As filed with the Securities and Exchange Commission on January 25, 2022.

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

YOSHIHARU GLOBAL CO.

(Exact name of registrant as specified in its charter)

| Delaware | 5812 | 87-3941448 | ||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

6940 Beach Blvd. Suite D-705,

Buena Park, CA 90621

(213) 272-1780

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

James Chae

Chief Executive Officer

6940 Beach Blvd. Suite D-705,

Buena Park, CA 90621

(213) 272-1780

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

Matthew Ogurick Darina Koleva Sarah Stewart K&L Gates LLP 599 Lexington Avenue New York, New York 10022 (212) 536-3901 |

Nimish Patel Blake Baron Mitchell Silberberg & Knupp LLP 2049

Century Park East, 18th Floor (310) 312-3102 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”) check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

CALCULATION OF REGISTRATION FEE

TITLE OF EACH CLASS OF SECURITIES TO BE REGISTERED | PROPOSED MAXIMUM AGGREGATE OFFERING PRICE(1) | AMOUNT OF REGISTRATION FEE | ||||||

| Units consisting of one share of Class A common stock, par value $0.0001 per share, and a warrant to purchase one share of Class A common stock(2)(3) | $ | 23,000,000.00 | $ | 2,132.10 | ||||

| Class A common stock included as part of the units(4)(6) | - | - | ||||||

| Warrants included as part of the units(4) | - | - | ||||||

| Class A common stock underlying the warrants included in the units(6) | $ | 28,750,000.00 | $ | 2,665.13 | ||||

| Representative’s warrants(5) | - | - | ||||||

| Class A common stock underlying the Representative’s warrants(5)(6) | $ | 1,437,500.00 | $ | 133.26 | ||||

| Total | $ | 53,187,500.00 | $ | 4,930.49 | ||||

| (1) | There is no current market for the securities or price at which the shares are being offered. Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Each unit consists of one share of Class A common stock and a warrant to purchase one share of Class A common stock at an exercise price per share equal to 125% of the unit offering price. |

| (3) | Includes shares of Class A common stock and/or warrants to purchase shares of Class A common stock that may be purchased by the underwriters pursuant to their over-allotment option. |

| (4) | Included in the price of the units. No separate registration fee required pursuant to Rule 457(g) under the Securities Act of 1933, as amended. |

| (5) | We have agreed to issue to the representative of the several underwriters warrants to purchase the number of shares of Class A common stock in the aggregate equal to five percent (5%) of the shares of Class A common stock to be issued and sold in this offering (including any shares of Class A common stock sold upon exercise of the over-allotment option). The warrants are exercisable for a price per share equal to 125% of the public offering price. The warrants are exercisable at any time and from time to time, in whole or in part, during the four-and-a-half-year period commencing six (6) months from the date of commencement of sales of the offering. This registration statement also covers such shares of Class A common stock issuable upon the exercise of the representative’s warrants. As estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act, the proposed maximum aggregate offering price of the representative’s warrants is $1,437,500.00, which is equal to 125% of $1,150,000.00 (5% of $23,000,000.00). “Underwriting” contains additional information regarding underwriter compensation. |

| (6) | Pursuant to Rule 416 under the Securities Act of 1933, as amended, there is also being registered hereby such indeterminate number of additional shares as may be issued or issuable because of stock splits, stock dividends and similar transactions. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| Preliminary Prospectus | Subject to Completion, dated January 25, 2022 |

4,000,000 UNITS

Each Unit Consisting of One Share of Class A Common Stock and One Warrant to Purchase One Share of Class A Common Stock

This is our initial public offering. We are offering 4,000,000 units, each unit consisting of one share of Class A common stock, par value $0.0001 per share, and one warrant to purchase one share of Class A common stock, assuming an initial public offering price of $4.50 per unit (which is the midpoint of the estimated range of the initial public offering price shown on the cover page of this prospectus). We currently estimate that the initial public offering price will be between $4.00 and $5.00 per unit. Each whole share exercisable pursuant to the warrants will have an exercise price per share of $5.625, equal to 125% of the initial public offering price, assuming an initial public offering price of $4.50 per unit. The warrants will be immediately exercisable and will expire on the fifth anniversary of the original issuance date. The units will not be certificated. The shares of Class A common stock and related warrants are immediately separable and will be issued separately, but must be purchased together as a unit in this offering.

Currently, there is no public market for our common stock or warrants. We have applied to list our Class A common stock under the symbol “YOSH” and our warrants under the symbol “YOSHW,” both on the Nasdaq Capital Market. The closing of this offering is contingent upon the successful listing of our Class A common stock and warrants on the Nasdaq Capital Market.

Following this offering, we will have two classes of outstanding common stock, Class A common stock and Class B common stock. Holders of our Class A common stock are entitled to one vote per share while holders of our Class B common stock are entitled to 10 votes per share, and all such holders will vote together as a single class except as otherwise required by applicable law. Each share of Class B common stock is convertible into one share of Class A common stock at the option of the holder, upon transfer or in certain specified circumstances. The beneficial owner of 100% of our Class B common stock is James Chae, our Chief Executive Officer, Chairman of the Board and founder. Upon completion of this offering, we will be controlled by Mr. Chae, who will hold approximately 74.4% of the combined voting power of our outstanding Class A common stock and Class B common stock, and will have the ability to determine all matters requiring approval by stockholders.

We are an emerging growth company as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and as such, we have elected to take advantage of certain reduced public company reporting requirements for this prospectus and future filings. In addition, following this offering, we will be a “controlled company” within the meaning of the corporate governance rules of the Nasdaq Stock Market. Under these rules, a listed company of which more than 50% of the voting power is held by an individual, group or another company is a “controlled company” and may elect not to comply with certain corporate governance requirements, including the requirement that (i) a majority of our board of directors consist of independent directors, (ii) director nominees be selected or recommended to the board by independent directors or an independent nominating committee, and (iii) we have a compensation committee that is composed entirely of independent directors. We have nevertheless elected to comply with the requirement that a majority of our board consists of independent directors and that our compensation committee be composed entirely of independent directors.

Investing in our Class A common stock and warrants involves a high degree of risk. See Risk Factors beginning on page 12 of this prospectus.

| Per Unit | Total | |||||||

| Initial public offering price | $ | $ | ||||||

| Underwriting discounts and commissions(1) | $ | $ | ||||||

| Proceeds, before expenses, to Yoshiharu Global Co. | $ | $ | ||||||

| (1) | Does not include the following additional compensation payable to the underwriters: We have agreed to pay the representative of the underwriters, EF Hutton, division of Benchmark Investments, LLC, which we refer to as EF Hutton or the representative, a non-accountable expense allowance equal to one percent (1.0%) of the total proceeds raised and to reimburse the underwriters for certain expenses incurred relating to this offering. In addition, we have agreed to issue to the representative warrants to purchase the number of shares of Class A common stock in the aggregate equal to five percent (5%) of the shares of Class A common stock to be issued and sold in this offering (including any shares of Class A common stock sold upon exercise of the over-allotment option). The warrants are exercisable for a price per share equal to 125% of the public offering price. The warrants are exercisable at any time and from time to time, in whole or in part, during the four-and-a-half-year period commencing six (6) months from the date of commencement of sales of the offering. The registration statement of which this prospectus forms a part also registers the shares of Class A common stock issuable upon the exercise of the representative’s warrants. “Underwriting” contains additional information regarding underwriter compensation. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

We have granted the underwriters the option for a period of 45 days to purchase up to 600,000 additional shares of Class A common stock and/or up to 600,000 additional warrants (equal to 15% of the shares of Class A common stock and warrants underlying the units sold in the offering) in any combination thereof, at the initial public offering price less the underwriting discounts and commissions, solely to cover over-allotments, if any.

The underwriters expect to deliver the units against payment on or about , 2022.

EF HUTTON

division of Benchmark Investments, LLC

The date of this prospectus is , 2022

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus and any free writing prospectus we may authorize to be delivered or made available to you. We have not, and the underwriters have not, authorized anyone to provide you with additional or different information from that contained in this prospectus and any free writing prospectus we have authorized. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, shares of Class A common stock and warrants only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the units. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. “Risk Factors” and “Special Note Regarding Forward-Looking Statements” contain additional information regarding these risks.

For investors outside the United States: We have not, and the underwriters have not, done anything that would permit this offering, or possession or distribution of this prospectus, in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the units and the distribution of this prospectus outside of the United States. See “Underwriting.”

DEALER PROSPECTUS DELIVERY OBLIGATION

Through and including , 2022 (the 25th day after the date of the prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

MARKET AND INDUSTRY DATA

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources (including industry publications, surveys and forecasts), and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and third-party sources, as well data from internal research, and are based on assumptions made by us upon reviewing such data and our knowledge of such industry and markets which we believe to be reasonable. Although we believe the data from these third-party sources are reliable as of their respective dates, neither we nor the underwriters have independently verified the accuracy or completeness of this information. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and “Special Note Regarding Forward-Looking Statements.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or food products in this prospectus is not intended to imply a relationship with, or endorsement or sponsorship by, these other parties. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks, service marks and trade names.

BASIS OF PRESENTATION

Certain monetary amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

In this prospectus, “Yoshiharu Global Co.,” “Yoshiharu Global” “Yoshiharu,” “we,” “us,” “our,” “our company” and the “Company” refer to Yoshiharu Global Co., together with its wholly owned subsidiaries Yoshiharu Holdings Co., or Yoshiharu Holdings, Yoshiharu Asset Co. (as defined below) and Yoshiharu Franchise Co. (as defined below) unless expressly indicated or the context otherwise requires. “Yoshiharu Holdings,” refers to Yoshiharu Holdings Co., a California corporation, our wholly owned subsidiary holding company, which directly owns all of our current stores. “Yoshiharu Asset” refers to Yoshiharu Asset Co., a California corporation, our wholly owned subsidiary, which owns all our intellectual property assets. “Yoshiharu Franchise” refers to Yoshiharu Franchise Co., a California corporation, our wholly owned subsidiary, which will hold the master franchisor license.

| i |

We sometimes refer to our Class A common stock as “common stock,” unless the context otherwise requires. We sometimes refer to our Class A common stock and Class B common stock as “equity interests” when described on an aggregate basis. On all matters to be voted on by stockholders, holders of our Class A common stock are entitled to one vote per share while holders of our Class B common stock are entitled to 10 votes per share. Each share of Class B common stock is convertible into one share of Class A common stock at the option of the holder, upon transfer or in certain specified circumstances. With the exception of voting rights and conversion rights, holders of Class A and Class B common stock will have identical rights. The terms “dollar” or “$” refer to U.S. dollars, the lawful currency of the United States.

The Company’s fiscal year end is December 31. Our financial statements are prepared in U.S. dollars and in accordance with accounting principles generally accepted in the United States (“GAAP”).

NON-GAAP FINANCIAL MEASURES

Certain financial measures presented in this prospectus, such as EBITDA, Adjusted EBITDA, Restaurant-level Contribution and Restaurant-level Contribution margin are not recognized under GAAP. We define these terms as follows:

| ● | “EBITDA” is defined as net income before interest, income taxes and depreciation and amortization. | |

| ● | “Adjusted EBITDA” is defined as EBITDA plus stock-based compensation expense, non-cash rent expense and asset disposals, closure costs and restaurant impairments. | |

| ● | “Restaurant-level Contribution” is defined as operating income plus depreciation and amortization and general and administrative expenses. “Restaurant-level Contribution margin” is defined as Restaurant-level Contribution divided by sales. |

EBITDA, Adjusted EBITDA, Restaurant-level Contribution and Restaurant-level Contribution margin are intended as supplemental measures of our performance that are neither required by, nor presented in accordance with, GAAP. We are presenting EBITDA, Adjusted EBITDA, Restaurant-level Contribution and Restaurant-level Contribution margin because we believe that they provide useful information to management and investors regarding certain financial and business trends relating to our financial condition and operating results. Additionally, we present Restaurant-level Contribution because it excludes the impact of general and administrative expenses which are not incurred at the restaurant-level. We also use Restaurant-level Contribution to measure operating performance and returns from opening new restaurants.

We believe that the use of EBITDA, Adjusted EBITDA, Restaurant-level Contribution and Restaurant-level Contribution margin provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing the Company’s financial measures with those of comparable companies, which may present similar non-GAAP financial measures to investors. However, you should be aware that Restaurant-level Contribution and Restaurant-level Contribution margin are financial measures which are not indicative of overall results for the Company, and Restaurant-level Contribution and Restaurant-level Contribution margin do not accrue directly to the benefit of stockholders because of corporate-level expenses excluded from such measures. In addition, you should be aware when evaluating EBITDA, Adjusted EBITDA, Restaurant-level Contribution and Restaurant-level Contribution margin that in the future we may incur expenses similar to those excluded when calculating these measures. Our presentation of these measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Our computation of EBITDA, Adjusted EBITDA, Restaurant-level Contribution and Restaurant-level Contribution margin may not be comparable to other similarly titled measures computed by other companies, because all companies may not calculate EBITDA, Adjusted EBITDA, Restaurant-level Contribution and Restaurant-level Contribution margin in the same fashion.

Because of these limitations, EBITDA, Adjusted EBITDA, Restaurant-level Contribution and Restaurant-level Contribution margin should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. We compensate for these limitations by relying primarily on our GAAP results and using EBITDA, Adjusted EBITDA, Restaurant-level Contribution and Restaurant-level Contribution margin on a supplemental basis. For a reconciliation of net income to EBITDA and Adjusted EBITDA and a reconciliation of net restaurant operating income (loss) to Restaurant-level Contribution, see “Summary Historical Financial and Operating Data.”

| ii |

ADDITIONAL FINANCIAL MEASURES AND OTHER DATA

“Average Unit Volumes” or “AUVs” consist of the average annual sales of all restaurants that have been open for 3 months or longer at the end of the fiscal year presented. AUVs are calculated by dividing (x) annual sales for the fiscal year presented for all such restaurants by (y) the total number of restaurants in that base. We make fractional adjustments to sales for restaurants that were not open for the entire fiscal year presented (e.g., a restaurant is closed for renovation) to annualize sales for such period of time. This measurement allows management to assess changes in consumer spending patterns at our restaurants and the overall performance of our restaurant base. Since AUVs are calculated based on annual sales for the fiscal year presented, they are not presented in this prospectus on an interim basis for the nine months ended September 30, 2020 and 2021.

“Comparable restaurant sales growth” refers to the change in year-over-year sales for the comparable restaurant base. We include restaurants in the comparable restaurant base that have been in operation for at least 3 months prior to the start of the accounting period presented. Growth in comparable restaurant sales represents the percent change in sales from the same period in the prior year for the comparable restaurant base. For the fiscal years ended December 31, 2019 and December 31, 2020, there were 4 and 5 restaurants, respectively, in our comparable restaurant base. For the nine months ended September 30, 2020 and September 30, 2021, there were 5 and 6 restaurants, respectively, in our comparable restaurant base. This measure highlights performance of these mature restaurants, as the impact of new restaurant openings is excluded. The small number of restaurants in our comparable restaurant base may cause this measure to fluctuate and be unpredictable.

“Number of restaurant openings” reflects the number of restaurants opened during a particular reporting period. Before we open new restaurants, we incur pre-opening costs. New restaurants may not be profitable, and their sales performance may not follow historical patterns. The number and timing of restaurant openings has had, and is expected to continue to have, an impact on our results of operations.

“Average check” is defined as (x) sales, divided by (y) restaurant guest count for a given period of time. This is an indicator which management uses to analyze the dollars spent per guest in our restaurants and aids management in identifying trends in guest preferences and the effectiveness of menu changes and price increases.

| iii |

This summary highlights certain information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements and related notes included elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our securities. You should read this entire prospectus carefully, especially the matters set forth under the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of this prospectus and our financial statements and related notes appearing elsewhere in this prospectus, before making an investment decision. All figures are in U.S. dollars, unless otherwise stated.

Overview of Yoshiharu

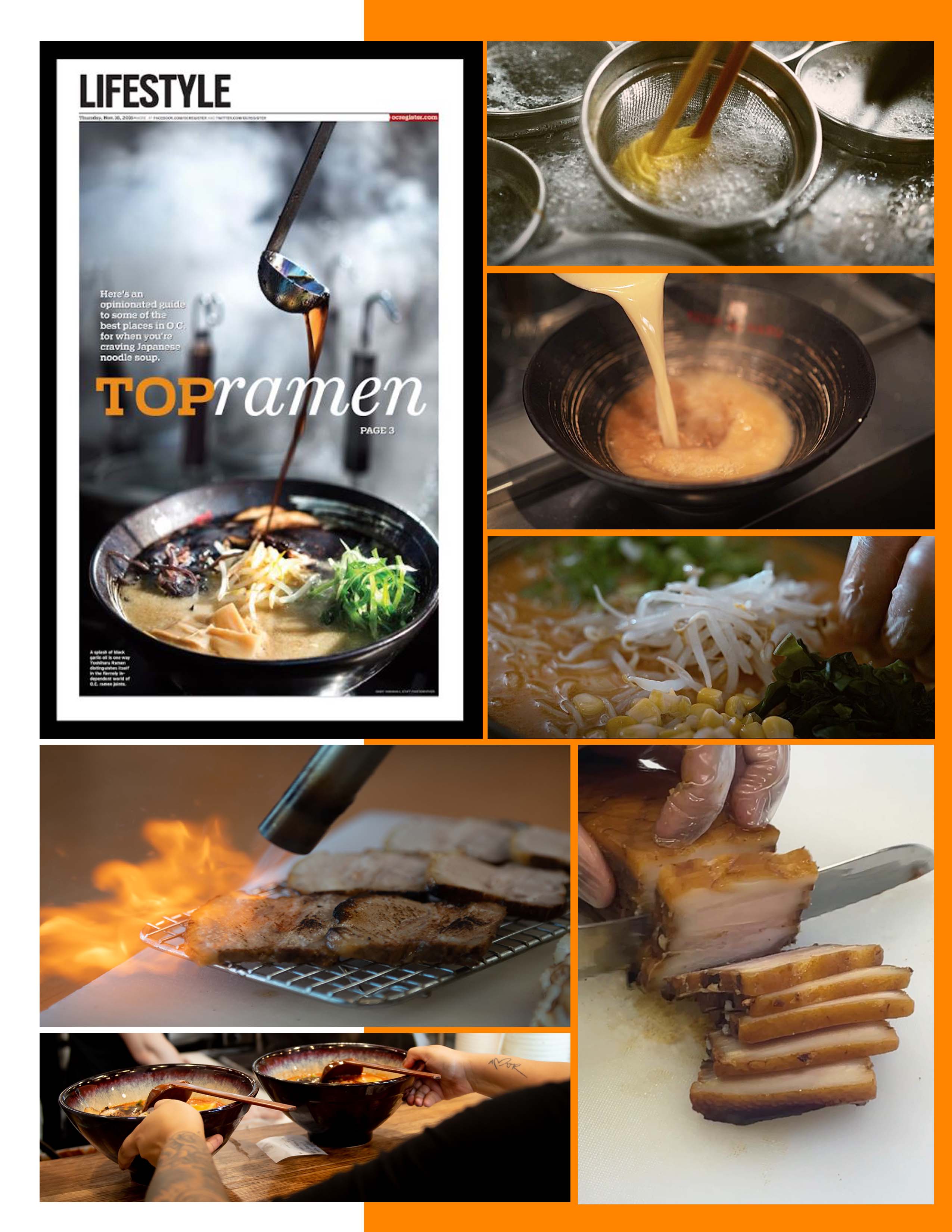

Yoshiharu is a fast-growing Japanese restaurant operator and was borne out the idea of introducing the modernized Japanese dining experience to customers all over the world. Specializing in authentic Japanese ramen, Yoshiharu gained recognition as a leading ramen restaurant in Southern California within six months of our 2016 debut and has continued to expand our top-notch restaurant service across Southern California, currently owning and operating 6 restaurant stores with an additional 3 in development and 8 expected to open in 2022.

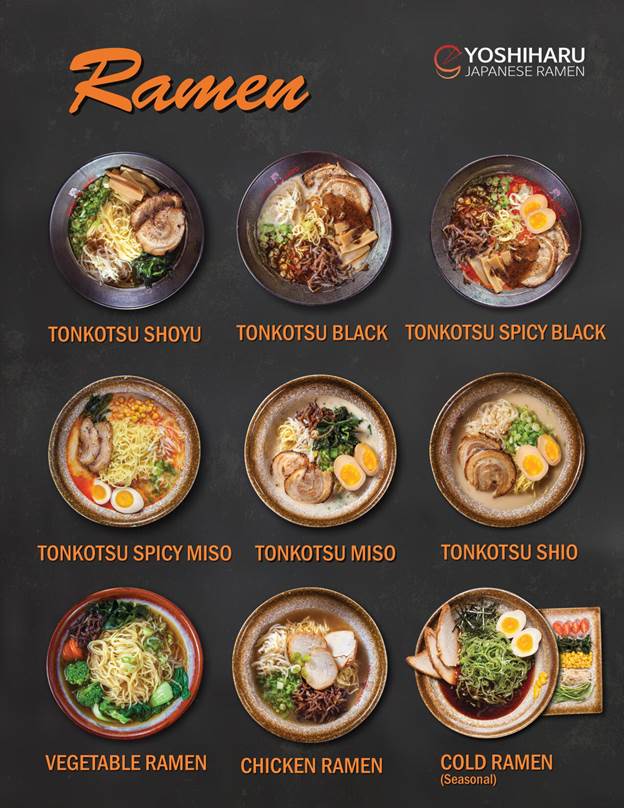

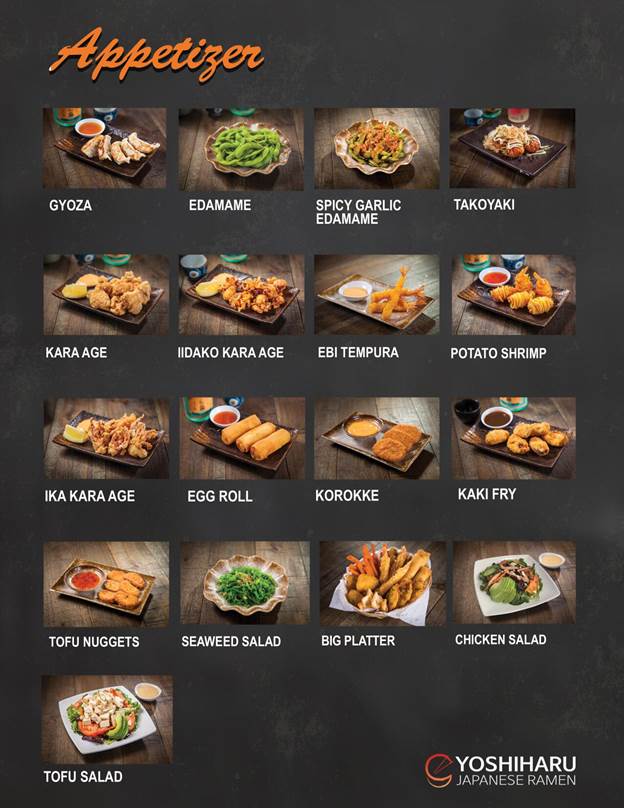

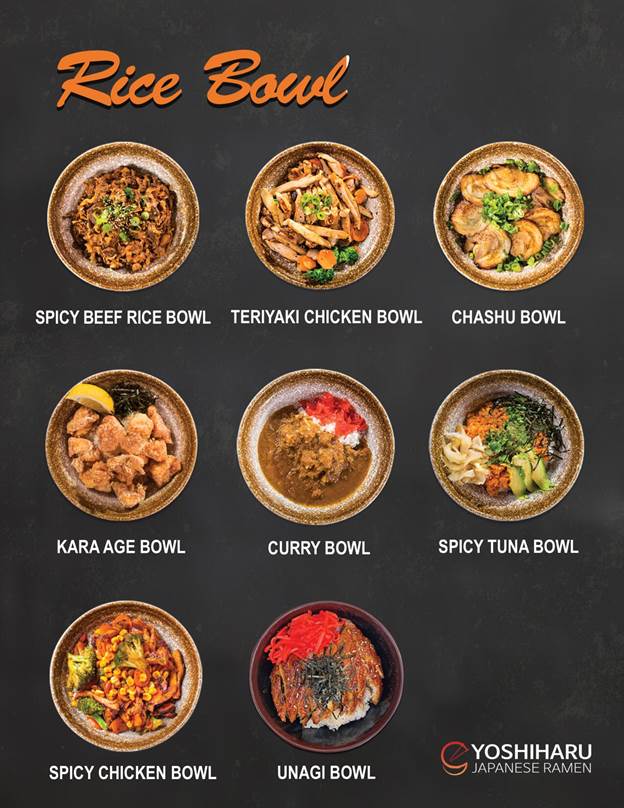

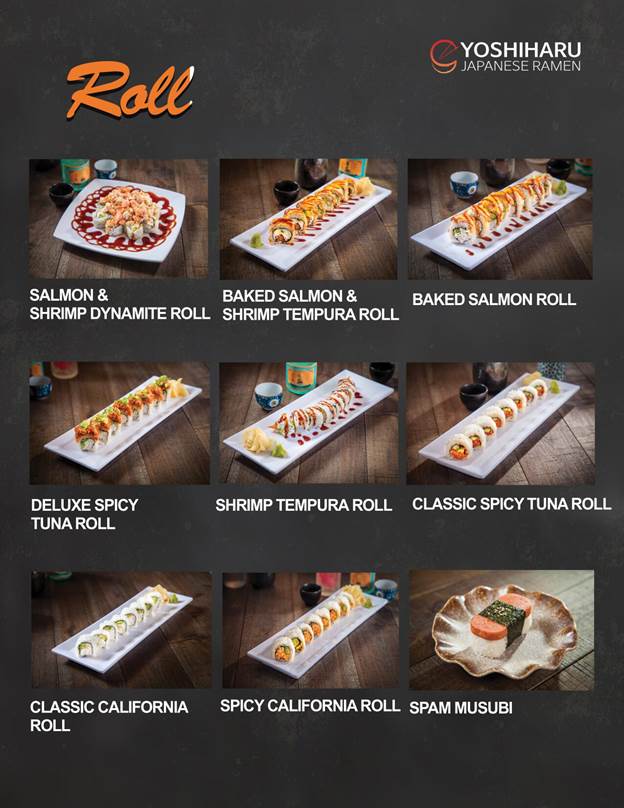

We take pride in our warm, hearty, smooth, and rich bone broth, which is slowly boiled for over 12 hours. Customers can taste and experience supreme quality and deep flavors. Combining the broth with the fresh, savory, and highest-quality ingredients, Yoshiharu serves the perfect, ideal ramen, as well as offers customers a wide variety of sushi, bento menu and other favorite Japanese cuisine. Our acclaimed signature Tonkotsu Black Ramen has become a customer favorite with its slow cooked pork bone broth and freshly made, tender chashu (braised pork belly).

Our mission is to bring ramen and Japanese cuisine to the mainstream, by providing a meal that customers find comforting. Since the inception of the business, we have been making our own ramen broth and other key ingredients such as pork chashu and flavored eggs from scratch, whereby upholding the quality and taste of our foods, including the signature texture and deep, rich flavor of our handcrafted broth. Moreover, we believe that slowly cooking the bone broth makes it high in collagen and rich in nutrients. Yoshiharu also strives to present food that is not only healthy, but also affordable. We feed, entertain and delight our customers, with our active kitchens and bustling dining rooms providing happy hours, student and senior discounts, and special holiday events. As a result of our vision, customers can comfortably enjoy our food in a friendly and welcoming atmosphere.

Our success has resulted in strong financial results as illustrated by the following:

| ● | Revenue grew from $1.9 million for the nine months ended September 30, 2020, to $4.4 million for the nine months ended September 30, 2021. | |

| ● | We continue to accelerate the pace of new “corporate-owned” (i.e., directly owned by us) restaurant openings and expect to operate over 14 corporate-owned locations by year end 2022. | |

| ● | We operate in a large and rapidly growing market. We believe the consumer appetite for Asian cuisine is widespread across many demographics and have an opportunity to expand in both existing and new U.S. markets, as well as internationally. In 2022, we expect to open 8 new corporate-owned restaurants by utilizing approximately 25% of the net proceeds of this offering. Based on our experience and our internal analysis, we believe that over the long-term we have the potential to grow our current domestic corporate-owned restaurants and international footprint to at least 250 restaurants domestically and at least 750 restaurants internationally by opening corporate-owned restaurants in new and existing markets. The rate of future restaurant growth in any particular period is inherently uncertain and is subject to numerous factors that are outside of our control. As a result, we do not currently have an anticipated timeframe for such expansion. | |

| ● | Yoshiharu is in the process of registering its franchise program (which it expects to be complete by the end of 2022), and once that is complete, we plan on providing franchisee opportunities to open both domestically and internationally. In the U.S., we believe there is a potential to open 20 stores per year by franchisees. Globally, we are also exploring the idea of granting country-wide exclusivity to franchisees, which we believe will help expand our global footprint considerably. As of the date of this prospectus, we do not have a franchise program. | |

| ● | Average sales per guest is moderate and increasing. During the year ended December 31, 2019, the average sales per guest in our stores was $13.51, which grew 15.4% to $15.59 during the year ended December 31, 2020. For the nine months ended September 30, 2021, average sales per guest in our restaurants was $15.74. The Company has suffered recurring losses from operations and has a significant accumulated deficit. During the audited years ended December 31, 2019 and December 31, 2020, and the nine month period ended September 30, 2021, the Company had net loss of $134,125, $450,128 and $42,968, respectively. In addition, the Company continues to experience negative cash flow from operations and has a significant accumulated deficit, which was $2,586,790 at September 30, 2021. These factors raise a substantial doubt about the Company’s ability to continue as a going concern, and our independent registered public accounting firm has included a going concern uncertainty explanatory paragraph in their report dated December 15, 2021. | |

| ● | Our flexible physical footprint, which has allowed us to open restaurants in size ranging from 1,500 to 2,500 square feet, allows us to open in-line and end-cap restaurant formats at strip malls and shopping centers and penetrate markets in both suburban and urban areas. |

| 1 |

Our Strengths

Experienced Management Team Dedicated to Growth.

Our team is led by experienced and passionate senior management who are committed to our mission. We are led by our Chief Executive Officer, James Chae. Mr. Chae founded Yoshiharu in 2016 and leads a team of talented professionals with deep financial, operational, culinary, and real estate experience.

Compelling Value Proposition with Broad Appeal.

Guests can enjoy our signature ramen dishes or select from our variety of fresh sushi, bento, and other Japanese cuisine. The high-quality dishes at affordable prices are the result of our efficient operations. In addition, we believe our commitment to high-quality and fresh ingredients in our food is at the forefront of current dining trends as customers continue to seek healthy food options.

Attractive Restaurant-Level Economics.

At Yoshiharu, we believe our rapid table turnover, combined with our ability to service customers at both lunch and dinner, allows for robust and efficient sales in each of our restaurants. Our average unit volume (“AUV”, as defined herein) was $1.1 million in 2019 and $0.9 million in 2020.

Quality of Food and Excellence in Customer Service.

We place a premium on serving high quality authentic Japanese cuisine. We believe in customer convenience and satisfaction and have created strong, loyal and repeat customers who help expand the Yoshiharu network to their friends, family and co-workers.

Flexibility to Pivot to Online and Delivery.

With the COVID-19 pandemic, we were able to efficiently transition from primarily in-store sales to a diversified mix of channels including takeout and delivery. As our customers habits adapt post-pandemic, we intend to invest further in our delivery and takeout programs, which currently rely on third-party providers. Yoshiharu’s ramen and Japanese cuisine is ideally suited for to-go packaging and transport. Due to our flexibility in pivoting to online and delivery, and we achieved out-of-store sales of $1.2 million for the nine months ended September 30, 2021, compared to $815,301 for the nine months ended September 30, 2020, or a growth rate of over 42.5%.

Our Growth Strategies

Pursue New Restaurant Development.

We have pursued a disciplined new corporate owned growth strategy. Having expanded our concept and operating model across varying restaurant sizes, we plan to leverage our expertise opening new restaurants to fill in existing markets and expand into new geographies. While we currently aim to achieve in excess of 100% annual unit growth rate over the next several years, we cannot predict the time period of which we can achieve any level of restaurant growth or whether we will achieve this level of growth at all. Our ability to achieve new restaurant growth is impacted by a number of risks and uncertainties beyond our control, including those described under the caption “Risk Factors.” In particular, see “Risk Factors—Our long-term success is highly dependent on our ability to successfully identify and secure appropriate sites and timely develop and expand our operations in existing and new markets” for specific risks that could impede our ability to achieve new restaurant growth in the future. We believe there is a significant opportunity to employ this strategy to open additional restaurants in our existing markets and in new markets with similar demographics and retail environments.

| 2 |

Deliver Consistent Comparable Restaurant Sales Growth.

We have achieved positive comparable restaurant sales growth in recent periods. We believe we will be able to generate future comparable restaurant sales growth by growing traffic through increased brand awareness, consistent delivery of a satisfying dining experience, new menu offerings, and restaurant renovations. We will continue to manage our menu and pricing as part of our overall strategy to drive traffic and increase average check. We are also exploring initiatives to grow sales of alcoholic beverages at our restaurants, including the potential of a larger format restaurant with a sake bar concept.

Franchise Program Development.

We expect to initiate sales of franchises beginning in 2022. We expect to submit an application for franchise registration in California, and we intend to submit franchise applications in additional states in the first half of 2022. While our initial franchise development will focus on the United States, we also believe the Yoshiharu concept will attract future franchise partners around the world.

Increase Profitability.

We have invested in our infrastructure and personnel, which we believe positions us to continue to scale our business operations. As we continue to grow, we expect to drive higher profitability by taking advantage of our increasing buying power with suppliers and leveraging our existing support infrastructure. Additionally, we believe we will be able to optimize labor costs at existing restaurants as our restaurant base matures and AUVs increase. We believe that as our restaurant base grows, our general and administrative costs will increase at a slower rate than our sales.

Heighten Brand Awareness.

We intend to continue to pursue targeted local marketing efforts and plan to increase our investment in advertising. We also are exploring the development of instant ramen noodles which we would distribute through retail channels. We intend to explore partnerships with grocery retailers to provide for small-format Yoshiharu kiosks in stores to promote a limited selection of Yoshiharu cuisine.

COVID-19 Impact on Our Business

The COVID-19 pandemic has significantly impacted health and economic conditions throughout the United States and globally, as public concern about becoming ill with the virus has led to the issuance of recommendations and/or mandates from federal, state, and local authorities to practice social distancing or self-quarantine. We have experienced significant disruptions to our business due to the COVID-19 pandemic and related suggested and mandated social distancing and shelter-in-place orders. The Company felt direct impact through reduced revenues through periods of time in 2020 and 2021 when restaurant locations were forced into closure or into limited capacities. Revenues were $3.2 million for the year ended December 31, 2020, compared to $4.1 million for the year ended December 31, 2019. The three restaurant locations that were open through all of 2020 each experienced significant sales declines. Combined average monthly sales for these locations decreased 36.8% for the year ended December 31, 2020. The Company attempted to mitigate the impact of reduced inside dining through expansion of food delivery operations during the pandemic affected periods. The Company intends to continue selling through these delivery channels, even with a return to full capacity inside dining. Revenues were $4.4 million for the nine months ended September 30, 2021, compared to $1.9 million for the nine months ended September 30, 2020, so the Company has already experienced significant recovery from the impact of the pandemic on customer traffic during 2020. The combined average monthly sales for the 4 restaurant locations that were open through all of 2020 increased 71.7% for the nine-month period ended September 30, 2021, from the comparable period in the prior year.

The Company obtained substantial amounts of funding available through government entities as assistance to maintain operations and, in particular, to maintain staffing levels through periods of reduced operations as a result of the pandemic. The Company received approximately $659,000 in Paycheck Protection Program (“PPP”) loans, $450,000 in Economic Injury Disaster (“EIDL”) loans and $750,000 in Restaurant Revitalization Fund (“RRF”) loans. These funds are all in the form of loans to be repaid over time, including interest, and have been reported within the Company’s balance sheets as such. However, the PPP and RRF loans allow for loan forgiveness if the Company meets certain criteria and submits applications for forgiveness along with supporting documentation. To date, the Company has been awarded forgiveness for approximately $273,000 of PPP loans, plus all accrued interest. This forgiveness was reported as Other Income for the nine months ended September 30, 2021. The Company does anticipate applying for additional forgiveness as allowed.

Corporate Overview

Corporate Reorganization

In December 2021, Yoshiharu Holdings was formed by James Chae as an S corporation for the purpose of acquiring all of the equity in each of the 6 restaurant store entities which were previously founded and wholly owned directly by James Chae in exchange for an issuance of 10,000,000 shares to James Chae, which constituted all of the issued and outstanding equity in Yoshiharu Holdings Co.

Yoshiharu Global Co. was incorporated on December 9, 2021 in Delaware by James Chae for purposes of effecting this offering. On December 9, 2021, James Chae contributed 100% of the equity in Yoshiharu Holdings Co. to Yoshiharu Global Co. in exchange for the issuance by Yoshiharu Global Co. of 9,450,900 shares of Class A common stock to James Chae. On December 10, 2021, the Company redeemed 670,000 shares of Class A common stock from James Chae at par ($0.0001 per share). In December 2021, the Company conducted a private placement solely to accredited investors and sold 670,000 shares of Class A common stock at $2.00 per share, which the Company’s board of directors determined to reflect the then current fair market value of the Company’s Class A common stock. The Company shall exchange 1,000,000 shares held by James Chae into 1,000,000 shares of Class B common stock immediately prior to the execution of the underwriting agreement.

Following the closing of this offering, James Chae will own all of our Class B common stock (1,000,000 shares) and 7,110,900 shares of our Class A common stock, representing approximately 74.4% of the combined voting power of our outstanding capital stock, or 72.3% if the underwriters exercise their option to purchase additional units and will have the ability to determine all matters requiring approval by stockholders. See “Risk Factors- Risks Related to our Organizational Structure” and “Principal Stockholders.” As a result, we will be a “controlled company” within the meaning of the corporate governance rules of the Nasdaq Stock Market.

On all matters to be voted on by stockholders, holders of our Class A common stock are entitled to one vote per share while holders of our Class B common stock are entitled to 10 votes per share. Each share of Class B common stock is convertible into one share of Class A common stock at the option of the holder, upon transfer or in certain specified circumstances. With the exception of voting rights and conversion rights, holders of Class A and Class B common stock will have identical rights. We do not intend to list Class B common stock on any stock exchange.

| 3 |

Corporate and other information.

Our offices are located at 6940 Beach Blvd. Suite D-705, Buena Park, CA 90621. Our website is www.yoshiharuramen.com and our telephone number is (714) 694-2400. We expect to make our periodic reports and other information filed with or furnished to the Securities and Exchange Commission, or the SEC, available free of charge through our website as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on, or otherwise accessible through, our website or any other website is not incorporated by reference herein and does not constitute a part of this prospectus. You should not consider information contained on our website to be part of this prospectus or in deciding whether to purchase shares of our Class A common stock or warrants.

Risk Factors Summary

Investing in our securities involves significant risks. You should carefully consider the risks described in “Risk Factors” before making a decision to invest in our securities. If any of these risks actually occur, our business, financial condition and results of operations would likely be materially adversely affected. In such case, the trading price of our securities would likely decline, and you may lose all or part of your investment. In reviewing this prospectus, we stress that past experience is no indication of future performance, and “Special Note Regarding Forward-Looking Statements” contains a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this prospectus. Below is a summary of some of the significant risks we face:

| ● | we may not be able to successfully implement our growth strategy if we are unable to identify appropriate sites for restaurant locations, expand in existing and new markets, obtain favorable lease terms, attract guests to our restaurants or hire and retain personnel; | |

| ● | we may not be able to maintain or improve our comparable restaurant sales growth; | |

| ● | the restaurant industry is a highly competitive industry with many competitors; | |

| ● | our limited number of restaurants, the significant expense associated with opening new restaurants, and the unit volumes of our new restaurants makes us susceptible to significant fluctuations in our results of operations; | |

| ● | we have incurred operating losses and may not be profitable in the future. Our plans to maintain and increase liquidity may not be successful; | |

| ● | we depend on our senior management team and other key employees, and the loss of one or more key personnel or an inability to attract, hire, integrate and retain highly skilled personnel could have an adverse effect on our business, financial condition or results of operations; | |

| ● | our operating results and growth strategies will be closely tied to the success of our future franchise partners and we will have limited control with respect to their operations; | |

| ● | we may face negative publicity or damage to our reputation, which could arise from concerns regarding food safety and foodborne illness or other matters; | |

| ● | minimum wage increases and mandated employee benefits could cause a significant increase in our labor costs; | |

| ● | events or circumstances could cause the termination or limitation of our rights to certain intellectual property critical to our business that is licensed from Yoshiharu Asset Co., or we could face infringements on our intellectual property rights and be unable to protect our brand name, trademarks and other intellectual property rights; | |

| ● | challenging economic conditions may affect our business by adversely impacting numerous items that include, but are not limited to: consumer confidence and discretionary spending, the future cost and availability of credit and the operations of our third-party vendors and other service providers; | |

| ● | we, or our point of sale and restaurant management platform partners, may fail to secure guests’ confidential, personally identifiable, debit card or credit card information or other private data relating to our employees or us; | |

| ● | we will face increased costs as a result of being a public company; and | |

| ● | the impact of the COVID-19 pandemic, or a similar public health threat, on global capital and financial markets, general economic conditions in the United States, and our business and operations. |

| 4 |

Emerging Growth Company Status

We are an “emerging growth company” as defined in the JOBS Act. For as long as we are an emerging growth company, unlike other public companies that do not meet those qualifications, we are not required to:

| ● | provide an auditor’s attestation report on management’s assessment of the effectiveness of our system of internal control over financial reporting pursuant to Section 404(b) of Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act; | |

| ● | provide more than two years of audited financial statements and related management’s discussion and analysis of financial condition and results of operations in a registration statement on Form S-1; | |

| ● | comply with any new requirements adopted by the Public Company Accounting Oversight Board, or the PCAOB, requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; | |

| ● | provide certain disclosure regarding executive compensation required of larger public companies or hold shareholder advisory votes on executive compensation required by the Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act; or | |

| ● | obtain shareholder approval of any golden parachute payments not previously approved. |

We will cease to be an “emerging growth company” upon the earliest of:

| ● | the last day of the fiscal year in which we have $1.07 billion or more in annual gross revenues; | |

| ● | the date on which we become a “large accelerated filer” (which means the year-end at which the total market value of our common equity securities held by non-affiliates is $700 million or more as of the last business day of our most recently completed second fiscal quarter); | |

| ● | the date on which we have issued more than $1 billion of non-convertible debt securities over a three-year period; and | |

| ● | the last day of the fiscal year following the fifth anniversary of our initial public offering. |

In addition, Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”), for complying with new or revised accounting standards, but we have irrevocably opted out of the extended transition period and, as a result, we will adopt new or revised accounting standards on the relevant dates in which adoption of such standards is required for other public companies.

| 5 |

THE OFFERING

| Units offered | 4,000,000 units (or 4,600,000 units, if the underwriters exercise in full their option to purchase additional units), each unit consisting of one Class A common share and one warrant to purchase one Class A common share. | |

| Class A common stock outstanding before the offering | 9,000,000 shares. | |

| Class A common stock outstanding after the offering | 13,000,000 shares (or 13,600,000 shares if the underwriters exercise their option to purchase additional shares of Class A common stock in full). | |

| Class B common stock outstanding after the offering | 1,000,000 shares. | |

| Over-allotment option | We have granted to the underwriters a 45-day option to purchase from us up to an additional 15% of the shares of Class A common stock and/or warrants sold in the offering in any combination thereof, solely to cover over-allotments, if any, at the initial public offering price, less the underwriting discounts. | |

| Representative’s warrants | We have agreed to issue to the representative of the several underwriters warrants to purchase the number of shares of Class A common stock in the aggregate equal to 5% of the shares of Class A common stock to be issued and sold in this offering (including any shares of Class A common stock sold upon exercise of the over-allotment option). The warrants are exercisable for a price per share equal to 125% of the public offering price. The warrants are exercisable at any time and from time to time, in whole or in part, during the four-and-a-half-year period commencing six (6) months from the date of commencement of sales of the offering. | |

| Use of proceeds | We expect to receive approximately $16,380,000 of the net proceeds from this offering (assuming an initial public offering price of $4.50 per unit, which is the midpoint of the price range set forth on the cover of this prospectus) from the sale of the units offered by us (or approximately $18,837,000 if the underwriters exercise in full their option to purchase additional units) after deducting underwriter discounts and commissions and estimated offering expenses payable by us. Each $1.00 change in the assumed initial public offering price would change our net proceeds by approximately $3,640,000 after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. | |

| We intend to use the net proceeds we receive from this offering to fund our expansion and development of new corporate-owned locations, expand our distribution capabilities, develop our franchise program and for general corporate purposes. See “Use of Proceeds”. |

| 6 |

| Voting rights | Each share of Class A common stock will entitle its holder to one vote on all matters to be voted on by stockholders generally.

James Chae will hold all of the outstanding shares of our Class B common stock and will also hold 7,110,900 shares of our Class A common stock. Each share of Class B common stock will entitle its holder to 10 votes on all matters to be voted on by stockholders generally. Upon completion of this offering, we will be controlled by James Chae, which will hold approximately 74.4% of the combined voting power of our outstanding Class A common stock and Class B common stock, or approximately 72.3% if the underwriters exercise their option to an additional 15% of the shares of Class A common stock and/or warrants sold in the offering in any combination thereof. | |

| Holders of our Class A common stock and Class B common stock will generally vote together as a single class, unless otherwise required by applicable law or our amended and restated certificate of incorporation. See “Description of Securities” for more information. | ||

| Conversion rights | Our Class B common stock is convertible as follows: |

| ● | at such time as any shares of Class B common stock cease to be beneficially owned by James Chae, such shares of Class B common stock will be automatically converted into shares of Class A common stock on a one-for-one basis; | |

| ● | all of the Class B common stock will automatically convert into Class A common stock on a one-for-one basis on such date when the number of shares of Class A and Class B common stock beneficially owned by James Chae represents less than 25% of the total number of shares of Class A and Class B common stock outstanding as set forth in the share exchange agreement; and | |

| ● | at the election of the holder of Class B common stock, any share of Class B common stock may be converted into one share of Class A common stock. |

| Controlled company | Following this offering we will be a “controlled company” within the meaning of the corporate governance rules of the Nasdaq Stock Market. See “Risk Factors—Risks Related to Our Organizational Structure” and “Management—Controlled Company.” | |

| Lock-up | We, all of our directors and officers and all of our existing shareholders have agreed with the underwriters, subject to certain exceptions, not to sell, transfer or dispose of, directly or indirectly, any of our Class A common stock, Class B common stock or securities convertible into or exercisable or exchangeable for our Class A or Class B common stock for a period of 12 months after the date of the final prospectus. See “Underwriting” for more information. | |

| Dividend policy | We do not anticipate paying any cash dividends to holders of our Class A common stock or Class B common stock in the foreseeable future. See “Dividend Policy” for additional information. |

| 7 |

| Risk factors | See “Risk Factors” for a discussion of factors that you should consider carefully before deciding whether to purchase shares of our securities. | |

| Proposed Nasdaq Capital Market symbols | In connection with this offering, we have filed an application to list our shares of Class A common stock under the symbol “YOSH” and our warrants under the symbol “YOSHW,” both on the Nasdaq Capital Market. We do not intend that the units trade and we will not apply for listing of the units on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the units will be limited. The closing of this offering is contingent upon the successful listing of our common stock and warrants on the Nasdaq Capital Market. |

The number of Class A common stock and Class B common stock to be outstanding after this offering is based on 9,000,000 shares of Class A common stock and 1,000,000 shares of Class B common stock outstanding as of , 2022.

Except as otherwise indicated, the number of Class A common stock and Class B common stock to be outstanding after this offering referred to above and all other information in this prospectus:

| ● | assumes the effectiveness of our certificate of incorporation and bylaws included as exhibits to the registration statement of which this prospectus forms a part, which we will adopt prior to the completion of this offering; | |

| ● | assumes no exercise by the underwriters of their over-allotment option to purchase up to 600,000 additional shares of Class A common stock and/or warrants from us at an initial public offering price of $4.50 per unit, which represents the midpoint of the price range set forth on the cover of this prospectus; | |

| ● | excludes [500,000] shares of common stock reserved for issuance under the [Yoshiharu Global Co. 2022 Equity Incentive Plan]; and | |

| ● | excludes shares of common stock issuable upon the exercise of warrants and the representative’s warrants. |

| 8 |

SUMMARY HISTORICAL FINANCIAL AND OPERATING DATA

The following table summarizes our historical financial and operating data for the periods and as of the dates indicated. The statements of income data for the fiscal years ended December 31, 2019 and December 31, 2020 and the balance sheet data as of December 31, 2019 and December 31, 2020 have been derived from our audited financial statements included elsewhere in this prospectus. The statements of income data for the nine months ended September 30, 2020 and September 30, 2021 and the balance sheet data as of September 30, 2021 have been derived from our unaudited interim financial statements included elsewhere in this prospectus. The financial data presented includes all normal and recurring adjustments that we consider necessary for a fair presentation of the financial position and results of operations for such periods.

The historical results presented below are not necessarily indicative of the results to be expected for any future period. This information should be read in conjunction with “Risk Factors,” “Selected Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited financial statements and unaudited interim financial statements and the related notes included elsewhere in this prospectus.

| Years Ended December 31, | Nine months ended September 30, | |||||||||||||||

| 2020 | 2019 | 2021 | 2020 | |||||||||||||

| Revenue: | ||||||||||||||||

| Food and beverage | $ | 3,170,925 | $ | 4,058,739 | $ | 4,449,354 | $ | 1,918,930 | ||||||||

| Total revenue | 3,170,925 | 4,058,739 | 4,449,354 | 1,918,930 | ||||||||||||

| Restaurant operating expenses: | ||||||||||||||||

| Food, beverages and supplies | 903,313 | 1,533,959 | 1,344,672 | 909,670 | ||||||||||||

| Labor | 1,542,796 | 1,241,075 | 1,999,084 | 1,075,751 | ||||||||||||

| Rent and utilities | 437,972 | 504,430 | 465,677 | 280,837 | ||||||||||||

| Delivery and service fees | 245,163 | 219,412 | 384,050 | 183,477 | ||||||||||||

| Depreciation | 114,478 | 102,416 | 94,294 | 83,181 | ||||||||||||

| Total restaurant operating expenses | 3,243,722 | 3,601,292 | 4,287,777 | 2,532,916 | ||||||||||||

| Net operating restaurant operating income | (72,797 | ) | 457,447 | 161,577 | (613,986 | ) | ||||||||||

| Operating expenses: | ||||||||||||||||

| General and administrative | 330,739 | 501,192 | 428,926 | 324,416 | ||||||||||||

| Advertising and marketing | 30,054 | 20,721 | 12,437 | 33,868 | ||||||||||||

| Total operating expenses | 360,793 | 521,913 | 441,363 | 358,284 | ||||||||||||

| Loss from operations | (433,590 | ) | (64,466 | ) | (279,786 | ) | (972,270 | ) | ||||||||

| Other income (expense): | ||||||||||||||||

| PPP loan forgiveness | - | - | 269,887 | - | ||||||||||||

| Other income | 53,929 | 16,934 | 25,000 | 40,718 | ||||||||||||

| Interest | (51,590 | ) | (64,036 | ) | (44,145 | ) | (73,356 | ) | ||||||||

| Total other income (expense) | 2,339 | (47,102 | ) | 250,742 | (32,638 | ) | ||||||||||

| Income before income taxes | (431,251 | ) | (111,568 | ) | (29,044 | ) | (1,004,908 | ) | ||||||||

| Income tax provision | 18,877 | 22,557 | 13,924 | 9,978 | ||||||||||||

| Net loss | $ | (450,128 | ) | $ | (134,125 | ) | $ | (42,968 | ) | $ | (1,014,886 | ) | ||||

| Loss per share: | ||||||||||||||||

| Basic and diluted | $ | (0.36 | ) | $ | (0.13 | ) | $ | (0.01 | ) | $ | (0.84 | ) | ||||

| Weighted average number of common shares outstanding: | ||||||||||||||||

| Basic and diluted | 1,236,836 | 1,035,959 | 3,131,740 | 1,205,000 | ||||||||||||

| 9 |

| As of December 31, | As of September 30, | |||||||||||

| 2020 | 2019 | 2021 | ||||||||||

| Cash | $ | - | $ | 78,117 | $ | 53,299 | ||||||

| Total assets | $ | 3,014,424 | $ | 2,134,165 | $ | 4,791,007 | ||||||

| Total liabilities | $ | 4,385,804 | $ | 2,450,223 | $ | 6,901,426 | ||||||

| Total stockholders’ deficit | $ | (1,371,380 | ) | $ | (316,058 | ) | $ | (2,110,419 | ) | |||

| Years Ended December 31, | Nine months ended September 30, | |||||||||||||||

| 2020 | 2019 | 2021 | 2020 | |||||||||||||

| Key Financial and Operational Metrics | ||||||||||||||||

| Restaurants at the end of period | 5 | 4 | 6 | 5 | ||||||||||||

| Average unit volumes (1) | $ | 904,745 | $ | 1,091,364 | N/A | N/A | ||||||||||

| Comparable restaurant sales growth (2) | -29.3 | % | 7.4 | % | 63.4 | % | 32.3 | % | ||||||||

| EBITDA (3) | (265,183 | ) | 54,884 | 109,395 | (848,371 | ) | ||||||||||

| Adjusted EBITDA (3) | (265,183 | ) | 54,884 | (167,318 | ) | (848,371 | ) | |||||||||

| as a percentage of sales | -8.4 | % | 1.4 | % | -3.8 | % | -44.2 | % | ||||||||

| Operating income | (433,590 | ) | (64,466 | ) | (279,786 | ) | (972,270 | ) | ||||||||

| Operating profit margin | -13.7 | % | -1.6 | % | -6.3 | % | -50.7 | % | ||||||||

| Restaurant-level Contribution (3) | 41,681 | 559,863 | 255,871 | (530,805 | ) | |||||||||||

| Restaurant-level Contribution Margin (3) | 1.3 | % | 13.8 | % | 5.8 | % | -27.7 | % | ||||||||

| (1) | Average Unit Volumes (AUVs) consist of the average annual sales of all restaurants that have been open for 3 months or longer at the end of the fiscal year presented. The AUVs measure has been adjusted for restaurants that were not open for the entire fiscal year presented (such as a restaurant closed for renovation) to annualize sales for such period of time. Since AUVs are calculated based on annual sales for the fiscal year presented, they are not shown on an interim basis for the nine-months ended September 30, 2020 and 2021. See “Additional Financial Measures and Other Data” for the definition of AUVs. | |

| (2) | Comparable restaurant sales growth represents the change in year-over-year sales for restaurants open for at least 3 months prior to the start of the accounting period presented, including those temporarily closed for renovations during the year. The comparable restaurant sales growth measure is calculated excluding the West Hollywood and Lynwood, California restaurants, which closed in fiscal year 2019 due to under performance. | |

| (3) | EBITDA, Adjusted EBITDA, Restaurant-level Contribution and Restaurant-level Contribution margin are intended as supplemental measures of our performance that are neither required by, nor presented in accordance with, GAAP. We are presenting EBITDA, Adjusted EBITDA, Restaurant-level Contribution and Restaurant-level Contribution margin because we believe that they provide useful information to management and investors regarding certain financial and business trends relating to our financial condition and operating results. Additionally, we present Restaurant-level Contribution because it excludes the impact of general and administrative expenses which are not incurred at the restaurant-level. We also use Restaurant-level Contribution to measure operating performance and returns from opening new restaurants. |

| 10 |

The following table presents a reconciliation of net income to EBITDA and Adjusted EBITDA:

| Years Ended December 31, | Nine months ended September 30, | |||||||||||||||

| 2020 | 2019 | 2021 | 2020 | |||||||||||||

| Net loss, as reported | $ | (450,128 | ) | $ | (134,125 | ) | $ | (42,968 | ) | $ | (1,014,886 | ) | ||||

| Interest, net | 51,590 | 64,036 | 44,145 | 73,356 | ||||||||||||

| Taxes | 18,877 | 22,557 | 13,924 | 9,978 | ||||||||||||

| Depreciation and amortization | 114,478 | 102,416 | 94,294 | 83,181 | ||||||||||||

| EBITDA | (265,183 | ) | 54,884 | 109,395 | (848,371 | ) | ||||||||||

| PPP loan forgiveness (a) | - | - | (276,713 | ) | - | |||||||||||

| Adjusted EBITDA | $ | (265,183 | ) | $ | 54,884 | $ | (167,318 | ) | $ | (848,371 | ) | |||||

| (a) | Represents income recorded upon the forgiveness of payroll protection loans from the SBA. |

The following table presents a reconciliation of net restaurant operating income (loss) to Restaurant-level Contribution:

| Years Ended December 31, | Nine months ended September 30, | |||||||||||||||

| 2020 | 2019 | 2021 | 2020 | |||||||||||||

| Net restaurant operating income (loss), as reported | $ | (72,797 | ) | $ | 457,447 | $ | 161,577 | $ | (613,986 | ) | ||||||

| Depreciation and amortization | 114,478 | 102,416 | 94,294 | 83,181 | ||||||||||||

| Restaurant-level Contribution | $ | 41,681 | $ | 559,863 | $ | 255,871 | $ | (530,805 | ) | |||||||

| Operating profit margin | -13.7 | % | -1.6 | % | -6.3 | % | -50.7 | % | ||||||||

| Restaurant-level Contribution Margin | 1.3 | % | 13.8 | % | 5.8 | % | -27.7 | % | ||||||||

| 11 |

An investment in our Class A common stock and warrants, which we refer to in this prospectus as our “securities,” involves a high degree of risk. You should carefully consider the risks and uncertainties described below before deciding whether to purchase shares of our Class A common stock. In assessing these risks, you should also refer to the other information contained in this prospectus, including our financial statements and related notes. If any of the risks described below actually occur, our business, financial condition or results of operations could be materially adversely affected. In any such case, the trading price of our Class A common stock or warrants could decline and you could lose all or part of your investment. The risks below are not the only risks we face. Additional risks and uncertainties not currently known to us or those we currently view to be immaterial also may materially and adversely affect our business, properties, operating results or financial condition.

Risks Related to Our Business and Industry

Our long-term success is highly dependent on our ability to successfully identify and secure appropriate sites and timely develop and expand our operations in existing and new markets.

One of the key means of achieving our growth strategies will be through opening and operating new restaurants on a profitable basis for the foreseeable future. We opened one new restaurant in fiscal year 2019 and one new restaurant in fiscal year 2020 by utilizing approximately 25% of the net proceeds of this offering. We have opened one new restaurant in fiscal year 2021. We currently have 3 locations under construction, and we expect to open an additional 8 new restaurants (4 of which have been identified) in fiscal year 2022. We identify target markets where we can enter or expand, taking into account numerous factors such as the locations of our current restaurants, demographics, traffic patterns and information gathered from various sources. We may not be able to open our planned new restaurants within budget or on a timely basis, if at all, given the uncertainty of these factors, which could adversely affect our business, financial condition and results of operations. As we operate more restaurants, our rate of expansion relative to the size of our restaurant base will eventually decline.

The number and timing of new restaurants opened during any given period may be negatively impacted by a number of factors including, without limitation:

| ● | identification and availability of locations with the appropriate size, traffic patterns, local retail and business attractions and infrastructure that will drive high levels of guest traffic and sales per unit; | |

| ● | competition in existing and new markets, including competition for restaurant sites; | |

| ● | the ability to negotiate suitable lease terms; | |

| ● | the lack of development and overall decrease in commercial real estate due to a macroeconomic downturn; | |

| ● | recruitment and training of qualified personnel in the local market; | |

| ● | our ability to obtain all required governmental permits, including zonal approvals, on a timely basis; | |

| ● | our ability to control construction and development costs of new restaurants; | |

| ● | landlord delays; | |

| ● | the proximity of potential sites to an existing restaurant, and the impact of cannibalization on future growth; | |

| ● | anticipated commercial, residential and infrastructure development near our new restaurants; and | |

| ● | the cost and availability of capital to fund construction costs and pre-opening costs. |

| 12 |

Accordingly, we cannot assure you that we will be able to successfully expand as we may not correctly analyze the suitability of a location or anticipate all of the challenges imposed by expanding our operations. Our growth strategy, and the substantial investment associated with the development of each new restaurant, may cause our operating results to fluctuate and be unpredictable or adversely affect our business, financial condition or results of operations. If we are unable to expand in existing markets or penetrate new markets, our ability to increase our sales and profitability may be materially harmed or we may face losses.

Our restaurant base is geographically concentrated in California, and we could be negatively affected by conditions specific to California.

Adverse changes in demographic, unemployment, economic, regulatory or weather conditions in California have had, and may continue to have, material adverse effects on our business, financial condition or results of operations. As a result of our concentration in California, we have been, and in the future may be, disproportionately affected by adverse conditions in this specific market compared to other chain restaurants with a national footprint.

Our expansion into new markets may present increased risks due in part to our unfamiliarity with the areas and may make our future results unpredictable.

As of September 30, 2021, we have opened one new restaurant in fiscal year 2021 and we currently have 3 locations under construction. We plan to continue to increase the number of our restaurants in the next several years as part of our expansion strategy and expect to open an additional 8 new restaurants (4 of which have been identified) in 2022 by utilizing approximately 25% of the net proceeds of this offering. We may in the future open restaurants in markets where we have little or no operating experience. This growth strategy and the substantial investment associated with the development of each new restaurant may cause our operating results to fluctuate and be unpredictable or adversely affect our business, financial condition or results of operations. Restaurants we open in new markets may take longer to reach expected sales and profit levels on a consistent basis and may have higher construction, occupancy or operating costs than restaurants we open in existing markets, thereby affecting our overall profitability. New markets may have competitive conditions, consumer tastes and discretionary spending patterns that are more difficult to predict or satisfy than our existing markets and there may be little or no market awareness of our brand in these new markets. We may need to make greater investments than we originally planned in advertising and promotional activity in new markets to build brand awareness. We also may find it more difficult in new markets to hire, motivate and keep qualified employees who share our vision, passion and business culture. If we do not successfully execute our plans to enter new markets, our business, financial condition or results of operations could be materially adversely affected.

New restaurants, once opened, may not be profitable, and the increases in average restaurant sales and comparable restaurant sales that we have experienced in the past may not be indicative of future results.

New restaurants may not be profitable and their sales performance may not follow historical patterns. In addition, our average restaurant sales and comparable restaurant sales may not increase at the rates achieved over the past several years. Our ability to operate new restaurants profitably and increase average restaurant sales and comparable restaurant sales will depend on many factors, some of which are beyond our control, including:

| ● | consumer awareness and understanding of our brand; | |

| ● | general economic conditions, which can affect restaurant traffic, local labor costs and prices we pay for the food products and other supplies we use; | |

| ● | changes in consumer preferences and discretionary spending; | |

| ● | competition, either from our competitors in the restaurant industry or our own restaurants; | |

| ● | temporary and permanent site characteristics of new restaurants; and | |

| ● | changes in government regulation. |

If our new restaurants do not perform as planned, our business and future prospects could be harmed. In addition, if we are unable to achieve our expected average restaurant sales, our business, financial condition or results of operations could be adversely affected.

| 13 |

Our sales and profit growth could be adversely affected if comparable restaurant sales are less than we expect.

The level of comparable restaurant sales growth, which represents the change in year-over-year sales for restaurants open for at least 3 months, could affect our sales growth. Our ability to increase comparable restaurant sales depends in part on our ability to successfully implement our initiatives to build sales. It is possible such initiatives will not be successful, that we will not achieve our target comparable restaurant sales growth or that the change in comparable restaurant sales could be negative, which may cause a decrease in our profitability and would materially adversely affect our business, financial condition or results of operations. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Our failure to manage our growth effectively could harm our business and operating results.

Our growth plan includes opening new restaurants. Our existing restaurant management systems, financial and management controls and information systems may be inadequate to support our planned expansion. Managing our growth effectively will require us to continue to enhance these systems, procedures and controls and to hire, train and retain managers and team members. We may not respond quickly enough to the changing demands that our expansion will impose on our management, restaurant teams and existing infrastructure which could harm our business, financial condition or results of operations.

Our limited number of restaurants, the significant expense associated with opening new restaurants, and the unit volumes of our new restaurants makes us susceptible to significant fluctuations in our results of operations.