UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant | ☒ | |

| Filed by a party other than the Registrant | ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under § 240. 14a-12 |

Yoshiharu Global Co.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

YOSHIHARU GLOBAL CO.

6940 Beach Blvd., Suite D-705

Buena Park, California 90621

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held Monday, November 20, 2023 at 9:00 AM (EST)

TO THE STOCKHOLDERS OF YOSHIHARU GLOBAL CO.:

Notice is hereby given that the Annual Meeting of Stockholders (the “Annual Meeting”) of Yoshiharu Global Co. (“Yoshiharu,” “we,” “us,” “our,” and the “Company”) will be held on Monday, November 20, 2023, at 9:00 AM EST, at the offices of Pryor Cashman LLP at 7 Times Square, New York, NY 10036, for the purposes of considering and acting on the following items:

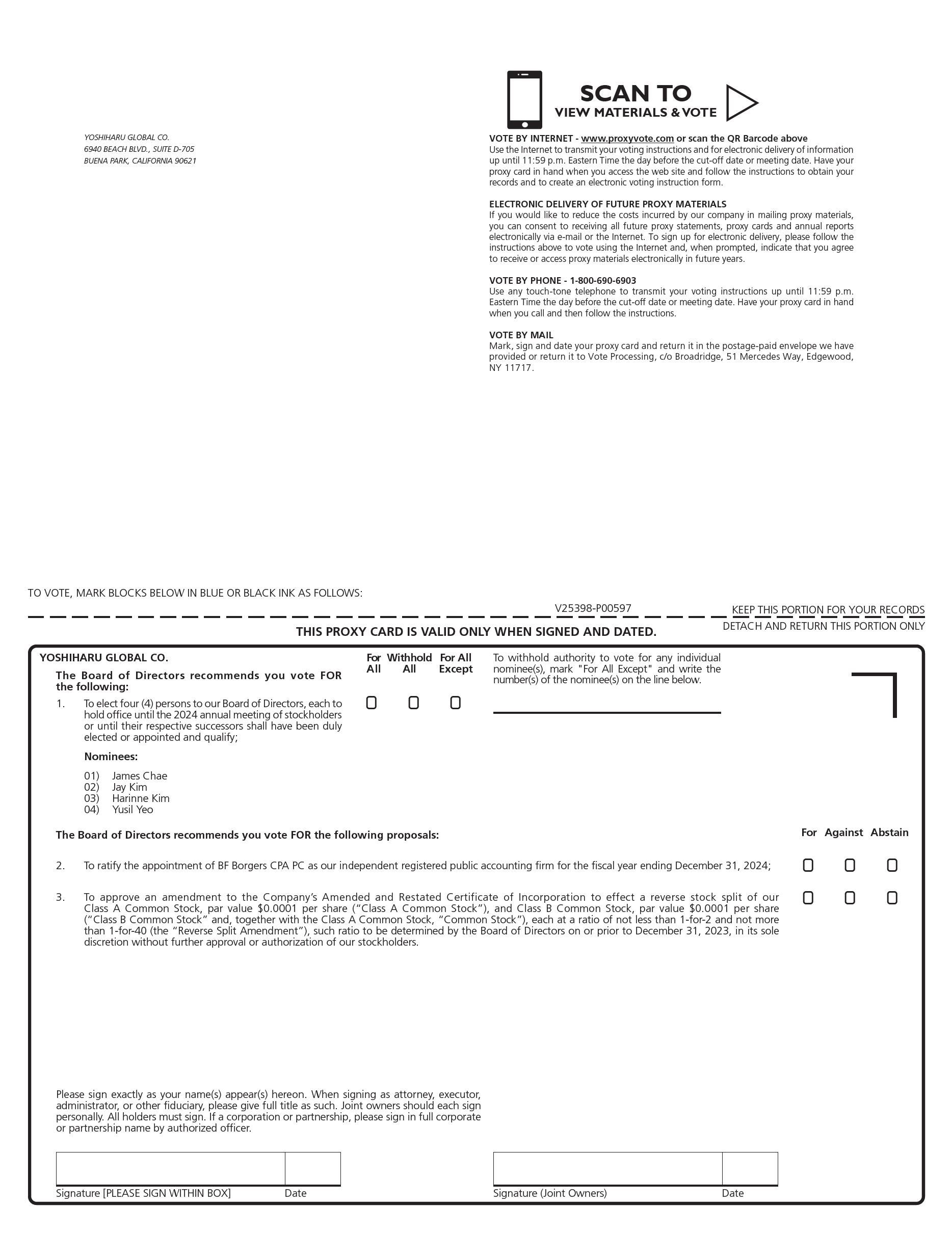

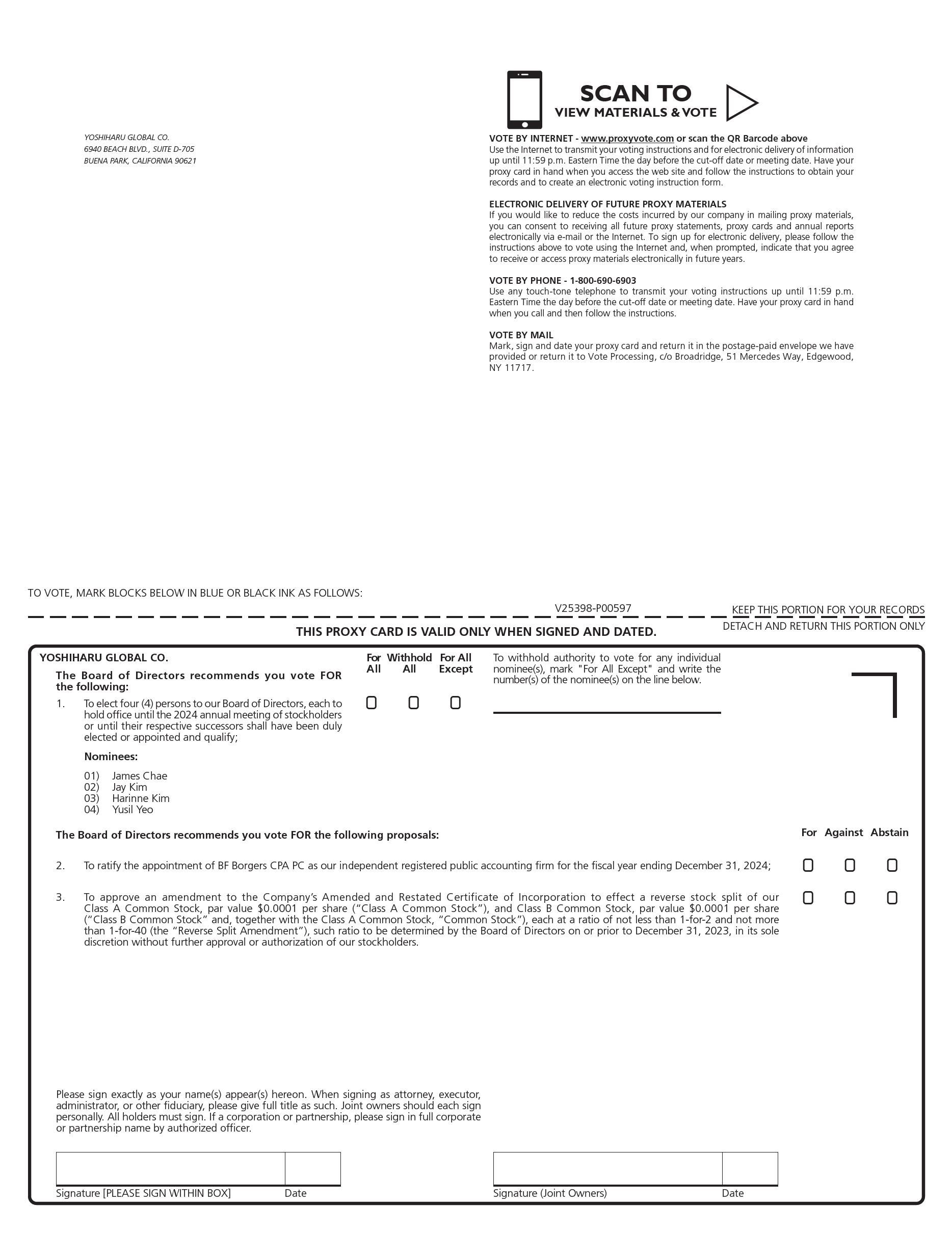

| 1. | To elect four (4) persons to our Board of Directors, each to hold office until the 2024 annual meeting of stockholders or until their respective successors shall have been duly elected or appointed and qualify; | |

| 2. | To ratify the appointment of BF Borgers CPA PC as our independent registered public accounting firm for the fiscal year ending December 31, 2024; | |

| 3. | To approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to effect a reverse stock split of our Class A Common Stock, par value $0.0001 per share (“Class A Common Stock”), and Class B Common Stock, par value $0.0001 per share (“Class B Common Stock” and, together with the Class A Common Stock, “Common Stock”), each at a ratio of not less than 1-for-2 and not more than 1-for-40 (the “Reverse Split Amendment”), such ratio to be determined by the Board of Directors on or prior to December 31, 2023, in its sole discretion without further approval or authorization of our stockholders; and | |

| 4. | Such other related matters and business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

The enclosed Proxy Statement includes information relating to these proposals.

Only holders of record of our Class A Common Stock and Class B Common Stock as of the close of business on October 20, 2023 are entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement of the Annual Meeting. The holders of at least a majority of our outstanding shares of voting stock entitled to vote and present in person or by proxy are required for a quorum. You may vote electronically through the Internet or by telephone. The instructions on your proxy card describe how to use these convenient services. Of course, if you prefer, you can vote by mail by completing your proxy card and returning it to us in the enclosed envelope.

| By Order of the Board of Directors, | |

| /s/ James Chae | |

| James Chae | |

| President, Chief Executive Officer and Chairman |

November 6, 2023

Buena Park, California

OUR BOARD OF DIRECTORS APPRECIATES AND ENCOURAGES YOUR PARTICIPATION IN OUR ANNUAL MEETING. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED. ACCORDINGLY, PLEASE AUTHORIZE A PROXY TO VOTE YOUR SHARES BY INTERNET, TELEPHONE OR MAIL. IF YOU ATTEND THE ANNUAL MEETING, YOU MAY WITHDRAW YOUR PROXY, IF YOU WISH, AND VOTE IN PERSON. YOUR PROXY IS REVOCABLE IN ACCORDANCE WITH THE PROCEDURES SET FORTH IN THIS PROXY STATEMENT.

YOSHIHARU GLOBAL CO.

6940 Beach Blvd., Suite D-705

Buena Park, California 90621

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held Monday, November 20, 2023 at 9:00 AM (EST)

ANNUAL MEETING AND PROXY SOLICITATION INFORMATION

General

This Proxy Statement is furnished in connection with the solicitation of proxies by the board of directors (the “Board of Directors”) of Yoshiharu Global Co., a Delaware corporation (“Yoshiharu,” “we,” “us,” “our,” and the “Company”), for use at the Annual Meeting of Stockholders to be held on Monday, November 20, 2023, at 9:00 AM EST, at the office of Pryor Cashman LLP at 7 Times Square, New York, NY 10036, and at any postponements or adjournments thereof (the “Annual Meeting”). This Proxy Statement, the Notice of Annual Meeting of Stockholders and the accompanying proxy cards are being mailed to stockholders on or about November 6, 2023.

Important Notice Regarding the Internet Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on November 20, 2023: The Proxy Statement and the Annual Report to Stockholders are available at https://ir.yoshiharuramen.com/. We encourage you to review all of the important information contained in the proxy materials contained herein or accessed via our website before voting.

Solicitation and Voting Procedures

Solicitation. The solicitation of proxies will be conducted by mail, and we will bear all attendant costs. These costs will include the expense of preparing and mailing proxy materials for the Annual Meeting and reimbursements paid to brokerage firms and others for their expenses incurred in forwarding solicitation materials regarding the Annual Meeting to beneficial owners of our shares entitled to vote at the Annual Meeting. We may conduct further solicitation personally, telephonically, electronically or by facsimile through our officers, directors and regular employees, none of whom would receive additional compensation for assisting with the solicitation. We do not intend, but reserve the right, to use the services of a third party solicitation firm to assist us in soliciting proxies.

Voting. Stockholders of record may authorize the proxies named in the enclosed proxy cards to vote their shares in the following manner:

| ● | by mail, by marking the enclosed proxy card(s) applicable to you as the holder of shares of our Class A Common Stock, par value $0.0001 per share (“Class A Common Stock”) and/or our Class B Common Stock, par value $0.0001 per share (“Class B Common Stock” and, together with Class A Common Stock, “Common Stock”), signing and dating it, and returning it in the postage-paid envelope provided; | |

| ● | by telephone, by dialing the toll-free telephone number 1-800-690-6903 from within the United States or Canada and following the instructions. Stockholders voting by telephone need not return the proxy card(s) applicable to them as the holder of shares of our Common Stock and/or our preferred stock; and | |

| ● | through the Internet, by accessing the World Wide Website address www.proxyvote.com. Stockholders voting by the Internet need not return the proxy card(s) applicable to them as the holder of shares of our Common Stock. |

Revocability of Proxies. Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is exercised in the same manner in which it was given, or by delivering to Soojae Ryan Cho, the Chief Financial Officer of Yoshiharu Global Co., at 6940 Beach Blvd., Suite D-705, Buena Park, California 90621, a written notice of revocation or a properly executed proxy bearing a later date, or by attending the Annual Meeting and giving notice of your intention to vote in person.

| 1 |

Voting Procedure. The presence at the Annual Meeting of a majority of our outstanding shares of voting stock entitled to vote and represented either in person or by proxy, will constitute a quorum for the transaction of business at the Annual Meeting. The close of business on October 20, 2023 has been fixed as the record date (the “Record Date”) for determining the holders of shares of our Common Stock entitled to notice of and to vote at the Annual Meeting. Each share of Class A Common Stock outstanding on the Record Date is entitled to one vote on all matters and each share of Class B Common Stock is entitled to ten votes on all matters.

As of the Record Date, there were 11,940,000 shares of Class A Common Stock outstanding, which shares were entitled to an aggregate of 11,940,000 votes at the Annual Meeting and 1,000,000 shares of Class B Common Stock outstanding, which shares were entitled to an aggregate of 10,000,000 votes at the Annual Meeting. Under Delaware law, stockholders will not have appraisal or similar rights in connection with any proposal set forth in this Proxy Statement.

Votes will be tabulated by the persons appointed by the Board of Directors to act as inspectors of election for the Annual Meeting. Shares represented by a properly executed and delivered proxy will be voted at the Annual Meeting and, when instructions have been given by the stockholder, will be voted in accordance with those instructions. If no instructions are given, the shares will be voted FOR Proposal Nos. 1, 2, and 3, as applicable.

Abstentions and broker non-votes will each be counted as present for the purpose of determining whether a quorum is present at the Annual Meeting. Abstentions and broker non-votes will have no effect on the outcome of Proposal No. 1. Abstentions will have the effect of being cast “against” Proposal Nos. 2 and 3.

A broker non-vote occurs when a broker submits a proxy card with respect to shares of Common Stock held in a fiduciary capacity (typically referred to as being held in “street name”), but declines to vote on a particular matter because the broker has not received voting instructions from the beneficial owner. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. In the event that a broker, bank, or other agent indicates on a proxy that it does not have discretionary authority to vote certain shares on a non-routine proposal, then those shares will be treated as broker non-votes. We believe that all proposals in this proxy statement, other than (i) the ratification of the independent registered public accounting firm, and (ii) the approval of a reverse stock split of our Common Stock in a ratio of not less than 1-for-2 and not more than 1-for-40, such ratio to be determined by the Board of Directors on or prior to December 31, 2023, in its sole discretion (Proposal No. 3) are non-routine proposals; therefore, your broker, bank or other agent will only be entitled to vote on Proposal Nos. 2 and 3 at the Annual Meeting without your instructions.

On each matter properly presented for consideration at the Annual Meeting, holders of Class A Common Stock will be entitled to one vote for each share of Class A Common Stock held and holders of Class B Common Stock will be entitled to ten votes for each share of Class B Common Stock. Stockholders do not have cumulative voting rights in the election of directors.

Vote Required.

For the election of directors (Proposal No. 1), the nominees who receive a plurality of votes from the shares present in person or by proxy and entitled to vote at the Annual Meeting will be elected.

For the approval of the ratification of our independent registered public accounting firm (Proposal No. 2) and the approval of a reverse stock split of our Common Stock in a ratio of not less than 1-for-2 and not more than 1-for-40, such ratio to be determined by the Board of Directors on or prior to December 31, 2023, in its sole discretion (Proposal No. 3), the vote of a majority of the shares present in person or by proxy and entitled to vote on the matter at the Annual Meeting is required.

If any other matters are properly presented for consideration at the Annual Meeting, the persons named in the enclosed proxy will have discretion to vote on those matters in accordance with their best judgment.

Householding. Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of this Proxy Statement or our annual report may have been sent to multiple stockholders in your household. We will promptly deliver a separate copy of either document to you if you call or write us at the following address or phone number: Yoshiharu Global Co., 6940 Beach Blvd., Suite D-705, Buena Park, California 90621, phone: (714) 694-2403, Attention: Chief Financial Officer. If you want to receive separate copies of our annual report and Proxy Statement in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker or other nominee record holder, or you may contact us at the above address and phone number.

| 2 |

PROPOSAL NO. 1

ELECTION OF DIRECTORS

General

Our Bylaws (the “Bylaws”) provide that the Board of Directors of our Company shall consist of not less than three (3) members and not more than eleven (11) members, as fixed by the Board of Directors. Currently, the Board of Directors consists of four (4) members.

At the Annual Meeting, four (4) directors are to be elected to serve until the 2024 annual meeting of our stockholders or until such directors’ respective successors are elected or appointed and qualify or until any such director’s earlier resignation or removal. The Board of Directors has nominated each of the persons listed below for election to the Board of Directors at the Annual Meeting. Each of the director nominees is currently a member of our Board of Directors.

| Name | Age | Position | Director Since | |||

| James Chae | 60 | President, Chief Executive Officer and Chairman of the Board of Directors | 2016 | |||

| Jay Kim(1)(2) | 61 | Director | 2022 | |||

| Harinne Kim(1)(2) | 50 | Director | 2023 | |||

| Yusil Yeo(1) | 44 | Director | 2022 |

(1) Member of Audit Committee.

(2) Member of Compensation Committee.

| Board Diversity Matrix (As of September 30, 2023) | ||||||||

| Total Number of Directors: 4 | ||||||||

| Female | Male | Non- Binary |

Did Not Disclose Gender | |||||

| Part I: Gender Identity | ||||||||

| Directors | 2 | 2 | - | - | ||||

| Part II: Demographic Background | ||||||||

| African American or Black | - | - | - | - | ||||

| Alaskan Native or Native American | - | - | - | - | ||||

| Asian | 2 | 2 | - | - | ||||

| Hispanic or Latinx | - | - | - | - | ||||

| Native Hawaiian or Pacific Islander | - | - | - | - | ||||

| White | - | - | - | - | ||||

| Two or More Races or Ethnicities | - | - | - | - | ||||

| LGBTQ+ | - | - | - | - | ||||

| Did Not Disclose Demographic Background | - | - | - | - | ||||

If any nominee is unable or unwilling to serve as a director at the time of the Annual Meeting, the proxies may be voted for the balance of those nominees named and for any substitute nominee designated by the current Board of Directors or the proxy holders to fill such vacancy or for the balance of those nominees named without the nomination of a substitute, or the size of the Board of Directors may be reduced in accordance with our Bylaws.

Nominees

James Chae. Mr. Chae founded Yoshiharu in 2016. Led by Mr. Chae, Yoshiharu has expanded to become a leading Japanese cuisine restaurant chain in Southern California. The root of Mr. Chae’s business knowledge comes from over two decades leading a wide array of industries including both the financial services and retail services segments. Mr. Chae has been a business executive for over 10 years, serving as the President of APIIS Financial, Inc., a financial planning and wealth management firm. Prior to APIIS Financial, Inc., Mr. Chae served as the Managing Site Partner for John Hancock from January 2002 to October 2010.

Mr. Chae immigrated from South Korea to the United States as a teenager, and diligently worked to enroll at UCLA where he studied Economics. Prior to graduation, Mr. Chae began his career at California Korea Bank, one of the first banks to service Koreans living in the United States. Mr. Chae rose to the position of Loan Adjuster before venturing out on his own as an entrepreneur. While starting his own businesses, Mr. Chae often found comfort in a warm bowl of ramen to uplift him and energize his spirit, which served as the inspiration for Yoshiharu. Mr. Chae’s background in the financial services industry provided him access to restaurants and retailers which helped him understand the restaurant industry and more importantly, the necessary foundations in building a successful restaurant business. Mr. Chae believed that there was a large addressable market for ramen, and together with his experience and passion for the business, founded Yoshiharu. As the founder and controlling stockholder of the Company, Mr. Chae possesses invaluable operational knowledge and insight making him qualified to serve as a member of our Board of Directors.

| 3 |

Jay Kim. Mr. Kim was appointed to serve as a director effective February 4, 2022. Mr. Kim serves as the Chief Executive Officer of Reborn Coffee Inc. Prior to Reborn, Mr. Kim founded Wellspring Industry, Inc. in California in 2007 which created the yogurt distribution company “Tutti Frutti” and bakery-café franchise “O’My Buns.” Tutti Frutti grew to approximately 700 agents worldwide that offered self-serve frozen yogurt. Mr. Kim sold the majority ownership of Wellspring to a group of investors in 2017.

Prior to founding Wellspring, Mr. Kim was the owner of Coffee Roasters in Riverside, California from 2002 to 2007. Mr. Kim worked as the project manager for JES Inc., based in Brea, CA from 1997 to 2002 where he coordinated and managed environmental engineering projects. Mr. Kim worked as a Senior Process Engineer for Allied Signal Environment Catalyst in Tulsa, Oklahoma, from 1992 to 1997 where he coordinated and implemented projects related to plant productivity and provided leadership and direction to other engineers as required and provided information needed for Division product quotations. He also acted as the leader in a start-up plant to be based in Mexico for Allied Signal. From 1988 to 1992 he worked as the plant start-up engineer for Toyota Auto Body Inc.

Mr. Kim has a B.S, in Chemical Engineering from California State University at Long Beach and followed a Chemical officer basic training at US Army Chemical School in 1988. He was commissioned 1st. LT. of the US Army in 1986 and retired from the US Army in 1988. Mr. Kim possesses extensive experience in leading and building restaurant and franchise companies making him qualified to serve as a member of our Board of Directors and our Audit Committee.

Harinne Kim. Ms. Kim was appointed to serve as a director effective February 17, 2023 to fill the vacancy created by former director Helen Lee’s resignation as of February 17, 2023. Ms. Kim is a leading financial advisor who is highly regarded in her field with over 23 years of experience having previously working with well-known financial firms such as Fidelity Investments, Vanguard and John Hancock.

Ms. Kim has completed her education at Loyola with a specialization in Economics and Finance. Currently, she has a large list of clients which vary from individuals to corporations.

Ms. Kim possesses extensive expertise and experience in financial management, making her qualified to serve as a “financial expert”, a member of our Board of Directors and our Audit Committee.

Yusil Yeo. Ms. Yeo was appointed to serve as a director effective May 25, 2022. Ms. Yeo is currently the president of Grace Yeo & Associates, C.P.A., Inc, a full-service accounting firm in Los Angeles, CA and has served in such capacity for the past 5 years. She has expertise in providing comprehensive accounting services. Ms. Yeo is a member of American Institute of Certified Public Accountants and the California Society of Certified Public Accountants. She is licensed as a Certified Public Accountant. Ms. Yeo has gained extensive accounting and tax experience through senior accountant and management roles for a variety of companies and CPA firms located in the Los Angeles area, including H&R Block and KNM Associates, Inc. Ms. Yeo holds a Bachelor of Science degree from the University of California, Los Angeles.

Ms. Yeo possesses extensive expertise and experience in financial management, making her qualified to serve as a “financial expert”, a member of our Board of Directors and our Audit Committee.

The above information is submitted concerning the nominees for election as directors based upon information received by us from such persons.

Vote Required and Board of Directors’ Recommendation

Assuming a quorum is present, the affirmative vote of a plurality of the votes cast at the Annual Meeting, either in person or by proxy, is required for the election of a director. For purposes of the election of directors, abstentions and broker non-votes will have no effect on the result of the vote.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS

VOTE “FOR” ALL OF THE NOMINEES NAMED IN PROPOSAL NO. 1.

| 4 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information regarding the ownership of our Common Stock as of October 20, 2023 (the “Determination Date”) by: (i) each current director of our company and each director nominee; (ii) each of our Named Executive Officers (“NEOs”); (iii) all current executive officers and directors of our company as a group; and (iv) all those known by us to be beneficial owners of more than five percent (5%) of our Common Stock.

Beneficial ownership and percentage ownership are determined in accordance with the rules of the SEC. Under these rules, beneficial ownership generally includes any shares as to which the individual or entity has sole or shared voting power or investment power and includes any shares that an individual or entity has the right to acquire beneficial ownership of within 60 days of the Determination Date, through the exercise of any option, warrant or similar right (such instruments being deemed to be “presently exercisable”). In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of our Common Stock that could be issued upon the exercise of presently exercisable options and warrants are considered to be outstanding. These shares, however, are not considered outstanding as of the Determination Date when computing the percentage ownership of each other person.

To our knowledge, except as indicated in the footnotes to the following table, and subject to state community property laws where applicable, all beneficial owners named in the following table have sole voting and investment power with respect to all shares shown as beneficially owned by them. Percentage of ownership is based on 11,940,000 shares of Class A Common Stock and 1,000,000 shares of Class B Common Stock outstanding as of the Determination Date. Unless otherwise indicated, the business address of each person in the table below is c/o Yoshiharu Global Co., at 6940 Beach Blvd., Suite D-705, Buena Park, California 90621. No shares identified below are subject to a pledge.

| Name of Beneficial Owner | Number of Class A Shares Beneficially Owned(1) | Percent of Class A Common Stock Outstanding(2) | Number of Class B Shares Beneficially Owned(1) | Percent of Class B Common Stock Outstanding(2) | Percent of Total Voting Power(2)(3) | |||||||||||||||

| James Chae | 7,160,900 | 59.97 | % | 1,000,000 | 100.00 | % | 78.22 | % | ||||||||||||

| Soojae Ryan Cho | 0 | * | - | - | * | |||||||||||||||

| Jay Kim | 100,000 | * | - | - | * | |||||||||||||||

| Harinne Kim | 25,000 | * | - | - | * | |||||||||||||||

| Yusil Yeo | 10,000 | * | - | - | * | |||||||||||||||

| All Beneficial Owners as a group (5) persons | 7,295,900 | 61.10 | % | 1,000,000 | 100.00 | % | 78.83 | % | ||||||||||||

| * | Beneficial ownership of less than 1.0% is omitted. |

| (1) | A person is considered to beneficially own any shares: (i) over which such person, directly or indirectly, exercises sole or shared voting or investment power, or (ii) of which such person has the right to acquire beneficial ownership at any time within 60 days (such as through exercise of stock options or warrants). Unless otherwise indicated, voting and investment power relating to the shares shown in the table for our directors and executive officers is exercised solely by the beneficial owner or shared by the owner and the owner’s spouse or children. |

| (2) | Shares of our Common Stock issuable upon the conversion of our convertible preferred stock are deemed outstanding for purposes of computing the percentage shown above. In addition, for purposes of this table, a person or group of persons is deemed to have “beneficial ownership” of any shares of Common Stock that such person has the right to acquire within 60 days after the date of this prospectus. For purposes of computing the percentage of outstanding shares of our Common Stock held by each person or group of persons named above, any shares that such person or persons has the right to acquire within 60 days after the date of this prospectus is deemed to be outstanding, but is not deemed to be outstanding for the purpose of computing the percentage ownership of any other person. The inclusion herein of any shares listed as beneficially owned does not constitute an admission of beneficial ownership. |

| (3) | Our Class B Common Stock has 10 votes per share, while our Class A Common Stock has one vote per share. |

From time to time, the number of our shares held in the “street name” accounts of various securities dealers for the benefit of their clients or in centralized securities depositories may exceed 5% of the total shares of our Common Stock outstanding.

| 5 |

Biographical Information Concerning Executive Officers

Biographical information concerning our Chief Executive Officer, who also serves as a member of our Board of Directors, is set forth above. Biographical information concerning our Chief Financial Officer is set forth below.

Soojae Ryan Cho is our Chief Financial Officer. Mr. Cho was appointed to serve as Chief Financial Officer effective May 25, 2022. For the prior five years, Mr. Cho served as a partner in S&R Accounting Professionals, LLP where he has provided various accounting, external audit, and tax services. He has 25 years of experience in public accounting and industry experience with US and global companies. Mr. Cho began his career with KPMG Los Angeles in 1996. After successfully completing 9 years at KPMG, Mr. Cho was recruited as a Controller and became a CFO for Prudential Securities in South Korea, a wholly owned subsidiary of Prudential Securities USA. Mr. Cho later joined Ticket Monster (TMon), a leading e-Commerce company as a Director of Finance managing over 40 accounting and finance team members. At TMon, Mr. Cho successfully led and completed mergers and acquisitions at different times with Groupon USA, Living Social, and KKR (one of the largest private equity firms in the USA), reported financial statements under US GAAP to its parent company, and worked closely with external auditors, PwC and E&Y. He has extensive experience in audits for both private and public companies, SEC reporting and due diligence transactions including post-merger integration services and IPO engagements. Mr. Cho offers specialized expertise in the automotive, manufacturing and distribution, technology, and e-Commerce industries.

Director’s Qualifications

In selecting a particular candidate to serve on our Board of Directors, we consider the needs of our Company based on particular experiences, qualifications, attributes and skills that we believe would be advantageous for members of our Board of Directors to have and that would qualify such candidate to serve on our Board of Directors given our business profile and the environment in which we operate. The table below sets forth such experiences, qualifications, attributes and skills, and identifies the ones that each director nominee possess.

| Attributes | Mr. Chae | Mr. Kim | Ms. Kim | Ms. Yeo | ||||||||||||

| Financial Experience | X | X | X | X | ||||||||||||

| Public Board Experience | ||||||||||||||||

| Industry Experience | X | X | X | |||||||||||||

| Scientific Experience | X | |||||||||||||||

| Commercial Experience | X | X | X | |||||||||||||

| Corporate Governance Experience | X | X | X | X | ||||||||||||

| Capital Markets Experience | X | X | X | X | ||||||||||||

| Management Experience | X | X | X | X | ||||||||||||

Arrangements Regarding Director Nominations

There are no arrangements regarding the nomination of our directors.

Family Relationships

There are no familial relationships between any of our executive officers and directors.

Director or Officer Involvement in Certain Legal Proceedings

Our directors and executive officers were not involved in any legal proceedings as described in Item 401(f) of Regulation S-K in the past ten years.

| 6 |

Independence of the Board of Directors

The Board of Directors utilizes NASDAQ’s standards for determining the independence of its members. In applying these standards, the Board of Directors considers commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships, among others, in assessing the independence of directors, and must disclose any basis for determining that a relationship is not material. The Board of Directors has determined that the following three (3) director nominees, namely Jay Kim, Harinne Kim and Yusil Yeo, are independent directors within the meaning of the NASDAQ independence standards. In making these independence determinations, the Board of Directors did not exclude from consideration as immaterial any relationship potentially compromising the independence of any of the above directors.

Meetings of the Board of Directors

To date, the Board of Directors held six meetings during our 2023 fiscal year. To date, during our 2023 fiscal year, each member of our Board of Directors attended more than 75% of the aggregate number of meetings of the Board of Directors that were held during the time that they served as members of the Board of Directors. We do not have a formal policy regarding attendance by members of the Board of Directors at the annual meeting of stockholders, but we strongly encourage all members of the Board of Directors to attend our annual meetings and expect such attendance except in the event of extraordinary circumstances.

Committees of the Board of Directors

The Board of Directors has established and currently maintains the following two standing committees: the Audit Committee and the Compensation Committee.

Currently, the Audit Committee consists of Ms. Yeo (Chair), Ms. Kim and Mr. Kim, and the Compensation Committee consists of Mr. Kim (Chair) and Ms. Kim. It is anticipated that, following the Annual Meeting, the committee members will remain the same. During the 2023 fiscal year, the Audit Committee held one meeting and the Compensation Committee held one meeting. Each member of the Board of Directors attended at least 75% of the meetings that were held during the periods when they served as members of such committee.

Mr. Chae controls a majority of the combined voting power of our outstanding equity interests. As a result, we are a “controlled company” within the meaning of the corporate governance rules of the Nasdaq Stock Market. As a controlled company, exemptions under the standards free us from the obligation to comply with certain corporate governance requirements, including the requirements:

| ● | that a majority of our Board of Directors consists of “independent directors,” as defined under the rules of the Nasdaq Stock Market; | |

| ● | that we have, to the extent applicable, a Nominating and Corporate Governance Committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; | |

| ● | that we have a Compensation Committee composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and | |

| ● | for an annual performance evaluation of the Nominating and Corporate Governance Committee and Compensation Committee. |

Since we avail ourselves of the “controlled company” exception under the Nasdaq Stock Market rules, we do not have a Nominating and Corporate Governance Committee. These exemptions do not modify the independence requirements for our Audit Committee, and we are in compliance with the requirements of Rule 10A-3 of the Exchange Act and the applicable rules of the Nasdaq Stock Market.

Audit Committee. The Audit Committee provides assistance to the Board of Directors in fulfilling its oversight responsibilities regarding the integrity of financial statements, our compliance with applicable legal and regulatory requirements, the integrity of our financial reporting processes including its systems of internal accounting and financial controls, the performance of our internal audit function and independent auditor and our financial policy matters by approving the services performed by our independent accountants and reviewing their reports regarding our accounting practices and systems of internal accounting controls. The Audit Committee also oversees the audit efforts of our independent accountants and takes action as it deems necessary to satisfy itself that the accountants are independent of management. Mr. Kim, Ms. Kim and Ms. Yeo meet the definition of “independent directors” for the purposes of serving on an Audit Committee under applicable SEC and Nasdaq Stock Market rules, and we are in compliance with these independence requirements. In addition, Mr. Kim, Ms. Kim and Ms. Yeo qualify as our “audit committee financial experts,” as such term is defined in Item 407 of Regulation S-K.

In general, an “audit committee financial expert” is an individual member of the audit committee or Board of Directors who:

| ● | understands generally accepted accounting principles and financial statements; |

| ● | is able to assess the general application of such principles in connection with accounting for estimates, accruals and reserves; |

| ● | has experience preparing, auditing, analyzing or evaluating financial statements comparable to the breadth and complexity to our financial statements; |

| ● | understands internal controls over financial reporting; and |

| ● | understands audit committee functions. |

Our Board of Directors has adopted a written charter for the Audit Committee, which is available on our corporate website at https://ir.yoshiharuramen.com/corporate-governance/governance-documents.

| 7 |

Compensation Committee. The Compensation Committee oversees our overall compensation structure, policies and programs, and assesses whether our compensation structure establishes appropriate incentives for officers and employees. The Compensation Committee reviews and approves corporate goals and objectives relevant to compensation of our chief executive officer and other executive officers, evaluates the performance of these officers in light of those goals and objectives, sets the compensation of these officers based on such evaluations and reviews and recommends to the Board of Directors any employment-related agreements, any proposed severance arrangements or change in control or similar agreements with these officers. The Compensation Committee also grants stock options and other awards under our stock plans. The Compensation Committee will review and self-evaluate, at least annually, the performance of the Compensation Committee and its members and the adequacy of the charter of the Compensation Committee.

Our Board of Directors has adopted a written charter for the Compensation Committee, which is available at https://ir.yoshiharuramen.com/corporate-governance/governance-documents. As a controlled company, we may rely upon the exemption from the requirement that we have a Compensation Committee composed entirely of independent directors, although our Compensation Committee consists entirely of independent directors.

Selection of Board Candidates

In selecting candidates for the Board of Directors, the Board of Directors begins by determining whether the incumbent directors whose terms expire at the annual meeting of stockholders desire and are qualified to continue their service on the Board of Directors. If there are positions on the Board of Directors for which the Board of Directors will not be re-nominating an incumbent director, or if there is a vacancy on the Board of Directors, the Board of Directors will solicit recommendations for nominees from persons whom the Board believes are likely to be familiar with qualified candidates, including members of our Board of Directors and our senior management. The Board of Directors may also engage a search firm to assist in the identification of qualified candidates. The Board of Directors will review and evaluate those candidates whom it believes merit serious consideration, taking into account all available information concerning the candidate, the existing composition and mix of talent and expertise on the Board of Directors and other factors that it deems relevant. In conducting its review and evaluation, the Board of Directors may solicit the views of management and other members of the Board of Directors, and may conduct interviews of proposed candidates.

The Board of Directors generally requires that all candidates for the Board of Directors be of the highest personal and professional integrity and have demonstrated exceptional ability and judgment. The Board of Directors will consider whether such candidate will be effective, in conjunction with the other members of the Board of Directors, in collectively serving the long-term interests of our stockholders. In addition, the Board of Directors requires that all candidates have no interests that materially conflict with our interests and those of our stockholders, have meaningful management, advisory or policy making experience, have a general appreciation of the major business issues facing us and have adequate time to devote to service on the Board of Directors.

The Board of Directors will consider stockholder recommendations for nominees to fill director positions, provided that the Board of Directors will not entertain stockholder nominations from stockholders who do not meet the eligibility criteria for submission of stockholder proposals under Rule 14a-8 of Regulation 14A under the Exchange Act. Stockholders may submit written recommendations for nominees to the Board of Directors, together with appropriate biographical information and qualifications of such nominees as required by our Bylaws, to our Secretary following the same procedures as described in “Stockholder Communications” in this Proxy Statement. In order for a nominee for directorship submitted by a stockholder to be considered, such recommendation must be received by the Secretary by the time period set forth in our most recent proxy statement for the submission of stockholder proposals under Rule 14a-8 of Regulation 14A under the Exchange Act. The Secretary shall then deliver any such communications to the Chairman of the Board of Directors. The Board of Directors will evaluate stockholder recommendations for candidates for the Board of Directors using the same criteria as for other candidates, except that the Board of Directors may consider, as one of the factors in its evaluation of stockholder recommended candidates, the size and duration of the interest of the recommending stockholder or stockholder group in our equity.

Board Leadership Structure and Role in Risk Oversight

The positions of Chairman of the Board of Directors and Chief Executive Officer are presently the same person and we do not have a lead independent director. As our Bylaws and corporate governance guidelines do not require that our Chairman and Chief Executive Officer positions be separate, our Board of Directors believes that having positions be held by the same person is the appropriate leadership structure for us at this time. We have determined that the leadership structure of our Board of Directors has permitted our Board of Directors to fulfill its duties effectively and efficiently and is appropriate given the size and scope of our company and its financial condition.

| 8 |

Our Board of Directors and the Audit Committee thereof is responsible for overseeing the risk management processes on behalf of our company. The Board of Directors and, to the extent applicable, the Audit Committee, receive and review periodic reports from management, auditors, legal counsel and others, as considered appropriate regarding our company’s assessment of risks. Where applicable, the Audit Committee reports regularly to the full Board of Directors with respect to risk management processes. The Audit Committee and the full Board of Directors focus on the most significant risks facing our company and our company’s general risk management strategy, and also ensure that risks undertaken by our company are consistent with the Board of Director’s appetite for risk. While the Board of Directors oversees the risk management of our company, management is responsible for day-to-day risk management processes. We believe this division of responsibilities is the most effective approach for addressing the risks facing our company and that our Board of Directors leadership structure supports this approach.

Stockholder Communications

All stockholder communications must: (i) be addressed to our Secretary or Board of Directors at our address; (ii) be in writing in print and delivered in person or by first class United States mail postage prepaid or by reputable overnight delivery service; (iii) be signed by the stockholder sending the communication; (iv) indicate whether the communication is intended for the entire Board of Directors, a committee thereof, or the independent directors; (v) if the communication relates to a stockholder proposal or director nominee, the name and address of the stockholder, the class and number of shares held by the stockholder, a description of any agreement, arrangement or understanding with respect to the nomination or other business between or among such stockholder or beneficial owner and any other person, including without limitation any agreements that would be required to be disclosed pursuant to Item 5 or Item 6 of Exchange Act Schedule 13D (regardless of whether the requirement to file a Schedule 13D is applicable to the stockholder or beneficial owner) and a description of any agreement, arrangement or understanding (including any derivative or short positions, profit interests, options, hedging transactions, and borrowed or loaned shares) that has been entered into as of the date of the stockholder’s notice by, or on behalf of, such stockholder or beneficial owner, the effect or intent of which is to mitigate loss, manage risk or benefit from changes in the share price of any class of the Company’s capital stock, or maintain, increase or decrease the voting power of the stockholder or beneficial owner with respect to shares of stock of the Company; provided that we will not entertain stockholder proposals or stockholder nominations from stockholders who do not meet the eligibility and procedural criteria for submission of stockholder proposals under Rule 14a-8 of Regulation 14A under the Exchange Act; and (vi) if the communication relates to a director nominee being recommended by the stockholder, must include all other information as required by our Bylaws, including without limitation, appropriate biographical information of the candidate.

Upon receipt of a stockholder communication that is compliant with the requirements identified above, the Secretary shall promptly deliver such communication to the appropriate member(s) of the Board of Directors or committee member(s) identified by the stockholder as the intended recipient of such communication by forwarding the communication to either the chairman of the Board of Directors with a copy to the Chief Executive Officer, the chairman of the applicable committee, or to each of the independent directors, as the case may be.

The Chief Executive Officer may, in his sole discretion and acting in good faith, provide copies of any such stockholder communication to any one or more of our directors and executive officers, except that in processing any stockholder communication addressed to the independent directors, the Chief Executive Officer may not copy any member of management in forwarding such communications. In addition, the Chief Executive Officer may, in his sole discretion and acting in good faith, not forward certain items if they are deemed of a commercial or frivolous nature or otherwise inappropriate for consideration by the intended recipient and any such correspondence may be forwarded elsewhere in our company for review and possible response.

| 9 |

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Approval for Related Party Transactions

Our Board of Directors has adopted a written related person transaction policy, which sets forth the policies and procedures for the review and approval or ratification of related party transactions. This policy is administrated by our Audit Committee. These policies provide that, in determining whether or not to recommend the initial approval or ratification of a related party transaction, the relevant facts and circumstances available shall be considered, including, among other factors it deems appropriate, whether the interested transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances and the extent of the related party’s interest in the transaction.

Related Party Transactions

In September 2021, Yoshiharu Holdings was formed by Mr. Chae as an S corporation for the purpose of acquiring all of the equity in each of the seven restaurant store entities which were previously founded and wholly owned directly by Mr. Chae and all of the intellectual property in the business held by Mr. Chae in exchange for an issuance of 9,450,900 shares to Mr. Chae, which constituted all of the issued and outstanding equity in Yoshiharu Holdings Co. Such transfers were completed in the fourth quarter of 2021.

Yoshiharu Global Co. was incorporated on December 9, 2021 in Delaware by Mr. Chae. On December 9, 2021, Mr. Chae contributed 100% of the equity in Yoshiharu Holdings Co. to Yoshiharu Global Co. in exchange for the issuance by Yoshiharu Global Co. of 9,450,900 shares of Class A Common Stock to Mr. Chae. On December 10, 2021, the Company redeemed 670,000 shares of Class A Common Stock from Mr. Chae at par ($0.0001 per share). In December 2021, the Company conducted a private placement solely to accredited investors and sold 670,000 shares of Class A Common Stock at $2.00 per share, which the Company’s Board of Directors determined to reflect the then current fair market value of the Company’s Class A Common Stock. On September 8, 2022, immediately prior to the Company’s initial public offering, the Company exchanged 1,000,000 shares held by Mr. Chae into 1,000,000 shares of Class B Common Stock. Effective February 7, 2022, the Company’s Board and stockholders unanimously approved the form of amended and restated certificate of incorporation, which clarifies the automatic conversion of Class B Common Stock held by Mr. Chae into Class A Common Stock, among other things.

From time to time, the Company borrowed money from Mr. Chae and his affiliate APIIS Financial, Inc., a company 100% owned and controlled by Mr. Chae. The balance is non-interest bearing and due on demand. As of June 30, 2022, December 31, 2021 and December 31, 2020, the balance was $1,417,433, $1,383,213 and $911,411, respectively.

From time to time, the Company made distributions in the form of dividends to Mr. Chae as the sole stockholder of the Company. For the years ended December 31, 2021 and 2020, James Chae was distributed $696,575 and $665,194, respectively. There were no distributions for the year ended December 31, 2022 or the six month period ended June 30, 2023.

Mr. Chae owns 100% of our outstanding Class B Common Stock, and 59.97% of our Class A Common Stock, and 78.22% of our total voting power. Our Class B Common Stock has 10 votes per share, while our Class A Common Stock, which is the class of stock we sold in our initial public offering and which is the only class of stock that is publicly traded, has one vote per share.

As a result of Mr. Chae’s 100% ownership of our Class B Common Stock, Mr. Chae is able to control all matters submitted to our stockholders for approval even if he owns significantly less than 50% of the number of shares of our outstanding equity interests. This concentrated control could discourage others from initiating any potential merger, takeover or other change of control transaction that other stockholders may view as beneficial.

| 10 |

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We have appointed BF Borgers CPA PC (“BFB”) to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2024. BFB has served as our independent registered public accounting firm since 2021.

In the event that ratification of this appointment of independent registered public accounting firm is not approved by the affirmative vote of a majority of votes cast on the matter, then the appointment of our independent registered public accounting firm will be reconsidered by us.

Your ratification of the appointment of BFB as our independent registered public accounting firm for the fiscal year ending December 31, 2024 does not preclude us from terminating our engagement of BFB and retaining a new independent registered public accounting firm, if we determine that such an action would be in our best interest.

The following table sets forth the fees billed to us for professional services rendered by BFB for the years ended December 31, 2022 and 2021:

SERVICES

| 31-Dec-22 | 31-Dec-21 | |||||||

| Audit fees | $ | 222,000 | $ | 0 | ||||

| Tax fees | 11,000 | 11,000 | ||||||

| All other fees | 33,000 | 33,000 | ||||||

| Total fees | $ | 266,000 | $ | 44,000 | ||||

| (1) | Audit Fees — Audit fees consist of fees billed for the audit of our annual financial statements and the review of the interim consolidated financial statements. |

| (2) | Audit-Related Fees — These consisted principally of the aggregate fees related to audits that are not included Audit Fees. |

| (3) | Tax Fees — Tax fees consist of aggregate fees for tax compliance and tax advice, including the review and preparation of our various jurisdictions’ income tax returns. |

Pre-Approval Policies and Procedures

The Audit Committee has the authority to appoint or replace our independent registered public accounting firm (subject, if applicable, to stockholder ratification). The Audit Committee is also responsible for the compensation and oversight of the work of the independent registered public accounting firm (including resolution of disagreements between management and the independent registered public accounting firm regarding financial reporting) for the purpose of preparing or issuing an audit report or related work. The independent registered public accounting firm was engaged by, and reports directly to, the Audit Committee.

The Audit Committee pre-approves all audit services and permitted non-audit services (including the fees and terms thereof) to be performed for us by our independent registered public accounting firm, subject to the de minimis exceptions for non-audit services described in Section 10A(i)(1)(B) of the Exchange Act and Rule 2-01(c)(7)(i)(C) of Regulation S-X, provided that all such excepted services are subsequently approved prior to the completion of the audit. We have complied with the procedures set forth above, and the Audit Committee has otherwise complied with the provisions of its charter.

Vote Required and Board of Directors’ Recommendation

Assuming a quorum is present, the affirmative vote of a majority of the shares present at the Annual Meeting and entitled to vote, either in person or by proxy, is required for approval of Proposal No. 2. For purposes of the ratification of our independent registered public accounting firm, abstentions will have the same effect as a vote against this proposal, and broker non-votes will have no effect on the result of the vote.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS

VOTE “FOR” PROPOSAL NO. 2.

| 11 |

PROPOSAL NO. 3

PROPOSAL TO approve reverse stock split of our Class A COMMON STOCK and Class B Common Stock in a ratio of not LESS THAN 1-FOR-2 AND NOT more than 1-for-40

General Description of Corporate Action

On October 24, 2023, the Board of Directors approved the proposal to amend our Amended and Restated Certificate of Incorporation, to enable a potential reverse split (the “Reverse Split”) of our outstanding shares of Class A Common Stock and Class B Common Stock within a ratio of not less than 1-for-2 and not more than 1-for-40 to be selected at the discretion of our Board of Directors. Stockholder approval of this proposal will authorize our Board of Directors, in its sole discretion, to determine whether to effect the Reverse Split and to set the exact ratio within the range at which the Reverse Split will be effected, at any time prior December 31, 2023. Our Board of Directors believes that approval of this proposal to effect the Reverse Split and to determine the ratio as opposed to approval of an immediate reverse stock split at a specific ratio, and to effect such reverse stock split at any time prior to December 31, 2023, will provide our Board of Directors with maximum flexibility to react to current market conditions and therefore to achieve the purposes of the Reverse Split, if implemented, and to act in the best interests of our stockholders.

Effecting the Reverse Split requires that our Amended and Restated Certificate of Incorporation be amended. If approved, the Reverse Split will be effective upon the filing of a Certificate of Amendment to the Amended and Restated Certificate of Incorporation, in the form attached to this proxy statement as Annex A (the “Certificate of Amendment”), with the Secretary of State of Delaware, with such filing to occur, if at all, at the sole discretion of the Board of Directors.

Reasons for Approving the Reverse Split

The intention of the Board of Directors in obtaining approval for the authority to effect a Reverse Split would be to increase the stock price of our Class A Common Stock sufficiently above the $1.00 minimum bid price requirement to regain its listing on the Nasdaq Capital Market (“Nasdaq”). The Board of Directors, in its sole discretion, can elect to abandon the Reverse Split in its entirety at any time.

One principal effect of the Reverse Split would be to decrease the number of outstanding shares of our Class A Common Stock as described below. Except for de minimus adjustments that may result from the treatment of fractional shares as described below, the Reverse Split will not have any dilutive effect on our stockholders since each stockholder would hold the same percentage of our Class A Common Stock (in hand or on an as converted basis) outstanding immediately following the Reverse Split as such stockholder held immediately prior to the Reverse Split. The relative voting and other rights that accompany the shares would not be affected by the Reverse Split.

General Effect of the Reverse Split

The table below shows the effect of the Reverse Split on the Class A Common Stock and Class B Common Stock issued and outstanding as of the date hereof, assuming an exchange ratio of each of 1:2, 1:20 and 1:40, respectively, for the Reverse Split.

The columns labeled “After Reverse Split” in the table do not reflect the adjustments that will result from the issuance of additional shares to certain holders to round up their fractional shares. The Company cannot calculate at this time the number of whole shares that will be issued in lieu of fractions as a result of the Reverse Split.

| Shares of Common Stock | Prior to Reverse Split | After Reverse Split (1 for 2) | After Reverse Split (1 for 20) | After Reverse Split (1 for 40) | ||||||||||||

| Authorized (Class A Common Stock) | 49,000,000 | 49,000,000 | 49,000,000 | 49,000,000 | ||||||||||||

| Authorized (Class B Common Stock) | 1,000,000 | 1,000,000 | 1,000,000 | 1,000,000 | ||||||||||||

| Issued and outstanding (Class A Common Stock | 11,940,000 | 5,970,000 | 597,000 | 298,500 | ||||||||||||

| Issued and outstanding (Class B Common Stock) | 1,000,000 | 500,000 | 50,000 | 25,000 | ||||||||||||

| Reserved for future issuance (Class A Common Stock) | 1,147,000 | 573,500 | 57,350 | 28,675 | ||||||||||||

| Reserved for future issuance (Class B Common Stock) | - | - | - | - | ||||||||||||

| Available for issuance (Class A Common Stock) | 35,913,000 | 42,456,500 | 48,345,650 | 48,672,825 | ||||||||||||

| Available for issuance (Class B Common Stock) | - | 500,000 | 950,000 | 975,000 | ||||||||||||

| 12 |

Please note: The proposed Reverse Split will apply equally to the Class A Common Stock and Class B Common Stock. However, because only the Class A Common Stock trades on the market, the discussion below relates principally to the Class A Common Stock.

Reasons for the Reverse Split; Nasdaq Requirements for Continued Listing

The Board of Directors’ primary objective in proposing a potential Reverse Split is to raise the per share trading price of our Class A Common Stock. Our Class A Common Stock currently trades on Nasdaq under the symbol “YOSH.”

On June 16, 2023, we received a deficiency notice from Nasdaq informing us that our Class A Common Stock failed to comply with the $1 minimum bid price required for continued listing on The Nasdaq Capital Market under Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”) based upon the closing bid price of the Class A Common Stock for the 30 consecutive business days prior to the date of the notice from Nasdaq. To regain compliance, the minimum bid price of the Class A Common Stock was required to meet or exceed $1.00 per share for a minimum of ten consecutive trading days at any time prior to December 13, 2023.

To regain compliance, among other things, the bid price of our Class A Common Stock must close at or above $1.00 per share for a minimum of ten consecutive business days at any time during the 180-day compliance period. If we again cease to comply with the minimum per share average closing price standard of Rule 5550(a)(2) and fail to regain compliance by the end of the 180-day compliance period, or December 13, 2023, we may be eligible for an additional 180 calendar days to regain compliance, provided that we (i) meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for the Nasdaq Capital Market, except for Nasdaq Listing Rule 5550(a)(2), and (ii) provide a written notice of our intention to cure this deficiency during the second compliance period, by effecting a reverse stock split, if necessary. If we again cease to comply with the minimum per share average closing price standard of Rule 5550(a)(2) and fail to regain compliance by the end of such additional 180-day compliance period, or if we are not granted such additional 180-day compliance period, our Class A Common Stock will be subject to delisting by the Nasdaq. In the event that our Class A Common Stock is delisted by Nasdaq, our Class A Common Stock would likely trade on the over-the-counter market. If our shares were to trade on the over-the-counter market, selling our common shares could be more difficult because smaller quantities of shares would likely be bought and sold, and transactions could be delayed. In addition, in the event our common shares are delisted, broker-dealers have certain regulatory burdens imposed upon them, which may discourage broker-dealers from effecting transactions in our common shares, further limiting the liquidity of our common shares. These factors could result in lower prices and larger spreads in the bid and ask prices for common shares. Such potential delisting from the Nasdaq and continued or further declines in our share price could also greatly impair our ability to raise additional necessary capital through equity or debt financing.

Our Board of Directors believes that the Reverse Split and any resulting increase in the per share price of our Class A Common Stock will enhance the acceptability and marketability of our Class A Common Stock to the financial community and investing public. Many institutional investors have policies prohibiting them from holding lower-priced stocks in their portfolios, which reduces the number of potential buyers of our Class A Common Stock, although we have not been told by them that is the reason for not investing in our Class A Common Stock. Additionally, analysts at many brokerage firms are reluctant to recommend lower-priced stocks to their clients or monitor the activity of lower-priced stocks. Brokerage houses frequently have internal practices and policies that discourage individual brokers from dealing in lower-priced stocks. Further, because brokers’ commissions on lower-priced stock generally represent a higher percentage of the stock price than commissions on higher priced stock, investors in lower-priced stocks pay transaction costs which are a higher percentage of their total share value, which may limit the willingness of individual investors and institutions to purchase our Class A Common Stock.

We cannot assure you that the Reverse Split will have any of the desired effects described above. More specifically, we cannot assure you that after the Reverse Split the market price of our Class A Common Stock will increase proportionately to reflect the ratio for the Reverse Split, that the market price of our Class A Common Stock will not decrease to its pre-split level, that our market capitalization will be equal to the market capitalization before the Reverse Split, or that we will be able to maintain our listing on Nasdaq.

Potential Disadvantages of the Reverse Split

As noted above, the principal purpose of the Reverse Split would be to help increase the per share market price of our Class A Common Stock by up to a factor of 40. We cannot assure you, however, that the Reverse Split will accomplish this objective for any meaningful period of time. While we expect that the reduction in the number of outstanding shares of Class A Common Stock will increase the market price of our Class A Common Stock, we cannot assure you that the Reverse Split will increase the market price of our Class A Common Stock by a multiple equal to the number of pre-split shares, or result in any permanent increase in the market price of our Class A Common Stock, which is dependent upon many factors, including our business and financial performance, general market conditions and prospects for future success. If the per share market price does not increase proportionately as a result of the Reverse Split, then the value of our Company as measured by our stock capitalization will be reduced, perhaps significantly.

| 13 |

The number of shares held by each individual holder of Class A Common Stock would be reduced if the Reverse Split is implemented. This will increase the number of stockholders who hold less than a “round lot,” or 100 shares. Typically, the transaction costs to stockholders selling “odd lots” are higher on a per share basis. Consequently, the Reverse Split could increase the transaction costs to existing holders of Class A Common Stock in the event they wish to sell all or a portion of their position.

Although our Board of Directors believes that the decrease in the number of shares of our Class A Common Stock outstanding as a consequence of the Reverse Split and the anticipated increase in the market price of our Class A Common Stock could encourage interest in our Class A Common Stock and possibly promote greater liquidity for our stockholders, such liquidity could also be adversely affected by the reduced number of shares outstanding after the Reverse Split.

Effecting the Reverse Split

Upon receipt of stockholder approval for the Reverse Split Proposal, if our Board of Directors concludes that it is in the best interests of our Company and our stockholders to effect the Reverse Split, the Certificate of Amendment will be filed with the Secretary of State of Delaware. The actual timing of the filing of the Certificate of Amendment with the Secretary of State of Delaware to effect the Reverse Split will be determined by our Board of Directors. In addition, if for any reason our Board of Directors deems it advisable to do so, the Reverse Split may be abandoned at any time prior to the filing of the Certificate of Amendment, without further action by our stockholders. In addition, our Board of Directors may deem it advisable to effect the Reverse Split even if the price of our Common Stock is above $1.00 at the time the Reverse Split is to be effected. The Reverse Split will be effective as of the date of filing of the Certificate of Amendment with the Secretary of State of the State of Delaware (the “Effective Time”).

Upon the filing of the Certificate of Amendment, without further action on our part or our stockholders, the outstanding shares of Class A Common Stock and Class B Common Stock held by stockholders of record as of the Effective Time would be converted into a lesser number of shares of Class A Common Stock and Class B Common Stock, as applicable, based on a Reverse Split ratio as determined by the Board of Directors.

Effect on Outstanding Shares, Options and Certain Other Securities

If the Reverse Split is implemented, the number of shares our Class A Common Stock and Class B Common Stock owned by each stockholder will be reduced in the same proportion as the reduction in the total number of shares outstanding, such that the percentage of our Class A Common Stock and Class B Common Stock owned by each stockholder will remain unchanged except for any de minimus change resulting from rounding up to the nearest number of whole shares so that we are not obligated to issue cash in lieu of any fractional shares that such stockholder would have received as a result of the Reverse Split. The number of shares of our Class A Common Stock that may be purchased upon exercise of outstanding options or other securities convertible into, or exercisable or exchangeable for, shares of our Class A Common Stock, and the exercise or conversion prices for these securities, will also be ratably adjusted in accordance with their terms as of the Effective Time. Pursuant to the Company’s Amended and Restated Certificate of Incorporation, if the Reverse Split is implemented, the one-to-one conversion ratio for the conversion of Class B Common Stock into Class A Common Stock will be maintained.

Effect on Registration

Our Class A Common Stock is currently registered under the Securities Act of 1933, as amended, and we are subject to the periodic reporting and other requirements of the Exchange Act. The proposed Reverse Split will not affect the registration of our Class A Common Stock.

Fractional Shares; Exchange of Stock Certificates

Our Board of Directors does not currently intend to issue fractional shares in connection with the Reverse Split. Therefore, we do not expect to issue certificates representing fractional shares. In lieu of any fractional shares, we will issue to stockholders of record who would otherwise hold a fractional share because the number of shares of Class A Common Stock or Class B Common Stock they hold of record before the Reverse Split is not evenly divisible by the Reverse Split ratio that number of shares of Class A Common Stock or Class B Common Stock, as applicable, as rounded up to the nearest whole share. No stockholders will receive cash in lieu of fractional shares.

| 14 |

We do not expect the Reverse Split and the rounding up of fractional shares to whole shares to result in a significant reduction in the number of record holders. We presently do not intend to seek any change in our status as a reporting company for federal securities law purposes, either before or after the Reverse Split.

On or after the Effective Time, we will mail a letter of transmittal to each stockholder. Each stockholder will be able to obtain a certificate evidencing his, her or its post-Reverse Split shares only by sending the exchange agent (who will be our transfer agent) the stockholder’s old stock certificate(s), together with the properly executed and completed letter of transmittal and such evidence of ownership of the shares as we may require. Stockholders will not receive certificates for post-Reverse Split shares unless and until their old certificates are surrendered. Stockholders should not forward their certificates to the exchange agent until they receive the letter of transmittal, and they should only send in their certificates with the letter of transmittal. The exchange agent will send each stockholder, if elected in the letter of transmittal, a new stock certificate after receipt of that stockholder’s properly completed letter of transmittal and old stock certificate(s). A stockholder that surrenders his, her or its old stock certificate(s) but does not elect to receive a new stock certificate in the letter of transmittal will be deemed to have requested to hold that stockholder’s shares electronically in book-entry form with our transfer agent.

Certain of our registered holders of Class A Common Stock and Class B Common Stock hold some or all of their shares electronically in book-entry form with our transfer agent. These stockholders do not have stock certificates evidencing their ownership of our Class A Common Stock or Class B Common Stock, as applicable. They are, however, provided with a statement reflecting the number of shares registered in their accounts. If a stockholder holds registered shares in book-entry form with our transfer agent, the stockholder may return a properly executed and completed letter of transmittal.

Stockholders who hold shares in street name through a nominee (such as a bank or broker) will be treated in the same manner as stockholders whose shares are registered in their names, and nominees will be instructed to effect the Reverse Split for their beneficial holders. However, nominees may have different procedures and stockholders holding shares in street name should contact their nominees.

Stockholders will not have to pay any service charges in connection with the exchange of their certificates.

Authorized Shares

If and when our Board of Directors elects to effect the Reverse Split, the Certificate of Amendment will not reduce the authorized number of shares of our capital stock.

In accordance with our Certificate of Incorporation, and Delaware law, our stockholders do not have any preemptive rights to purchase or subscribe for any of our unissued or treasury shares.

Anti-Takeover and Dilutive Effects

The authorized Class A Common Stock and Class B Common Stock will not be diluted as a result of the Reverse Split. The Class A Common Stock and Class B Common Stock that is authorized but unissued provides the Board of Directors with flexibility to effect among other transactions, public or private financings, acquisitions, stock dividends, stock splits and the granting of equity incentive awards. However, these authorized but unissued shares may also be used by our Board of Directors, consistent with and subject to its fiduciary duties, to deter future attempts to gain control of us or make such actions more expensive and less desirable. The Certificate of Amendment would continue to give our Board of Directors authority to issue additional shares from time to time without delay or further action by the stockholders except as may be required by applicable law or regulations. The Certificate of Amendment is not being recommended in response to any specific effort of which we are aware to obtain control of us, nor does our Board of Directors have any present intent to use the authorized but unissued Class A Common Stock or Class B Common Stock or preferred stock to impede a takeover attempt. There are no plans or proposals to adopt other provisions or enter into any arrangements that have material anti-takeover effects.

Accounting Consequences

As of the Effective Time, the stated capital attributable to Class A Common Stock and Class B Common Stock on our balance sheet will be reduced proportionately based on the Reverse Split ratio that is determined by the Board of Directors (including a retroactive adjustment of prior periods), and the additional paid-in capital account will be credited with the amount by which the stated capital is reduced. Reported per share net income or loss will be higher because there will be fewer shares of our Class A Common Stock and Class B Common Stock outstanding.

| 15 |

Federal Income Tax Consequences

The following discussion is a summary of the U.S. federal income tax consequences of the Reverse Split generally applicable to U.S. holders (as defined below) of our Class A Common Stock and Class B Common Stock, and is based upon U.S. federal income tax law and relevant interpretations thereof in effect as of the date of this proxy statement, all of which are subject to change, possibly with retroactive effect. This summary does not discuss all aspects of U.S. federal income taxation that may be important to you in light of your individual circumstances, including if you are subject to special tax rules that apply to certain types of investors (e.g., financial institutions, insurance companies, broker-dealers, partnerships or other pass-through entities for U.S. federal income tax purposes, tax-exempt organizations (including private foundations), taxpayers that have elected mark-to-market tax accounting, S corporations, regulated investment companies, real estate investment trusts, investors that will hold our securities as part of a straddle, hedge, conversion, or other integrated transaction for U.S. federal income tax purposes, or investors that have a functional currency other than the U.S. dollar), all of whom may be subject to tax rules that differ materially from those summarized below. In addition, this summary does not discuss other U.S. federal tax consequences (e.g., estate or gift tax), any state, local, or non-U.S. tax considerations, the Medicare tax on certain investment income or the alternative minimum tax.

This summary is limited to U.S. holders that hold our Class A Common Stock and Class B Common Stock as “capital assets” (generally, property held for investment) within the meaning of Section 1221 of the Internal Revenue Code of 1986, as amended (the “Code”). We have not sought, and will not seek, a ruling from the Internal Revenue Service (the “IRS”) regarding any matter discussed herein, and no assurance can be given that the IRS would not assert, or that a court would not sustain, a position contrary to any of the tax aspects set forth below.

For purposes of this summary, a “U.S. holder” is a beneficial holder of Class A Common Stock or Class B Common Stock who or that, for U.S. federal income tax purposes, is:

| ● | an individual who is a United States citizen or resident of the United States; | |

| ● | a corporation or other entity treated as a corporation for United States federal income tax purposes that is created or organized (or treated as created or organized) in or under the laws of the United States or any state or political subdivision thereof; | |

| ● | an estate the income of which is subject to United States federal income taxation regardless of its source; or | |

| ● | a trust if (A) the administration of which is subject to the primary supervision of a United States court and which has one or more United States persons (within the meaning of the Code) who have the authority to control all substantial decisions of the trust or (B) it has in effect a valid election under applicable Treasury regulations to be treated as a United States person. |

If a partnership (or other entity classified as a partnership for U.S. federal income tax purposes) is the beneficial owner of our Class A Common Stock or Class B Common Stock, the U.S. federal income tax treatment of a partner in the partnership will generally depend on the status of the partner and the activities of the partnership. Partnerships that hold our Class A Common Stock or Class B Common Stock, and partners in such partnerships, should consult their own tax advisors regarding the U.S. federal income tax consequences of the Reverse Split.

Each stockholder should consult his, her or its own tax advisor regarding the U.S. federal, state, local and foreign income and other tax consequences of the Reverse Split.