YOSHIHARU GLOBAL CO.

6940 Beach Blvd., Suite D-705

Buena Park, CA 90621

(714) 694-2403

June 13, 2022

United States Securities and Exchange Commission

Division of Corporate Finance

Officer of Trade and Services

| Attention: | Amy Geddes 202-551-3304 | |

| Linda Cvrkel 202-551-3813 | ||

| Donald Field 202-551-3680 | ||

| Erin Jaskot 202-551-3442 |

| Re: | Yoshiharu Global Co. |

| Amendment No. 3 to Registration Statement on Form S-1 | |

| Filed May 31, 2022 | |

| File No. 333-262330 |

Dear Ms. Geddes:

Yoshiharu Global Co. (the “Company”) confirms receipt of the letter dated June 3, 2022, from the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) with respect to the above-referenced filing. We are responding to the Staff’s comment as set forth below. The Staff’s comment is set forth below, followed by the Company’s response in bold:

Amendment No. 3 to Registration Statement on Form S-1

Capitalization, page 37

1. Refer to our previous comment 1. We continue to have difficulty recalculating the ProForma As Adjusted and Pro Forma As Adjusted with Over-Allotment Option figures for cash, Class A common shares, and additional paid-in capital presented in your Capitalization table using the information contained in the narrative description here. As previously requested, please provide to us in your response your detailed calculation of the figures presented here. Adjustments used in in this calculation should be supported by reference to disclosures elsewhere in the document. For example, net proceeds should not only be specifically disclosed, but the components of such calculation should be identified. For example, the calculation should be accompanied by a narrative including number of shares, midpoint of the price range, total gross proceeds, total expenses and commissions deducted from gross proceeds, resulting net proceeds, and page reference to your document supporting these figures.

RESPONSE: The Company has revised its disclosures in Amendment No. 4 to the Registration Statement (the “Amendment No. 4”) in response to the Staff’s comment.

Dilution, page 38

2. We continue to be unable to recalculate any of the figures presented as part of your calculation of Dilution from the information presented in your filing. Please provide to us in your response your detailed calculation of all figures presented here and used in your calculation of Dilution. This calculation should be footnoted with specific references to where each of the figures used in every part of the calculation can be found in your document.

RESPONSE: The Company has revised its disclosures in Amendment No. 4 in response to the Staff’s comment.

Business, page 58

3. We note your disclosure on page 56 that the company faces inflationary pressures related to food and beverage costs, labor costs, and energy costs. Please revise to discuss food and beverage, labor and energy inflation (and any other material inflationary pressures) in greater detail to include their resulting impacts on the company’s business and operations. Please also discuss in greater detail the company’s actions, taken or anticipated, if any, to mitigate any identified inflationary pressures. Lastly, if any identified inflationary pressures have materially impacted or are expected to materially impact the company’s business and operations, please add a risk factor identifying and discussing the inflationary pressure and how it has affected or may affect the company’s business and operations.

United States Securities and Exchange Commission

June 13, 2022

RESPONSE: The Company has revised its disclosures in Amendment No. 4 in response to the Staff’s comment.

4. Please disclose whether and how your business segments, products, lines of service, projects, or operations are materially impacted by supply chain disruptions. For example, discuss whether you have or expect to:

• suspend the production, purchase, sale or maintenance of certain items;

• experience labor shortages that impact your business;

• experience higher costs due to constrained capacity or increased commodity prices or challenges sourcing materials;

• experience surges or declines in consumer demand for which you are unable to adequately adjust your supply; or

• be unable to supply products at competitive prices or at all.

Additionally, explain whether and how you have undertaken efforts to mitigate the impact and where possible quantify the impact to your business or operations. To the extent applicable, please enhance your risk factors to discuss material supply chain disruptions.

RESPONSE: The Company has revised its disclosures in Amendment No. 4 in response to the Staff’s comment.

Consolidated Statements of Cash Flows, page F-6

5. The amount of shareholder contributions and distributions as disclosed in your statement of cash flows for the year ended December 31, 2020 do not agree to the amounts in your consolidated statements of stockholders’ equity for this period. Please reconcile and revise these disclosures.

RESPONSE: The Company has revised its disclosures in Amendment No. 4 in response to the Staff’s comment.

Consolidated Statements of Operations for the three months ended March 31, 2022 and 2021, page F-26

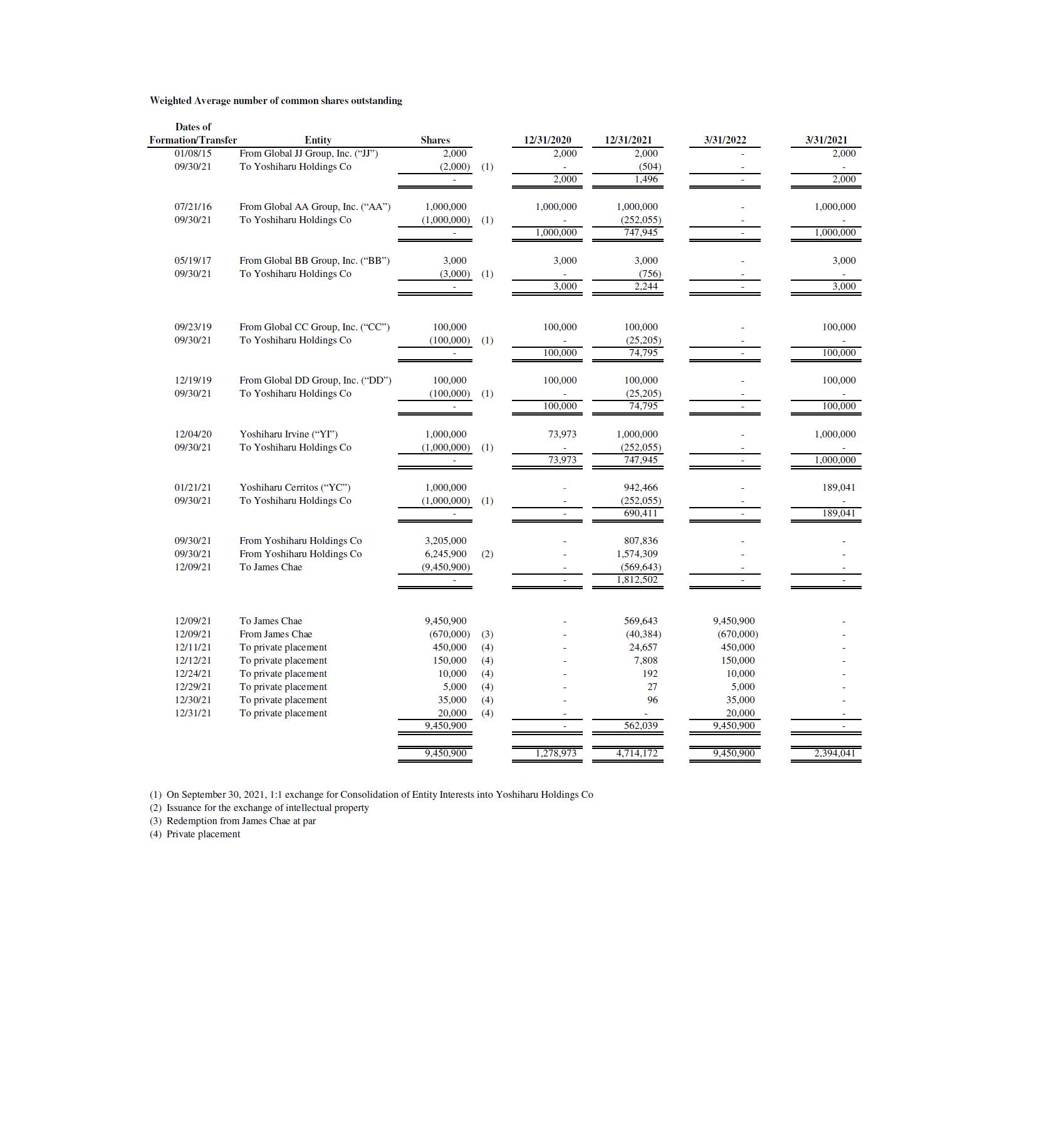

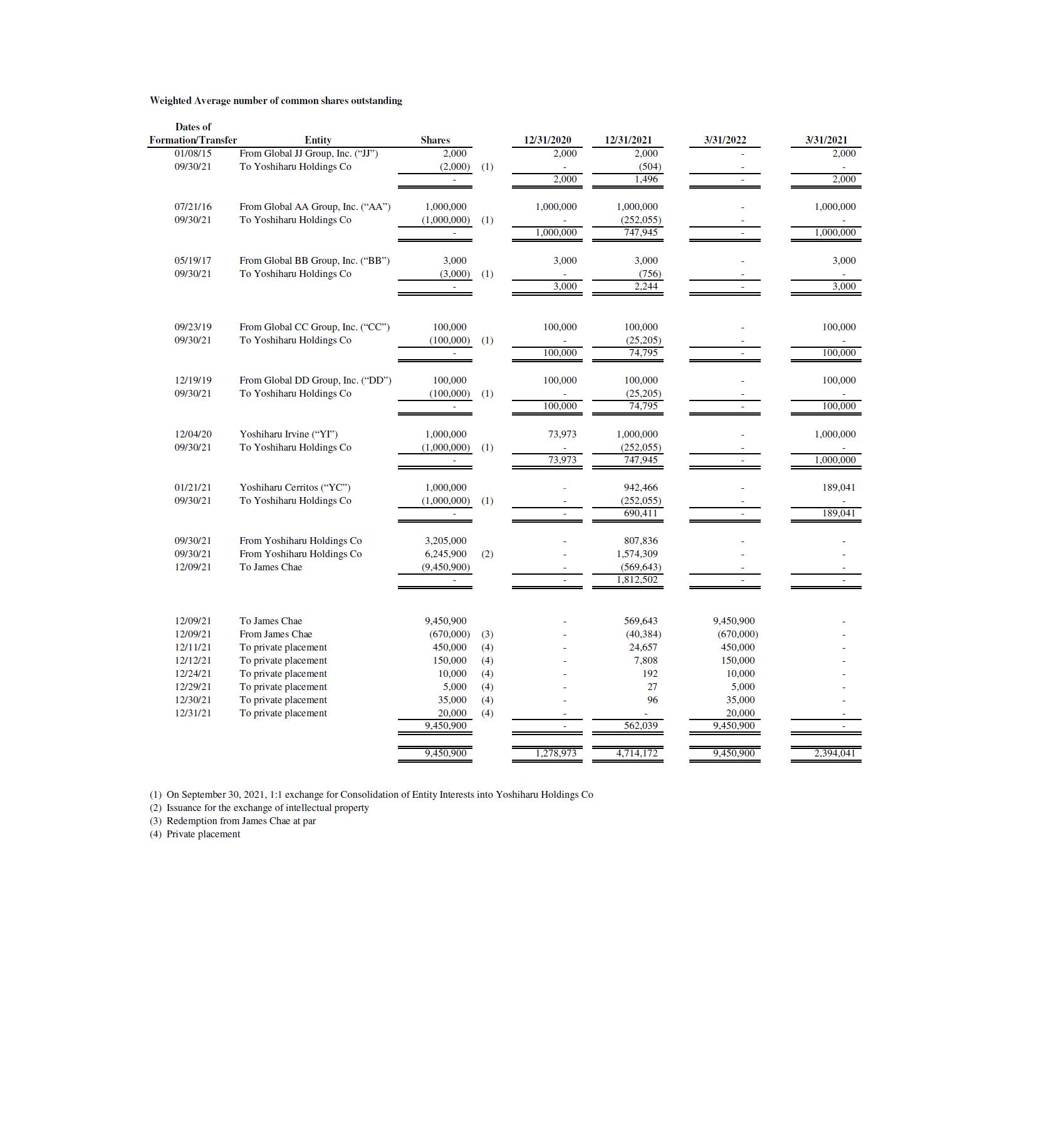

6. Please explain how you calculated or determined the weighted average shares used to calculate basic and diluted earnings per share for three months ended March 31, 2022 and 2021 given that you had 9,450,000 Class A shares outstanding at both December 31, 2021 and March 31, 2022 and 0 and 1,000,000 Class A shares outstanding at December 31, 2020 and March 31, 2020. Please advise or revise.

RESPONSE: There have been no changes in the total number of shares of outstanding shares in common stock from 9,450,900 as of December 31, 2021 to 9,450,900 as of March 31, 2022. 1,000,000 shares of Class A stock shall be exchanged by James Chae for 1,000,000 shares of Class B stock prior to the IPO, which shall result in no difference in the basic and diluted earnings per share at any time. Weighted average shares outstanding for three months ended March 31, 2022 were 9,450,900, and we have revised the disclosure to make this clear.

For the three months ended March 31, 2021, we formed one entity to open a new restaurant during the said period and therefore, we have revised our disclosure to reflect a weighted average of 2,394,041 shares of common stock outstanding for such period.

We also have provided the calculation table as Exhibit A attached hereto for your convenience.

3. Property and Equipment, net, page F-35

7. The amount of your property and equipment, net, as of March 31, 2022 and December 31, 2021 as disclosed in Note 3 does not agree to the amounts reflected on your balance sheet on page F-25. Please reconcile and revise these disclosures.

RESPONSE: The Company has revised its disclosures in Amendment No. 4 in response to the Staff’s comment.

5. Loan Payables, PPP, page F-37

8. The amount of loan payables, PPP, as of December 31, 2021 as disclosed on page F-37 does not agree to the amount in the balance sheet at this date on page F-25. Please reconcile and revise these disclosures.

RESPONSE: The Company has revised its disclosures in Amendment No. 4 in response to the Staff’s comment.

Exhibit 23.1 Consent of Independent Registered Accounting Firm, page 1

9. The consent of the independent registered accounting firm references their report dated April 29, 2022, but their report on page F-2 is dated May 27, 2022. Please reconcile and revise these disclosures.

United States Securities and Exchange Commission

June 13, 2022

RESPONSE: The Company has reconciled its disclosures in Amendment No. 4 in response to the Staff’s comment.

We trust that this response satisfactorily responds to your request. Should you require further information, please contact our legal counsel Matthew Ogurick at 212/536-4085.

| Very truly yours, | |

| /s/ James Chae | |

| James Chae, Chief Executive Officer |

cc: Matthew Ogurick, Esq.

Exhibit A