or its beneficiary under a deed of trust, if any) in the Premises, the remainder of the Shopping Center

or the underlying realty. “Taxes” shall not include Landlord’s general income taxes, inheritance, estate or gift taxes.

Beginning on the Commencement Date, Tenant is obligated to pay Taxes attributable to the Premises pursuant to Section 5.1(b) below and

Taxes attributable to the Common Area pursuant to Section 9.3 below.

(b)

“Tenant’s Tax Contribution” shall be determined by multiplying all of the Taxes on the Larger Parcel

for the applicable year (except for those Taxes billed pursuant to Section 9.3) by Tenant’s Share, plus a fee for administration

and overhead equal to fifteen percent (15%) of the product so obtained. Landlord, at its option, may collect Tenant’s Tax Contribution

after the actual amount of Taxes are ascertained or may collect in advance, monthly or quarterly, based upon estimated Taxes. If Landlord

collects Tenant’s Tax Contribution based upon estimated amounts, then following the end of each calendar year or, at Landlord’s

option, its fiscal year, Landlord shall give Tenant a statement covering the year just expired showing the total Tenant’s Tax Contribution

payable by Tenant for that year and the payments made by Tenant with respect to that year. If there is a shortfall between what Tenant

has already paid and the actual Tenant’s Tax Contribution due, then Tenant shall pay the deficiency within ten (10) days after

its receipt of Landlord’s statement. If Tenant’s Tax Contribution for the year exceeds the actual Tenant’s Tax Contribution

payable by Tenant, Tenant may offset the excess against the next payment(s) of Tenant’s Tax Contribution becoming due.

5.2

OTHER PROPERTY TAXES. Tenant shall pay, prior to delinquency, all taxes, assessments, license fees and public charges levied,

assessed or imposed upon its business operation, trade fixtures, leasehold improvements, merchandise and other personal property on the

Premises. If any such items are assessed with Landlord’s property, then the assessment shall be equitably allocated by Landlord

on a reasonable basis. No taxes or assessments referred to in this Section 5.2 shall be considered Taxes.

5.3

CONTESTING TAXES. If Landlord contests any Taxes, Tenant will not be required to pay the cost of the contest; however, if Landlord

is successful in such contest, Landlord will deduct from Tenant’s portion of any refund received an amount equal to Tenant’s

Share of Taxes multiplied by the costs incurred by Landlord in prosecuting the contest.

ARTICLE

6

UTILITIES

AND HVAC

6.1

TENANT’S PAYMENT OF UTILITY CHARGES. Tenant shall pay directly to the utility service provider all charges for utility services

supplied to the Premises for which there is a separate meter and/or submeter, and shall comply with all energy usage reporting and disclosure

requirements of Landlord relating to Tenant’s use of the Premises, consistent with applicable “Laws” (as defined in

Section 7.3). If there is no meter or submeter, Tenant shall pay Landlord for its share of utility services supplied to the Premises

upon billing by Landlord in an amount not more than the cost Tenant would be charged if billed directly by the local utility provider

supplying such service. Landlord shall not be liable for any failure or interruption of any utility or service, unless such failure or

interruption prevents Tenant from carrying on its business in the Premises for a period of seventy-two (72) consecutive hours and is

directly attributable to (a) the negligence of Landlord, its agents or employees, or (b) Landlord’s wrongful failure to act reasonably

and promptly to restore the interrupted utility service after Landlord receives Notice from Tenant. Tenant’s sole and exclusive

remedy in such event shall be an equitable abatement of Base Rent from and after such seventy-two (72)-hour period until such failure

or interruption is cured. No failure or interruption of any utility or service shall entitle Tenant to otherwise discontinue paying Rent,

and in no event shall any such failure or interruption entitle Tenant to terminate this Lease. If Tenant fails to pay when due any charges

referred to in this Article 6, Landlord may pay the charge and Tenant shall reimburse Landlord, within ten (10) days of billing therefor.

Landlord shall have the option from time to time to supply any and all utilities to the Premises in accordance with the terms of a program

applicable to the majority of tenants in the Shopping Center. Tenant shall comply with all of the requirements of such program.

6.2

TRASH DISPOSAL. Tenant shall deposit trash and rubbish only within receptacles in the Common Area approved by Landlord. Landlord

shall cause trash receptacles to be emptied at Tenant’s cost and expense; provided, however, at Landlord’s option, Landlord

may provide trash removal services, the cost of which shall be paid for by Tenant either (a) as a Common Area Expense, or (b) pursuant

to an equitable proration of said costs by Landlord.

6.3

HEATING, VENTILATING AND AIR CONDITIONING. During the term, Tenant shall have use of the heating, ventilating and air conditioning

unit or system (“HVAC”) serving the Premises upon Tenant’s acceptance of the Premises. Tenant shall maintain,

repair, replace and operate such system in the Premises at its sole cost and expense. Tenant agrees to have the HVAC units serving the

Premises serviced at least quarterly by a service contractor reasonably approved by Landlord. Within ten (10) days of receipt of Notice

from Landlord, Tenant shall provide evidence of the service contract with said HVAC service contractor and that the HVAC system has been

maintained in accordance with the terms of this Section 6.3. Upon the expiration or termination of the Term of the Lease, title to such

additions and replacements shall remain in and shall vest solely in Landlord.

ARTICLE

7

TENANT’S

CONDUCT OF BUSINESS

7.1

PERMITTED TRADE NAME AND USE. Tenant shall use the Premises solely under the Trade Name and solely for the Permitted Use and for

no other use or purpose. Nothing contained in this Lease shall be deemed to give Tenant an express or implied exclusive right to operate

any particular type of business in the Shopping Center, whether of the same or similar type or nature, or otherwise. Tenant hereby acknowledges

and agrees that Landlord has entered into this Lease with Tenant expressly based upon the specific Trade Name to be used by Tenant, and

based upon the Permitted Use. Tenant agrees, as a material inducement and condition to Landlord’s agreement to enter into this

Lease, and as a matter specifically bargained for by Landlord and Tenant, that it shall not make any material change to the decor, operations,

menu or type of cuisine of the restaurant (“Concept”) operated from the Premises from that described in Section

1.10 of the Lease, or from a Concept subsequently approved by Landlord in writing to another Concept without the prior written consent

of Landlord, which consent Landlord may, in its sole discretion, withhold for any reason, including Landlord’s subjective determination

that such proposed Concept could (i) diminish the quality, acceptability and reputation of the restaurant operation or the Premises,

or (ii) conflict or compete or be inconsistent with the operation, type of cuisine or Concept of any other restaurant within the Shopping

Center. Tenant also acknowledges and agrees that Landlord has entered into this Lease based upon Landlord’s desire to maintain

a very specific tenant mix, level of quality, level of customer interest, and level of customer service with respect to the target customers

of the Shopping Center, together with Landlord’s determination that Tenant’s specific business and market niche fulfills

such goals. Any deviation from the provisions set forth in this Section, Section 1.3 and Section 1.10 would constitute a material failure

of consideration to Landlord. For purposes of this Lease, Tenant expressly acknowledges and agrees that the Shopping Center is a “shopping

center” as described and intended in United States Bankruptcy Code 11 U.S.C.

§365(b)(3).

7.2

COVENANT TO OPEN AND OPERATE. Tenant covenants to open for business to the public in the entire Premises under the Trade Name

on or before the Commencement Date fully fixturized, staffed and stocked with merchandise and inventory. Subject to temporary closures

due to casualty, condemnation, force majeure or permitted remodeling, Tenant shall operate continuously for the Permitted Use under the

Trade Name in the entire Premises during the times set forth in Exhibit G, Section 1, and at all times shall keep and maintain

within the Premises an adequate stock of merchandise and trade fixtures to service and supply the usual and ordinary requirements of

its customers.

7.3

COMPLIANCE WITH LAWS. Tenant shall comply with all laws, rules, regulatory standards, guidelines and regulations relating to the

Premises (collectively, “Laws”) including, but not limited to, (i) all applicable Laws relating to any “hazardous

material,” as currently defined in Section 25260 of the California Health and Safety Code, or as defined in any other applicable

Laws, and any microbial elements or matter which pose a significant risk to human health (collectively, “Hazardous Materials”),

including any Laws (a) applicable to products that may be sold by Tenant at the Premises, such as Proposition 65 or other warning, notification,

and right-to-know requirements or (b) requiring notifications or reports to be provided to governmental agencies concerning spills or

releases of Hazardous Materials, and (ii) Water Quality Laws, as such term is defined and as further set forth in Section 8.3 below.

7.4

RADIUS RESTRICTION. During the Term, Tenant shall not, nor shall any person, firm, corporation or other entity which has an interest

in Tenant or which controls, is controlled by Tenant or is under common control with Tenant, own, operate or become financially interested

in a business similar to the one to be operated by Tenant (“Other Business”) if the Other Business is opened

after the Lease Date and its front door is located within the Radius Restriction Area specified in Section 1.11. If Tenant violates this

covenant, then, as liquidated damages, the Gross Sales of the Other Business shall be included in the Gross Sales made from the Premises

for the purpose of computing Percentage Rent. Landlord shall have the Audit rights specified in Section 4.2 with respect to the books,

records and accounts of the Other Business. The foregoing covenant shall not apply with respect to any store opened by Tenant in any

shopping center owned or operated by Landlord, its parent company, subsidiaries and related entities and affiliates.

7.5

HAZARDOUS MATERIALS. In the event Tenant intends to or does use, encounter, handle, store, release, spill or dispose of any Hazardous

Material in connection with its business operations within the Premises, Tenant shall promptly notify Landlord in writing. Tenant shall

promptly provide Landlord with true, correct, complete and legible copies of any reports, notices or correspondence relating to Hazardous

Materials on the Premises which may be filed, prepared by or sent to Tenant. Landlord may, at any time or from time to time, require

Tenant (i) to conduct monitoring, evaluation or any required remediation activities with respect to Hazardous Materials on the Premises,

at Landlord’s discretion and at Tenant’s sole cost and expense, performed by an environmental consultant approved by Landlord,

provided that Landlord has reasonable grounds to believe that a release of Hazardous Materials exists or is imminent, (ii) to complete

and deliver to Landlord an Environmental Questionnaire, in Landlord’s then current form (and Tenant shall update and resubmit to

Landlord the Environmental Questionnaire in the event of any material change to the information contained therein), and/or (iii) to cease

and desist from using, handling, storing, releasing, or disposing any such Hazardous Materials within the Premises. Tenant’s indemnity

set forth in Section 12.2 shall apply to any Costs arising out of Tenant’s use, storage, handling, release, remediation or disposal

of Hazardous Materials on or about the Premises, including any Costs necessary to return the Premises, or any other property, to their

condition existing before Tenant’s introduction of Hazardous Materials on the Premises. Tenant’s obligations under this Section

7.5 shall survive the expiration or earlier termination of this Lease. Notwithstanding anything to the contrary contained in this Lease,

Tenant shall not be required to remediate or pay for the removal of any Hazardous Materials to the extent such Hazardous Materials exist

in an amount in violation of applicable laws and are determined by reasonably sufficient evidence generated by a qualified, independent

environmental consultant to have been present in such condition in the Premises prior to delivery of the Premises to Tenant.

7.6

RULES AND REGULATIONS. Tenant shall comply with the Rules and Regulations of the Shopping Center attached as Exhibit G,

which shall be administered by Landlord in a non-discriminatory manner.

7.7

ASBESTOS REQUIREMENTS. Tenant must notify and obtain prior written consent from Landlord (which consent may be withheld in Landlord’s

sole discretion) before using any asbestos-containing materials in connection with (i) any repairs to or maintenance of the Premises,

(ii) any Alterations to the Premises or (iii) Tenant’s Work. If Landlord consents to Tenant’s use of any asbestos containing

materials for such work, Landlord may require Tenant to have an asbestos survey conducted following the completion of such work and provide

any resulting survey reports to Landlord.

ARTICLE

8

MAINTENANCE

AND REPAIRS

8.1

LANDLORD’S MAINTENANCE OBLIGATIONS. Landlord shall maintain in good condition and repair the structural components of the

Building and all other buildings within the Shopping Center (excluding other buildings located on ground lease parcels within the Shopping

Center that are maintained by the tenant(s) thereunder), including without limitation, foundations, roofs, the exterior surfaces of the

exterior walls of all such buildings within the Shopping Center (but specifically excluding signage, doors, door frames, door checks,

windows, window frames, mullion systems and, at Landlord’s election, storefronts and storefront awnings). The obligations described

in the preceding sentence are referred to as “Landlord’s Maintenance Obligations.” Except to the

extent specifically excluded in Section 9.3 below, the cost of Landlord’s Maintenance Obligations will be included as Common Area

Expenses, provided, however, Landlord’s Maintenance Obligations shall not include and Tenant shall be solely responsible for the

costs of any repairs or replacements resulting from (i) Tenant’s negligence or willful acts, or those of anyone claiming under

Tenant, or (ii) Tenant’s failure to observe or perform any condition or agreement contained in this Lease, or (iii) any alterations,

additions or improvements made by Tenant or anyone claiming under Tenant. Notwithstanding anything to the contrary contained in this

Lease, Landlord will not be liable for failing to make any repairs required to be made by Landlord under this Lease unless Tenant has

first delivered to Landlord Notice of the need for such repairs and Landlord has failed to commence and complete the repairs within a

reasonable period of time following receipt of Tenant’s Notice. Tenant waives the provisions of Sections 1932(1),1941 and 1942

of the Civil Code of the State of California, or of any similar, related or superseding provisions of Law which permit Tenant to make

repairs at Landlord’s expense or to terminate this Lease.

8.2

TENANT’S MAINTENANCE OBLIGATIONS. Except for obligations that are specifically designated as part of Landlord’s Maintenance

Obligations, Tenant, at its expense, shall keep the entire Premises and all utility and mechanical facilities and systems exclusively

serving the Premises (collectively, “Tenant Utility Facilities”) in first-class order, condition and repair

and shall make replacements necessary to keep the Premises and Tenant Utility Facilities in such condition. All trade fixtures, signs

and other personal property installed in or attached to the Premises by Tenant must be new when installed or attached, and all replacements

of such items shall be of a quality equal to or exceeding that of the original. Tenant’s repair and maintenance obligations with

respect to the Premises, shall include any signage, doors, door frames, door checks, windows, window frames, mullion systems, storefronts

and storefront awnings (unless Landlord elects to maintain the storefronts and storefront awnings as provided in Section 8.1 above).

Storefronts include the facia and exterior insulation finishing systems (EIFS), and the repair and maintenance of storefronts include

glazing, patching, painting and stucco work. If Landlord determines, in its sole discretion, that Tenant’s failure to perform any

of its repair or maintenance obligations under this Section 8.2 adversely affects the exterior appearance of the Premises (such as, without

limitation, the failure to clean windows or awnings or painting/refinishing the storefront), and if such failure is not remedied within

the time frame specified in a Notice thereof from Landlord to Tenant, then Landlord shall have the right, but not the obligation, to

perform such repair or maintenance work on behalf of and for the account of Tenant.

Tenant

shall use the Cleaning Facility (as defined in Exhibit C) for the steam cleaning of grease containers and for the similar cleaning

of any other restaurant equipment, utensils or other items used in the operation of Tenant’s business in the Premises, and Tenant

shall use the Grease Storage Facility (as defined in Exhibit C) for storing all cooking oil waste and other grease generated from

the operation of Tenant’s business. Tenant agrees to confine all such activities to the Cleaning Facility and the Grease Storage

Facility, as applicable. Without limiting the foregoing, in no event shall any exterior portion of the Premises, areas adjacent to the

Premises or any portion of the Common Area be used for (a) storing or disposing of cooking oil or grease generated from the operation

of Tenant’s business or (b) cleaning any restaurant equipment, utensils or other items used in the operation of Tenant’s

business. Tenant shall contract directly with a service company to service the Grease Storage Facility and for the removal of all cooking

oil waste and other grease generated from the operation of Tenant’s business. All grease storage and removal and other cleaning

activities of Tenant shall be conducted in accordance best industry standards, techniques and technology to provide for containment and

disposal of liquids in compliance with all Water Quality Laws and as otherwise required under this Lease.

8.3

WATER QUALITY, AIR QUALITY AND DRAINAGE. Without limiting any other provisions contained in this Lease, Tenant’s maintenance

obligations shall be subject to and include the following requirements:

(a)

Tenant acknowledges that the Shopping Center is subject to various federal, state and local Laws regarding drainage and water quality

(“Water Quality Laws”) or air quality (“Air Quality Laws”), many of which are implemented

by governmental agencies, including, without limitation, of the U.S. Environmental Protection Agency, the California State Water Resources

Control Board, the Regional Water Quality Control Board, the California Coastal Commission, the County of Orange, South Coast Air Quality

Management District and all Laws of any governmental authority having jurisdiction over odors or emissions from the Shopping Center or

air quality and the city in which the Premises are located, which Water Quality Laws and Air Quality Laws may change from time to time.

At its sole cost and expense, Tenant shall comply with the Water Quality Laws and Air Quality Laws, and obtain any and all permits or

other authorizations which may be required by them, in connection with Tenant’s use or operation of the Premises, Tenant’s

Work or any “Alteration” (defined in Section 21.8). Tenant shall cooperate in good faith with the appropriate governmental

authorities and Landlord to ensure Tenant’s compliance with the requirements of this Section 8.3.

(b)

All wash water runoff must be collected, reclaimed, and disposed of in the approved wash water disposal location for the Shopping Center

(if any), or removed from the Shopping Center and disposed of off site subject to all appropriate governmental rules and regulations

(including any Water Quality Laws). Any water or liquid used to clean the Premises must be prevented from entering any storm drains.

Further, Tenant shall not discharge water or other liquids from the Premises into the Common Area or permit the flow of residue to any

area outside of the enclosed portion of the Premises. The only water permitted in the storm drain is rainwater.

8.4

LANDLORD’S RIGHT OF ENTRY. Landlord or its authorized representatives may enter the Premises following not less than twenty-four

(24) hours prior Notice to Tenant (except in a case of emergency, in which event no Notice shall be required) to: (a) inspect or re-measure

the Premises; (b) perform any obligation or exercise any right or remedy of Landlord under this Lease; (c) make repairs, alterations,

improvements or additions to the Premises or to other portions of the Shopping Center; (d) perform work necessary to comply with Laws

of any public authority or the rules or regulations of any insurance underwriter; (e) show the Premises to prospective tenants, lenders

or purchasers, and (f) perform work that Landlord deems necessary to prevent waste or deterioration of the Premises should Tenant fail

to promptly commence and complete such repairs within three (3) days after Landlord delivers Notice.

ARTICLE

9

COMMON

AREA

9.1

MAINTENANCE, USE AND CONTROL OF COMMON AREA. “Common Area” means all areas within the exterior boundaries

of the Shopping Center and adjacent streets, now or later made available for the non-exclusive use of Tenant and other persons entitled

to occupy Floor Area in the Shopping Center. Landlord shall maintain the Shopping Center in a first-class condition similar to other

shopping centers in Orange County, California; however, the manner in which the Shopping Center is managed shall be within Landlord’s

sole discretion. Tenant shall have a non-exclusive right to use the Common Area provided that (i) such permission is subject to the reservations

set forth in Section 2.2, and (ii) Landlord shall have the sole and exclusive control of the Common Area, and the right to make additions

and changes to the Common Area and the Shopping Center and the improvements located therein, which rights shall include, without limitation,

the right to (a) utilize from time to time any portion of the Common Area for promotional, entertainment and related matters, (b) place

permanent or temporary kiosks, displays, carts and stands in the Common Area and to lease same to tenants, (c) temporarily close any

portion of the Common Area for repairs, improvements or alterations, or for any other reasons deemed sufficient in Landlord’s reasonable

judgment, and (d) reasonably change the shape and size of the Common Area, add, eliminate or change the location of improvements to the

Common Area, including without limitation, buildings, lighting, parking areas, roadways and curb cuts, and construct buildings on the

Common Area. Any such changes will not materially or adversely affect Tenant’s access to or visibility from the Common Area located

immediately adjacent to the Premises, except during any period of construction. Tenant shall have no right to pursue any injunctive relief

or recover damages or otherwise with respect to disruption of business for any construction of changes.

9.2

PARKING. Tenant and its employees shall park their vehicles only in the parking areas designated for that purpose by Landlord.

If Landlord implements any program related to parking, parking facilities or transportation facilities including any program of parking

validation, employee parking, employee shuttle transportation during peak traffic periods or other program to limit, control, enhance,

regulate or assist parking by customers of the Shopping Center, Tenant agrees to participate in the program, comply with any reasonable

and nondiscriminatory rules and regulations established by Landlord and pay its proportionate share of the costs of the program as reasonably

determined by Landlord.

9.3

COMMON AREA EXPENSES. The term “Common Area Expenses” means all costs and expenses incurred by Landlord:

(a) in operating, managing, policing, repairing and maintaining the Common Area and the Common Facilities, and in maintaining, repairing

and replacing all sidewalks, landscaping, parking areas and other improvements located in the Common Area for the non-exclusive use of

the tenants of the Shopping Center; (b) in performing Landlord’s Maintenance Obligations, which shall include maintaining, repairing

and replacing the exterior surface of exterior walls (and storefronts and storefront awnings if Landlord has elected to include the cleaning

and maintenance of same as part of Common Area Landlord’s Maintenance Obligations) and maintaining, repairing and replacing roofs

of the buildings located in the Shopping Center; (c) in operating, repairing, replacing and maintaining all utility facilities and systems

not exclusively serving the premises of any tenant or store (“Common Utility Facilities”), Common Area furniture

and equipment (including, without limitation, furniture for any so-called “people places” or other amenities within the Shopping

Center), seasonal and holiday decorations, Common Area lighting fixtures, Shopping Center sign monuments and directional signage; (d)

for Taxes on the improvements and land comprising the Common Area (“Common Area Taxes”); (e) all office and

personnel costs (including without limitation all salaries, wages, employee benefits and other compensation) incurred by Landlord for

on-site and off-site personnel (whether employees of Landlord or third-party contractors) to the extent such personnel are involved in

the operation and management of the Shopping Center, based upon a reasonable allocation of such costs between the Shopping Center and

all other properties which are the responsibility of such employees or contractors; (g) for expenditures which are required under any

governmental Law or regulation that was not specifically applicable to the Shopping Center at the time it was originally constructed;

(g) Tenant’s share of the cost of Landlord’s Insurance (as defined in Exhibit F); and (h) a fee for calculating, billing,

and administering Common Area Expenses equal to fifteen percent (15%) of the Common Area Expenses enumerated in (a) through (g) above

for the applicable year. The cost of any Common Area Expense described in the preceding sentence that is properly classified under generally

accepted accounting principles as a capital improvement shall be amortized over the useful life of the item in question (as reasonably

determined by Landlord) on a straight-line basis, together with interest at the Interest Rate. Excluded from Common Area Expenses are:

(i) interest, amortization, or other payments on secured loans to Landlord encumbering the Shopping Center; (ii) ground rent in connection

with its lease of the land on which the Shopping Center is situated; (iii) income, excess profits or franchise taxes or other such taxes

imposed on or measured by the income of Landlord from the operation of the Shopping Center; (iv) cost of work directly related to the

sole advantage of any particular tenant of the Shopping Center other than Tenant; (v) costs incurred in connection with the original

construction of the Shopping Center; (vi) costs incurred in connection with development or leasing of the Shopping Center; (vii) costs

incurred by Landlord for the repair of damage or destruction caused by insured casualties to the extent of insurance proceeds actually

received by Landlord or that would have been received by Landlord had it maintained the insurance it was required to maintain pursuant

to the Lease; and (viii) costs incurred by Landlord to enforce the terms of any lease.

9.4

PRORATION OF COMMON AREA EXPENSES. Portions of the Shopping Center are, or may be, owned or leased from time to time by persons

or entities occupying (a) freestanding facilities or (b) other facilities containing a substantial amount of Floor Area and contributing

to the Common Area Expenses on a basis other than that described herein (collectively, “Other Stores”). “Tenant’s

Common Area Contribution” shall be determined by subtracting the contributions, if any, paid by the Other Stores from the

total Common Area Expenses and multiplying the result by Tenant’s Share of Common Area Expenses. Tenant’s Common Area Contribution

shall be payable in the following manner:

(a)

Tenant shall pay to Landlord, on the first day of each calendar month, an amount estimated by Landlord to be the monthly amount of Tenant’s

Common Area Contribution. The estimated monthly Tenant’s Common Area Contribution may be adjusted periodically by Landlord on the

basis of Landlord’s reasonably anticipated costs. Following the end of each calendar year or, at Landlord’s option, its fiscal

year, Landlord shall give Tenant a statement covering the preceding calendar or fiscal year (as the case may be), showing the actual

Tenant’s Common Area Contribution for that year and the monthly payments made by Tenant during that year for Tenant’s Common

Area Contribution (the “Annual CAM Statement”). If the total of such monthly payments of Tenant’s Common

Area Contribution for such year are less than the actual Tenant’s Common Area Contribution payable by Tenant, Tenant shall pay

to Landlord the deficiency within ten (10) days after Landlord’s delivery of the Annual CAM Statement. If the total of such monthly

payments of Tenant’s Common Area Contribution for the year exceed the actual Tenant’s Common Area Contribution payable, Tenant

may offset the excess against payments of Tenant’s Common Area Contribution next due. An appropriate proration of Tenant’s

Common Area Contribution as of the Commencement Date and the Expiration Date of the Lease shall be made.

(b)

If Tenant reasonably questions any billing of Common Area Expenses, Tenant shall have the right, within thirty (30) days after Tenant’s

receipt of the Annual CAM Statement, to request in writing copies of backup documentation reasonably sufficient to support the disputed

item(s) set forth in such bill, which Landlord shall provide within a reasonable time after Landlord receives Tenant’s written

request. Should Tenant fail to object in writing to Landlord’s determination of the actual amount of Tenant’s Common Area

Contributions within one (1) year following delivery of the applicable Annual CAM Statement, Landlord’s determination of the actual

amount of Tenant’s Common Area Contribution for the applicable year shall be conclusive and binding on Tenant. Tenant acknowledges

that, with respect to insurance, such costs are currently based upon a master policy covering other assets of Landlord and that, accordingly,

the backup documentation shall consist solely of either a letter from (a) a third-party actuary stating that the amount of the allocation

to the Shopping Center is reasonable, or (b) a licensed broker or underwriter showing that the allocated amount is a market rate. Any

Landlord approved adjustment shall be set forth in an adjusted bill reflecting a credit for such adjustment. Tenant’s right to

request backup documentation shall not entitle Tenant to withhold, delay or offset against any payment of Common Area Expenses or any

other charge owing under the Lease.

(c)

Notwithstanding anything contained in this Section 9.4 to the contrary, the Floor Area of tenants in the Shopping Center that maintain,

repair and replace a portion of their premises or insure their own premises shall not be included in the proration of the portion of

the Common Area Expenses relative to the portion of their premises that they maintain, repair, replace or insure, and the Floor Area

of such premises shall be excluded from the calculations made pursuant to Section 9.4(a) with respect to such items of maintenance, repair,

replacement or insurance. Landlord shall periodically determine Floor Area for all purposes under this Lease and Landlord’s determination

shall be conclusive.

ARTICLE

10

ASSIGNMENT

AND SUBLETTING

10.1

NO ASSIGNMENT OR SUBLETTING. Tenant shall not, whether in one (1) transaction or a series of transactions, assign, sublet, encumber,

mortgage, hypothecate or pledge this Lease or its interest in the Premises nor allow the Premises to be occupied, in whole or in part,

by any other person or entity, nor enter into franchise, license or concession agreements, nor change ownership or voting control, nor

otherwise transfer (including any transfer by operation of Law) all or any part of this Lease or of Tenant’s interest in the Premises

or Tenant’s business (collectively, “Assign” or an “Assignment”) without Landlord’s

prior written consent, not to be unreasonably withheld, delayed or conditioned. If Tenant, or an entity owning a controlling interest

in Tenant, is a corporation which is not a public corporation, or is an unincorporated association, limited liability company or partnership,

(i) the encumbrance, mortgage, hypothecation or other pledge, whether in one (1) transaction or a series of transactions, of any stock

or interest in Tenant or an entity owning a controlling interest in Tenant, or (ii) the entering into of any management agreement or

any agreement in the nature thereof transferring control or any substantial percentage of the profits and losses from the business operations

of Tenant in the Premises to a person or entity other than Tenant, or otherwise having substantially the same effect, shall be deemed

an Assignment within the meaning of this Article. Tenant hereby represents and warrants to Landlord that as of the Lease Date it has

not entered into any encumbrance, mortgage, hypothecation or other pledge which would result in an encumbrance or pledge of this Lease

or Tenant’s interest in the Premises. For purposes of this Article 10, the term “control” (including

the terms “controlled by” and “under common control with”) means the possession,

directly or indirectly, of the power to direct or cause the direction of the management and policies of any Person, whether through the

ownership of voting securities or by contract or otherwise, and/or ownership of more than fifty percent (50%) of the outstanding voting

capital stock of a corporation or more than fifty percent (50%) of the beneficial interests of any other entity. “Person”

means an individual, partnership (whether general or limited), limited liability company, corporation, trust, estate, unincorporated

association, nominee, joint venture or other entity.

10.2

PROCEDURES. Should Tenant desire to enter into an Assignment, Tenant shall request, in writing, Landlord’s consent to the

proposed Assignment at least sixty (60) days before the intended effective date of the proposed Assignment, which request shall include

the following: (a) the effective date, terms and conditions of the proposed Assignment, (b) detailed financial information regarding

the proposed transferee, including a detailed statement of its tangible net worth, (c) a description of the previous business experience

of the proposed transferee, (d) a complete business plan prepared by the proposed transferee, and (e) any further information relevant

to the proposed Assignment which Landlord shall reasonably request. Within thirty (30) days after the later of (i) Landlord’s receipt

of Tenant’s request for consent to the proposed Assignment, and (ii) Landlord’s receipt of all of the information set forth

in (a) through (e) above, Landlord may elect either to: (aa) consent to the proposed Assignment; (bb) deny such consent; or (cc) in Landlord’s

sole discretion, terminate this Lease, such termination to be effective thirty (30) days following Landlord’s election. Tenant

shall have the right to void Landlord’s termination by withdrawing its request for consent prior to the expiration of such thirty

(30)-day period.

10.3

STANDARD FOR CONSENT. Tenant agrees that Landlord may refuse its consent to the proposed transfer on any reasonable grounds, and

(by way of example and without limitation) Tenant agrees that it shall be reasonable for Landlord to withhold its consent if any of the

following situations exist or may exist: (a) the use to which the Premises will be put by the proposed transferee is different than the

use set forth in Section 1.10; (b) the proposed transferee’s financial condition is inadequate to support the financial and other

obligations of Tenant under this Lease; (c) the business reputation or character of the proposed transferee is not reasonably acceptable

to Landlord; (d) the proposed transferee is not likely to conduct on the Premises a business of a quality substantially equal to that

conducted by Tenant; (e) the nature of the proposed transferee’s proposed or likely use of the Premises would impose an increased

burden on the Common Area, or increase the risk of the release of Hazardous Materials; (f) Landlord has not received assurances acceptable

to Landlord in its sole discretion that all past due amounts owing from Tenant to Landlord, if any, will be paid and all other Defaults

on the part of Tenant, if any, will be cured prior to the effective date of the proposed Assignment; (g) in Landlord’s reasonable

business judgment the amount of annual Gross Sales Landlord anticipates will be generated by the proposed transferee is less than the

average annual Gross Sales Tenant has generated during the two (2) years immediately prior to the proposed Assignment; and (h) in Landlord’s

reasonable business judgment the Assignment would breach any covenant of Landlord respecting radius, location, use or exclusivity relating

to the Shopping Center, or, in Landlord’s sole discretion, conflict with, be incompatible with or have an adverse impact on the

tenant mix of the Shopping Center. Each of the rights of Landlord set forth in this Article 10 is a reasonable restriction for purposes

of California Civil Code Section 1951.4.

10.4

NO RELEASE. No Assignment shall relieve Tenant or any Guarantor from its covenants and obligations under this Lease. Any purported

Assignment requiring Landlord’s consent shall be void and confer no rights whatsoever on any third party if Landlord’s consent

is not obtained. Consent by Landlord to any Assignment shall not constitute a waiver of the requirement for such consent to any subsequent

Assignment. Landlord may collect and accept any one or more payments of Rent from any person or party in possession or control of the

Premises (or claiming the same) without the same constituting a consent to any transfer of possession or control of the Premises or an

Assignment and Landlord may otherwise enforce any of the duties, obligations or covenants of the “Tenant” hereunder, all

without any release of Tenant whatsoever and without any waiver or limitation of Landlord’s rights and remedies under this Lease

or at Law or in equity.

10.5

RENTAL INCREASE. If an Assignment occurs, the Base Rent shall be increased, effective as of the date of the Assignment, to the

greater of (a) an amount equal to the total of the applicable Base Rent due (for each remaining lease period set forth in Section 1.8)

plus Percentage Rent required to be paid by Tenant during the twelve (12)-month period immediately preceding the request for Landlord’s

consent to the Assignment, (b) Base Rent specified in Section 1.8, adjusted in accordance with the provisions of Section 21.7 of this

Lease relating to percentage adjustments in the “Index” (as defined in Section 21.7), or (c) a sum equal to the then fair

market rental value of the Premises, agreed upon by Landlord and Tenant. If Landlord and Tenant are unable to agree upon the then fair

market rental value of the Premises, then the fair market rental value may be determined by a qualified independent appraiser chosen

by Landlord and reasonably approved by Tenant. Thereafter, Base Rent shall be increased proportionately in accordance with the periodic

adjustments to Base Rent as set forth in Section 1.8.

ARTICLE

11

PROMOTIONAL

SERVICES

11.1

PROMOTIONAL SERVICE. Tenant shall participate in a service organized to promote the Shopping Center (“Promotional

Service”). As its contribution for the operation and management of the Promotional Service, Tenant shall pay to Landlord

(i) the Initial Promotional Assessment specified in Section 1.12(a), and (ii) the Promotional Charge calculated in the manner set forth

in Section 1.12(b) (which Promotional Charge shall be increased by five percent (5%) on each July 1, commencing the first time such date

is more than one hundred eighty (180) days after the Commencement Date). Tenant shall pay the Initial Promotional Assessment and the

first monthly installment of the Promotional Charge concurrently with Tenant’s execution of this Lease. Tenant shall pay all subsequent

installments of the Promotional Charge monthly in advance on or before the first day of each month. As partial compensation for implementing

and managing the Promotional Service, Landlord shall be entitled to retain twenty-five percent (25%) of the Promotional Service charges

payable pursuant to this Section 11.1.

11.2

TENANT REQUIRED ADVERTISING. From and after the Commencement Date, Tenant or Tenant’s corporate office shall spend during

each calendar year an amount equal to at least two percent (2%) of Tenant’s Gross Sales from the Premises for advertising Tenant’s

business at the Shopping Center (“Required Advertising”). The Required Advertising shall be in television,

radio, newspapers, tabloids, direct mailings or other media covering the trade area served by the Shopping Center, and shall designate

the location of the Premises by reference to the Shopping Center by name. The Required Advertising may include electronic media (such

as Tenant boosting a comment/ad on Facebook, banner ad buys on any websites, or paying for an email blast by buying the list of names),

but the costs of creating and maintaining a web/internet/social media presence, such as Tenant’s website, Facebook page or Twitter

account shall not satisfy the Required Advertising. At any time upon request by Landlord, Tenant shall furnish Landlord with its Annual

Statement of Gross Sales and a certified statement showing the amounts Tenant actually spent for advertising. If Tenant fails to spend

the Required Advertising amount, Tenant shall pay to Landlord, as liquidated damages, the difference between (a) the amount actually

spent by Tenant for advertising during the preceding calendar year, and (b) the Required Advertising amount that Tenant was required

to spend for advertising during the applicable calendar year pursuant to this Section 11.2.

ARTICLE

12

INSURANCE

AND INDEMNITY

12.1

INSURANCE. The insurance obligations of Landlord and Tenant are set forth in Section 1.13 and Exhibit F.

12.2

INDEMNITY. Tenant shall pay for, defend (with an attorney approved by Landlord), indemnify, and hold Landlord harmless from any

real or alleged damage or injury and from all claims, judgments, liabilities, penalties, costs and expenses, including attorneys’

fees and costs (collectively, “Costs”), in any way connected to Tenant’s use of the Premises, Tenant’s

activities within the Shopping Center, or any repairs, alterations or improvements (including Tenant’s Work) which Tenant may make

or cause to be made on the Premises, or by any breach of this Lease by Tenant and any loss or interruption of business or loss of Rent

income resulting from any of the foregoing; provided, however, Tenant shall not be liable for Costs to the extent such damage or injury

is ultimately determined to be caused by the negligence or misconduct of Landlord. Notwithstanding the foregoing, Tenant shall in all

cases accept any tender of defense of any action or proceeding in which Landlord is named or made a party and shall, notwithstanding

any allegations of negligence or misconduct on the part of Landlord, defend Landlord as provided herein until a final determination of

negligence or misconduct is made. Costs shall also include all of Landlord’s attorneys’ fees, litigation costs, investigation

costs and court costs and all other costs, expenses and liabilities incurred by Landlord or its counsel from the date Landlord first

receives Notice that any claim or demand is to be made or may be made. For purposes of this Section 12.2, (a) “Landlord”

includes Landlord and Landlord’s directors, officers, shareholders, members, agents and employees, and (b) “Tenant”

includes Tenant and its directors, officers, shareholders, members, agents, contractors and employees. Tenant’s obligations under

this Section 12.2 shall survive the termination of this Lease.

12.3

WAIVER. Landlord shall not be liable to Tenant, Tenant’s employees, agents or invitees for: (a) any damage to property of

Tenant, or of others, located in, on or about the Premises, (b) the loss of or damage to any property of Tenant or of others by theft

or otherwise, (c) any injury or damage to persons or property resulting from fire, explosion, falling plaster, steam, gas, electricity,

water, rain or leaks from any part of the Premises or from the pipes, appliance of plumbing works or from the roof, street or subsurface

or from any other places or by dampness or by any other cause of whatsoever nature, or (d) any such damage caused by other tenants or

persons in the Premises, occupants of adjacent property of the Shopping Center, or the public, or caused by operations in construction

of any private, public or quasi-public work. The foregoing shall not be construed to relieve Landlord of liability for Landlord’s

willful misconduct. Landlord shall in no event be liable for any consequential damages or loss of business or profits and Tenant hereby

waives any and all claims for any such damages. All property of Tenant kept or stored on the Premises shall be so kept or stored at the

sole risk of Tenant and Tenant shall hold Landlord harmless from any claims arising out of damage to the same, including subrogation

claims by Tenant’s insurance carriers, unless such damage shall be caused by the willful misconduct of Landlord. Landlord or its

agents shall not be liable for interference with the light or other intangible rights.

ARTICLE

13

DAMAGE

13.1

INSURED CASUALTY. The following provisions shall apply in the case of damage by fire or other perils required to be covered by

Landlord’s Insurance specified in Exhibit F:

(a)

Within sixty (60) days after all required permits have been obtained, Landlord shall begin the repair, reconstruction and restoration

of the Premises as Landlord, in its reasonable business judgment, deems necessary, and shall proceed with reasonable diligence to complete

such work; provided, however, that Tenant, at its cost, shall repair and restore all items of Tenant’s Work and all intervening

alterations and improvements and replace its stock in trade, trade fixtures, furniture, furnishings and equipment. Upon delivery of the

possession of the Premises, Tenant shall promptly begin this work and shall proceed with all reasonable diligence to completion.

(b)

Notwithstanding the foregoing, if the Premises is totally destroyed, or if the Shopping Center is destroyed to an extent of at least

fifty percent (50%) of its full replacement cost as of the date of destruction, then (i) if the destruction occurs during the last two

(2) years of the Term, Landlord and Tenant shall each have the right to terminate this Lease, and

(ii)

if the destruction occurs prior to the last two (2) years of the Term, Landlord shall have the exclusive right to terminate this Lease.

In each case, the termination right shall be exercised by the terminating party giving Notice to the other party within thirty (30) days

after the date of destruction.

13.2

UNINSURED CASUALTY. If the Premises or the Shopping Center are damaged as a result of any casualty not required to be covered

by the insurance specified in Part 6 of Exhibit F, Landlord, within ninety (90) days following the date of such damage, shall

begin the repair, reconstruction or restoration of the Premises as provided in this Lease and shall proceed with reasonable diligence

to complete such work, provided, however, if the damage to the Premises, or to the buildings in the Shopping Center excluding the Premises,

and excluding any freestanding buildings, is greater than ten percent (10%) of the total replacement cost, Landlord may elect within

said ninety (90) days not to so repair, reconstruct or restore the damaged property, in which event, at Landlord’s option, this

Lease shall terminate upon the expiration of such ninety (90)-day period. If Landlord elects to restore the Premises, then Tenant shall

have the same repair, restoration and replacement obligations it has pursuant to Section 13.1(a).

13.3

INSURANCE PROCEEDS. If this Lease terminates pursuant to this Article 13, Tenant shall pay to Landlord all proceeds from the Fire

and Extended Coverage insurance carried pursuant to Part 1.E of Exhibit F, but excluding proceeds for Tenant’s property

not permanently affixed to Landlord’s property such as trade fixtures, merchandise, signs and other personal property.

13.4

ABATEMENT. To the extent that Tenant has maintained the business interruption or loss of income insurance required by Exhibit

F and the proceeds of such insurance may be exhausted during the period of any repair, reconstruction and restoration required by

this Article 13, Base Rent shall be abated proportionately with the degree to which Tenant’s use of the Premises is impaired during

the remainder of the period of repair, reconstruction and restoration; provided, however, the amount of Base Rent abated pursuant to

this Section 13.4 shall not exceed the amount of loss of rental income insurance proceeds actually received by Landlord. Tenant shall

continue the operation of its business on the Premises during any such period to the extent reasonably possible from the standpoint of

prudent business management, and the obligation of Tenant to pay Percentage Rent (to the extent Tenant is operating its business from

the Premises) and other charges shall remain in full force and effect. Tenant shall not be entitled to any compensation or damages from

Landlord for loss of use of any part of the Premises or the Building, Tenant’s personal property or any inconvenience or annoyance

occasioned by such damage, repair, reconstruction or restoration. Tenant hereby waives any statutory rights of termination which may

arise by reason of any partial or total destruction of the Premises or improvements thereon.

ARTICLE

14

EMINENT

DOMAIN

14.1

TAKING. “Taking,” as used in this Article 14, means an appropriation or taking under the power of eminent

domain by any governmental authority or a voluntary sale or conveyance in lieu of condemnation but under threat of condemnation. This

Lease sets forth the terms and conditions upon which this Lease may terminate in the event of a Taking. Accordingly, Landlord and Tenant

waive the provisions of the California Code of Civil Procedure Section 1265.130 and any successor or similar statutes permitting Landlord

or Tenant to terminate this Lease as a result of a taking.

14.2

TOTAL TAKING. In the event of a Taking of the entire Premises, this Lease shall terminate and expire as of the date possession

is delivered to the condemning authority and Landlord and Tenant shall each be released from any liability under this Lease after the

date of such termination, but Rent for the last month of Tenant’s occupancy shall be prorated and Landlord shall refund to Tenant

any Rent paid in advance.

14.3 PARTIAL

TAKING. If there is a Taking of (a) more than twenty-five percent (25%) of the Floor Area of the Premises or, (b) a portion of

the Premises and, regardless of the amount taken, the remainder of the Premises is not one (1) undivided parcel of property, then

either Landlord or Tenant may terminate this Lease as of the date Tenant is required to vacate a portion of the Premises. The

terminating party shall give Notice of the termination to the other party within thirty (30) days after Tenant receives Notice from

Landlord of the Taking.

14.4

AWARD. The entire award in any such condemnation proceeding, whether for a total or partial Taking, or for diminution in the value

of the leasehold or for the fee, shall belong to Landlord. Without diminishing the rights of Landlord under the preceding sentence, Tenant

is entitled to recover from the condemning authority such compensation as may be separately awarded by the condemning authority to Tenant

in its own right for the taking of trade fixtures and equipment owned by Tenant and for the expense of removing and relocating its trade

fixtures and equipment, but only in the event that the compensation awarded to Tenant is in addition to and does not diminish the compensation

awarded to Landlord as provided above.

14.5

CONTINUATION OF LEASE. If Landlord and Tenant elect not to terminate this Lease after a Taking (or have no right to so terminate)

then as soon as reasonably possible Landlord shall, to the extent of available condemnation proceeds, restore the Premises on the remaining

land to a complete unit of like quality and character as existed prior to the Taking and, thereafter, Base Rent shall be reduced on an

equitable basis, taking into account the relative value of the portion of the Premises taken as compared to the portion remaining, and

Landlord shall be entitled to receive the total award or compensation.

ARTICLE

15

DEFAULTS

BY TENANT

15.1

EVENTS OF DEFAULT. Any of the following constitutes a material breach of this Lease by Tenant (“Default”):

(i) Tenant fails to pay any monetary obligation for a period of five (5) days after Notice from Landlord; or (ii) Tenant fails to perform

any other obligation of the Lease for more than a reasonable time (not exceeding ten (10) days) after Landlord delivers Notice to Tenant

(unless the Default complained of, other than a Default for the payment of money, cannot be cured within such ten (10)-day period, then

Tenant shall not be considered to be in Default of the Lease so long as it commences to cure the Default within such ten (10)-day period

and thereafter diligently and continuously prosecutes the cure to completion); or (iii) Tenant vacates or abandons the Premises; or (iv)

Tenant makes a general assignment for the benefit of creditors; or (v) the attachment or judicial seizure of substantially all of Tenant’s

assets located at the Premises or Tenant’s interest in this Lease (where the seizure is not discharged within thirty (30) days);

or (vi) Tenant or any Guarantor fails to pay its debts as they become due or admits in writing its inability to pay its debts, or makes

a general assignment for the benefit of creditors; or (vii) any financial statements given to Landlord by Tenant, any assignee of Tenant,

subtenant of Tenant, any Guarantor, or successor in interest of Tenant are intentionally false; or (viii) Tenant or any Guarantor of

this Lease declares bankruptcy or is otherwise declared insolvent and in the case of the Guarantor, Tenant fails to provide to Landlord

a Guarantee from a substitute guarantor which is acceptable to Landlord in its sole business judgment, taking into account Tenant’s

financial obligations under the Lease. In addition to all other rights or remedies of Landlord set forth in this Lease, if a Default

occurs, Landlord shall have all rights available to Landlord as may be permitted from time to time by the Laws of the State of California,

without further Notice or demand to Tenant. In addition, Landlord has the remedy described in California Civil Code Section 1951.4 (Landlord

may continue this Lease in effect after Tenant’s breach and abandonment and recover Rent as it becomes due, if Tenant has the right

to sublet or assign, subject only to reasonable limitations). In any case in which Landlord re-enters and occupies the Premises, by unlawful

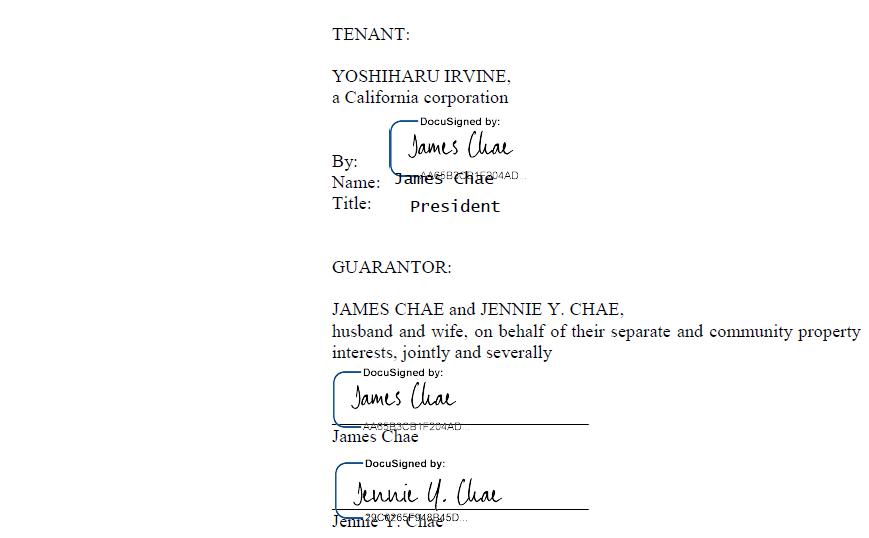

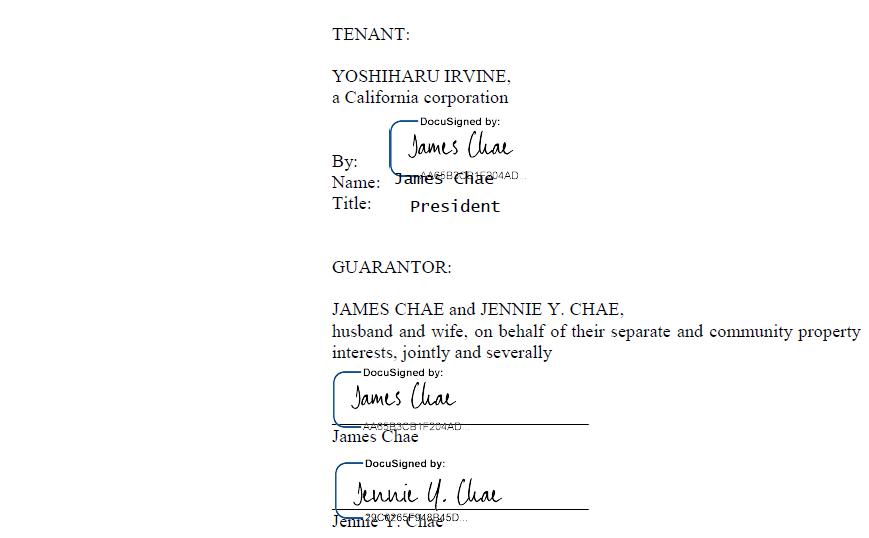

detainer proceedings or otherwise, Landlord, at its option, may repair, alter, subdivide or change the character of the Premises as Landlord